CRM Job Report July 2022

Tracking CRM employment demand, wages & required education

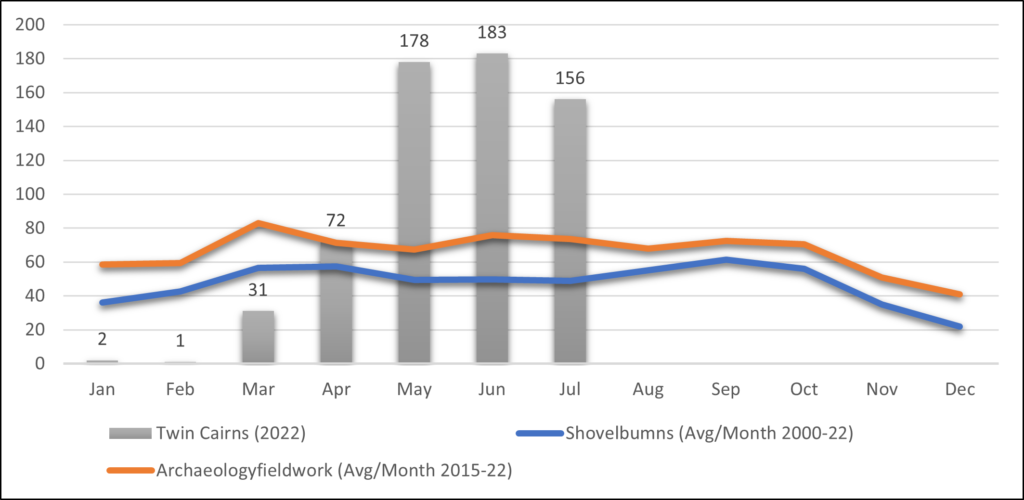

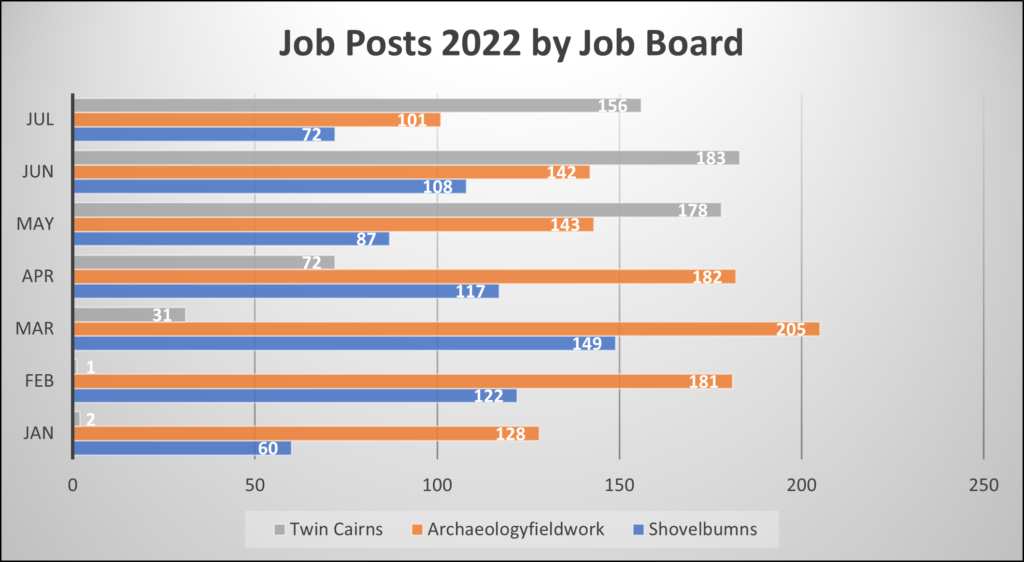

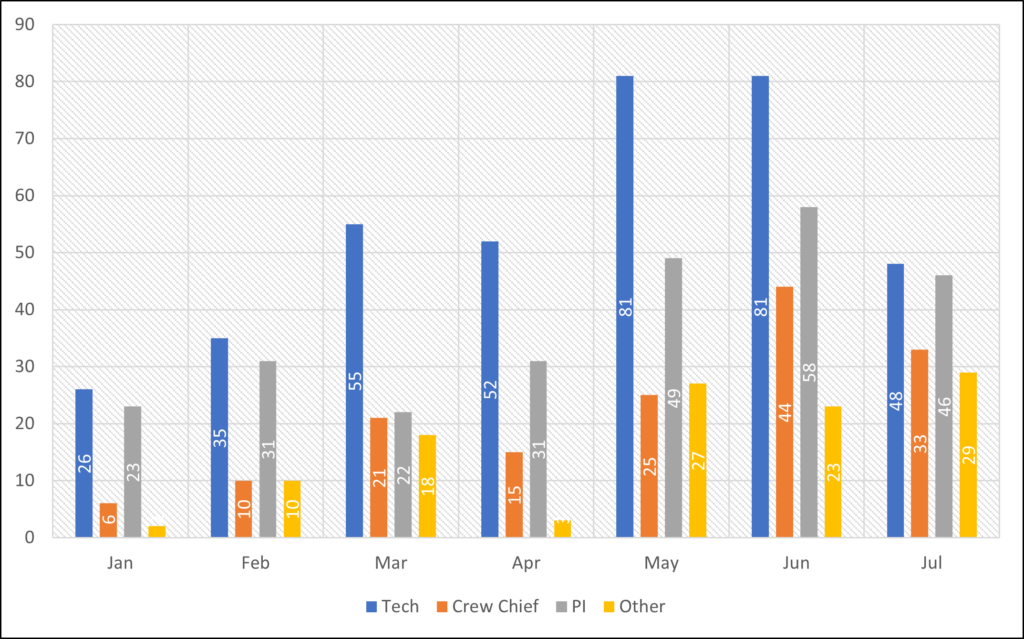

The number of CRM jobs posted online during the month of July declined by 15%, compared with the number of jobs posted in the previous two months (Fig. 1). Notwithstanding the above, demand is still unprecedented across all job types and job posting sites (Fig. 2).

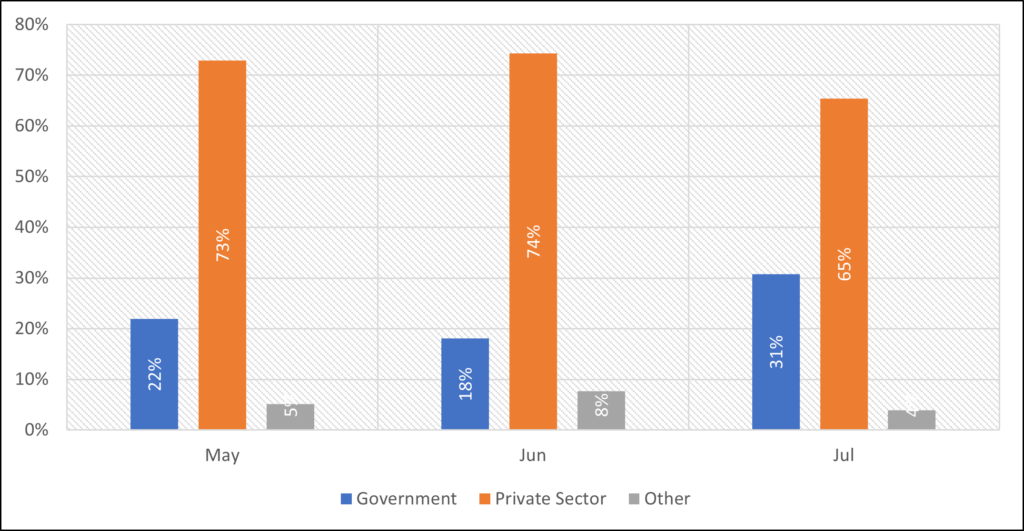

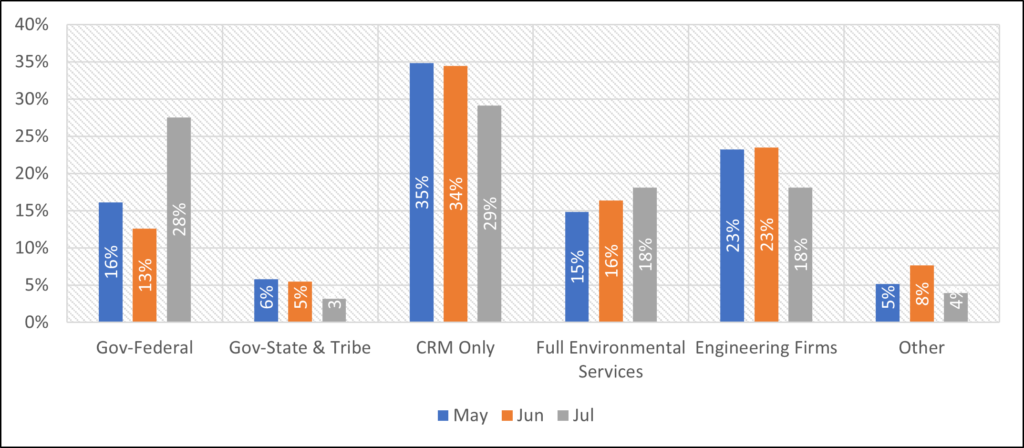

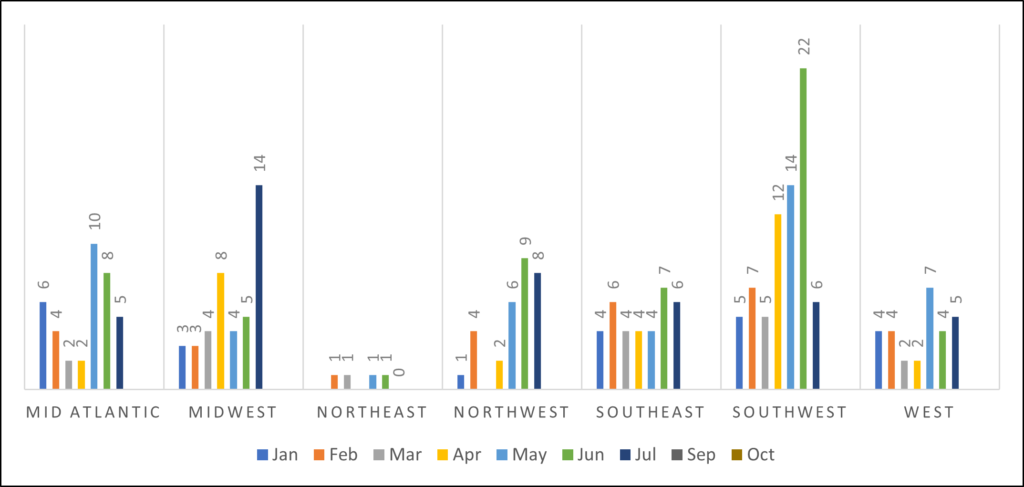

Government at all levels continued its robust hiring spree, especially federal agencies (Fig. 3-4). The number of jobs posted by companies limited to CRM work declined from 63 positions offered in June to 37 positions offered in July. Similar decline is observed among Engineering firms, which posted 43 positions in June compared to 23 in July.

The demand for all CRM job types declined in July. Striking is the substantial decline in Field Tech job posts, reduced by 41% since its peak in the May-June period of this year (Fig. 5). The number of Historian and Architecture Historian job posts increased, indicating a very strong demand for these specialties. Some of this increase is related to the federal government multi agency initiative to identify, preserve and display landmarks of the Underground Railroad across the U.S.

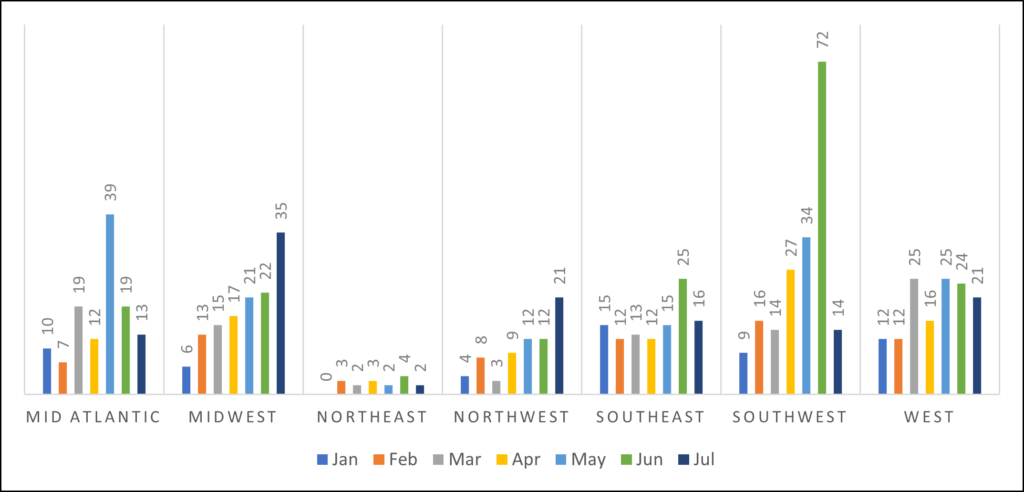

Both the Midwest and Northwest showed significant increase in CRM jobs (Fig. 6). Driving this demand is an increase in job posts for Project Managers/Principal investigators (Fig. 7). Everywhere else, a decline in jobs offered is evident, especially in the Southwest – usually a thriving region with plenty of CRM jobs.

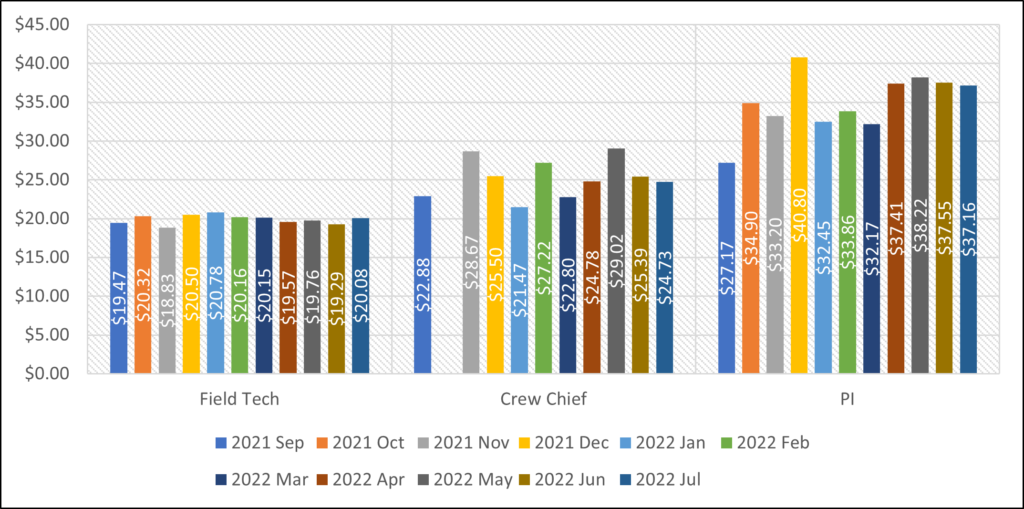

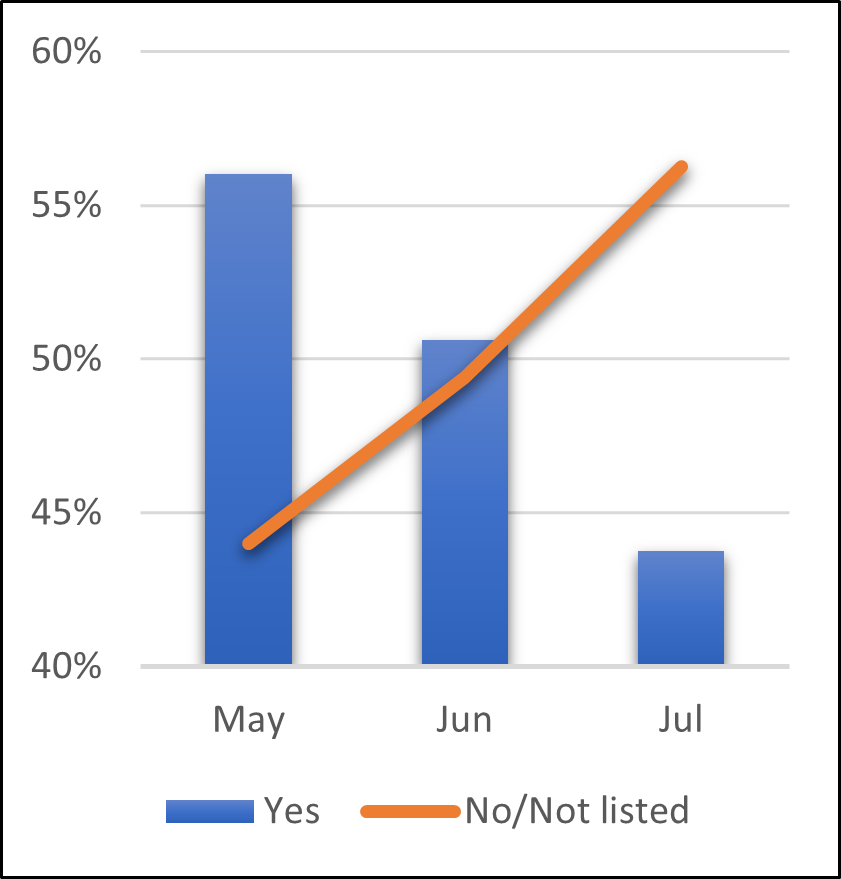

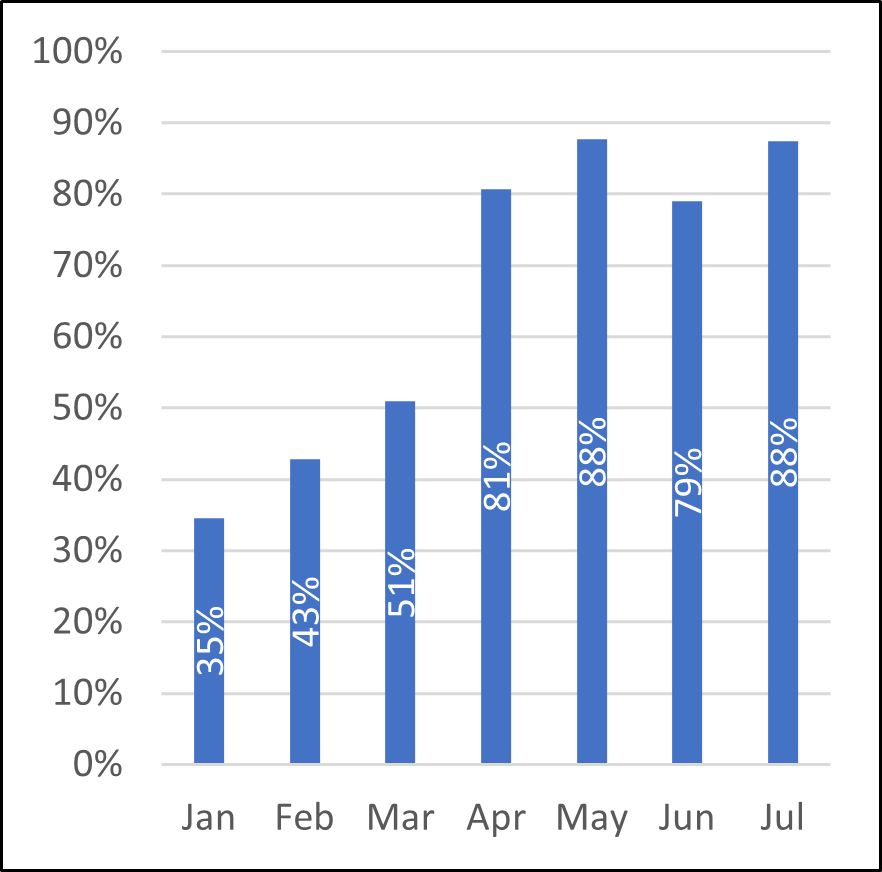

Average hourly wages for Field Techs increased in July, from $19.29 to $20.08 (Fig. 8). This is a robust 4.1% increase and may reflect the increasing shortage of Field Techs. This high demand is also reflected in the almost collapsed requirement for a field school (Fig. 9), where only 44% of Field Tech job posts required a field school as a condition of employment. At the same time, wage transparency continues to be robust, and almost all Field Tech job posts displaying at least minimum hourly wages (Fig. 10)

Wages for PM’s/PI’s decreased in July, but only slightly and from a robust high (Fig. 8). Wages for Crew Chiefs have declined for the second month, from a high of $29.02/Hr. in May to $24.73/Hr. in July – a 15% decline. Crew chief average hourly wages in July are still 8% higher than wages reported in September 2021, so the July decline may just represent market correction.

Summary

July data indicates a period of labor market cooling off in the CRM sector. The market is still robust with 156 jobs offered, so this may represent only a periodic slowing down. If the $430 Billion Climate Change bill passed on August 7 in the U.S. Senate will become law, it is likely that more funds will be available for CRM work and the sector will need to further increase capacity to address such demand. We believe that despite the declines seen in July, the CRM sector is still very strong and will continue to grow for a significant time.