CRM Job Report August 2022

Tracking CRM employment demand, wages & required education

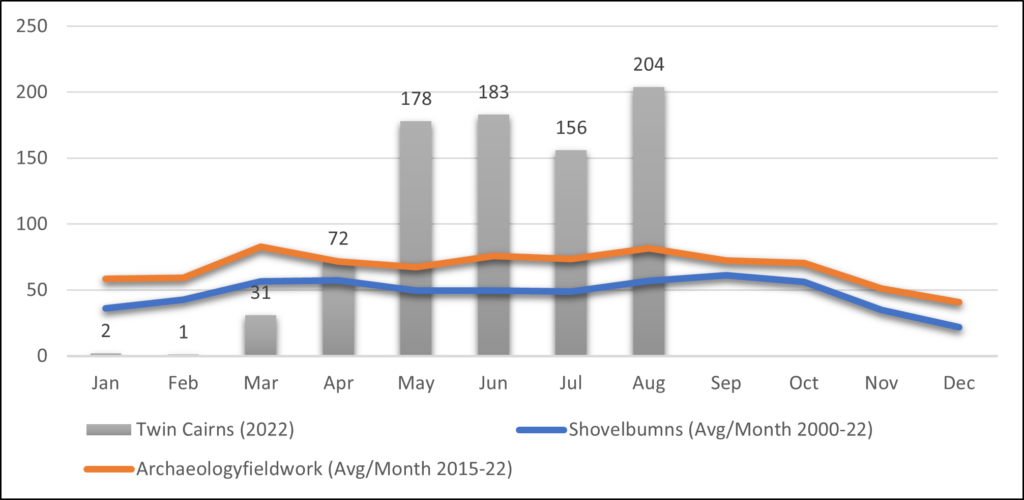

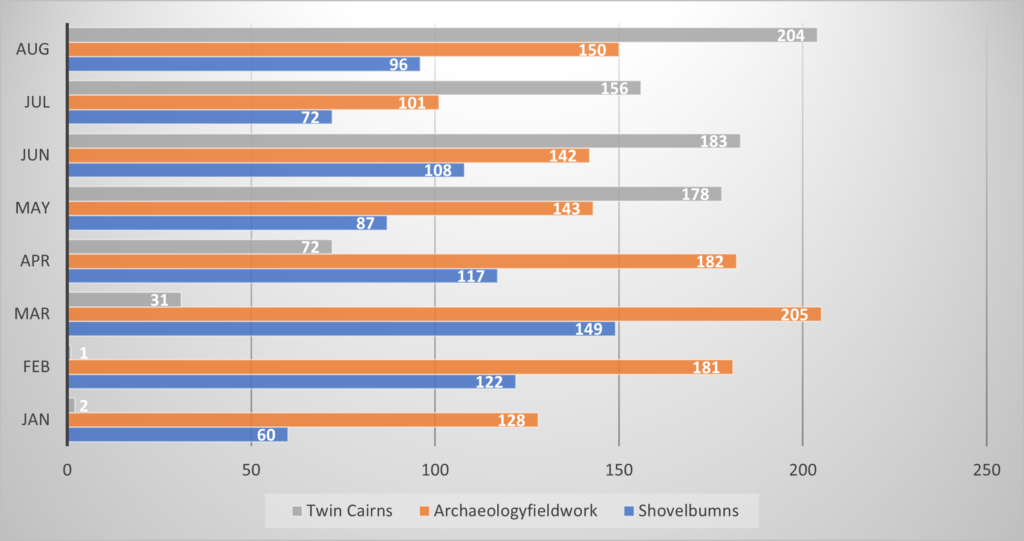

The number of CRM jobs posted online for August was the second highest recorded this year and more than double the average number of jobs usually posted for this month (Fig. 1-2– 2). In total, 204 jobs were posted on the Twin Cairns site for the month.

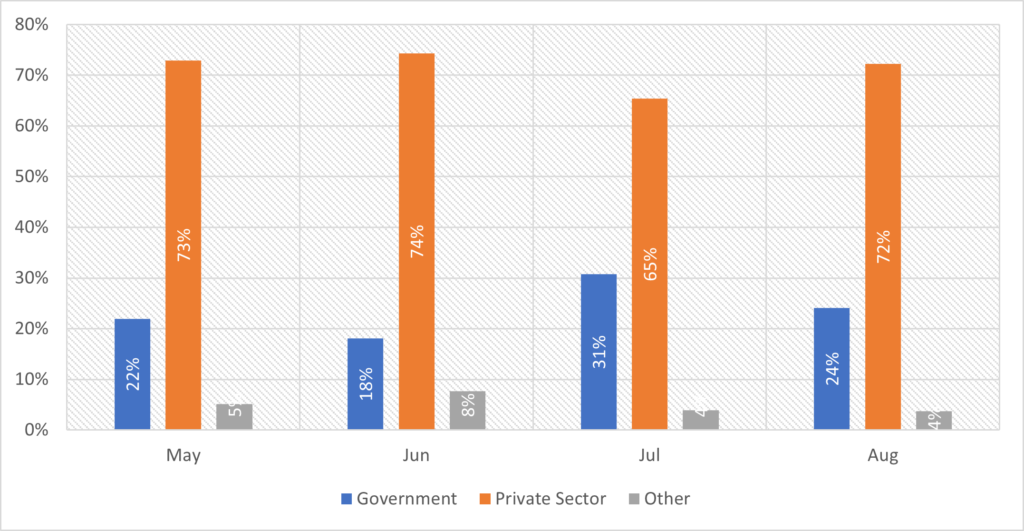

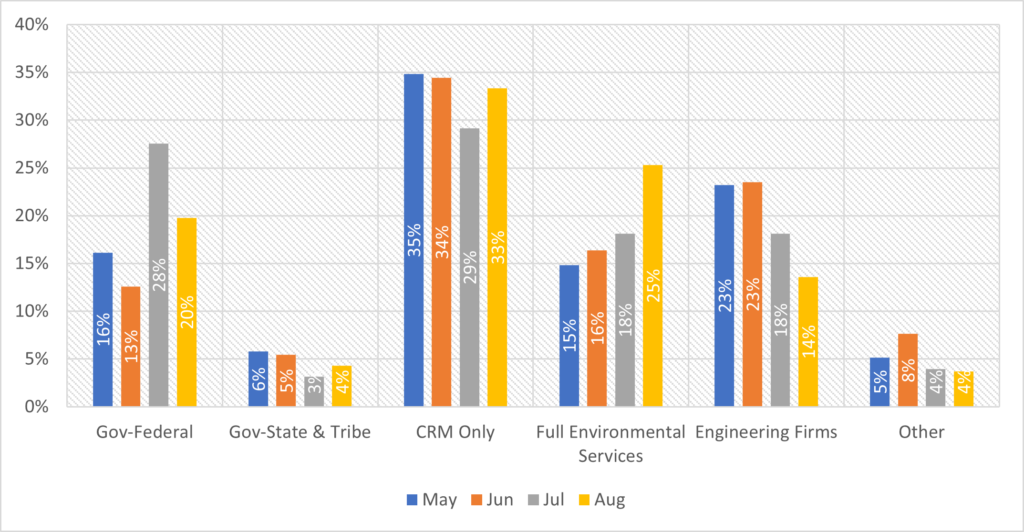

Government at all levels continued its robust hiring push, although at somewhat reduced numbers (Fig. 3). Per usual, most of hiring by government was done by federal government agencies (Fig. 4). In the private sector, dedicated CRM firms and those that offer full environmental consulting services increased their hiring pace, combined posting 95 job offers of all types.

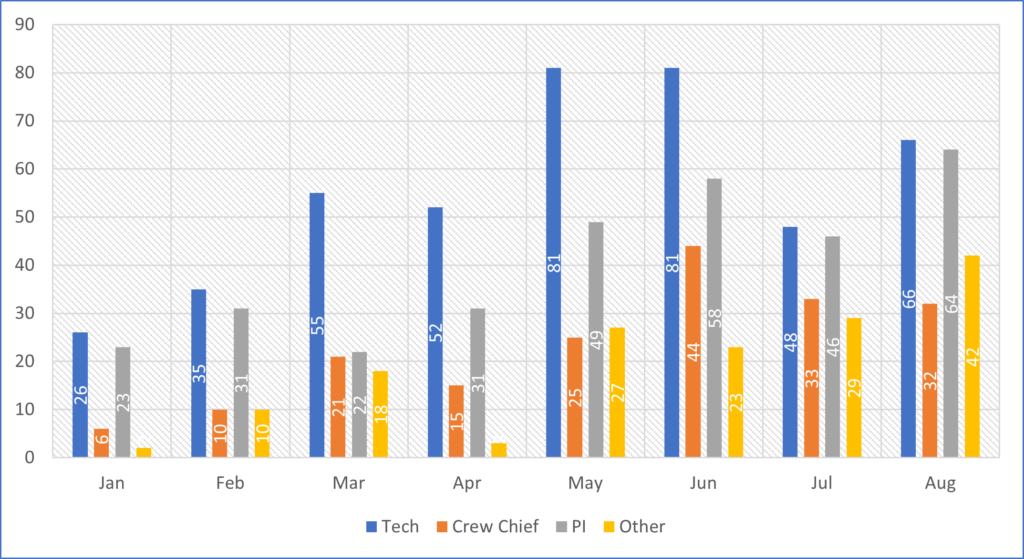

The demand for both Field Techs and Project Manager/PI’s dominated the job offering in August, together with demand for support jobs in the sector – GIS Techs, Lab Personal, etc. (Fig. 5). Demand for Crew Chiefs remained robust but stable.

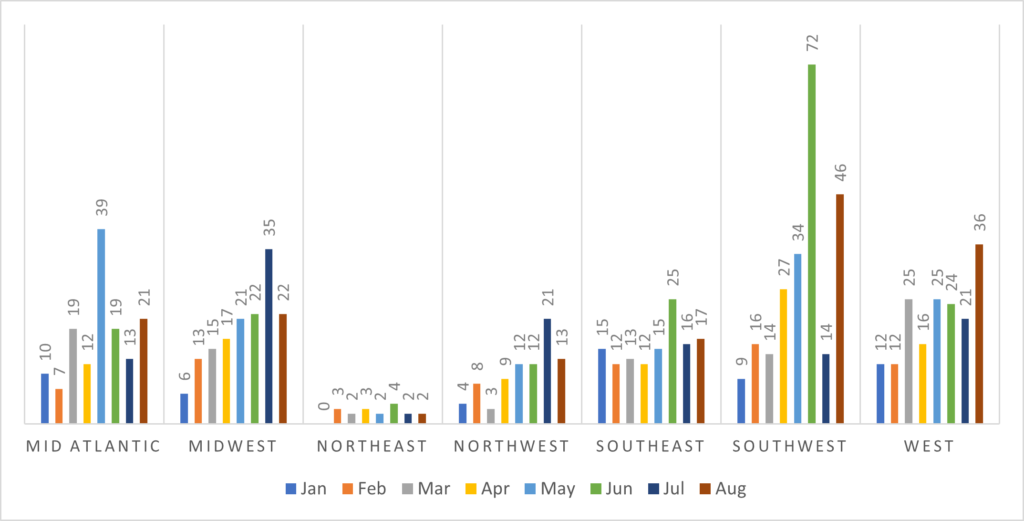

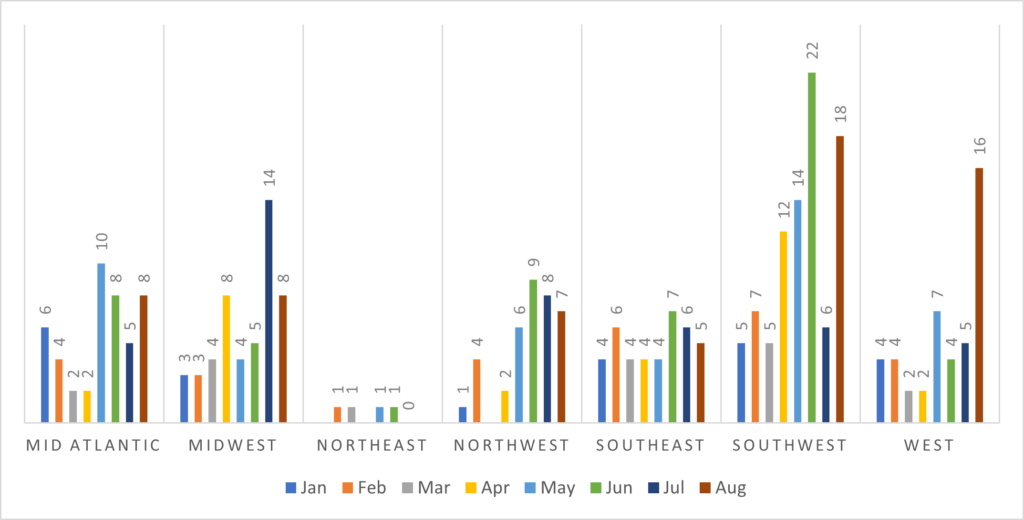

The largest number of jobs were offered for positions in the West and the Southwest (Fig. 6). In the Northeast, the data show continued anemic demands for all types of CRM jobs. Driving the growth in the west is an increased demand for Project Managers/Principal Investigators (Fig. 7).

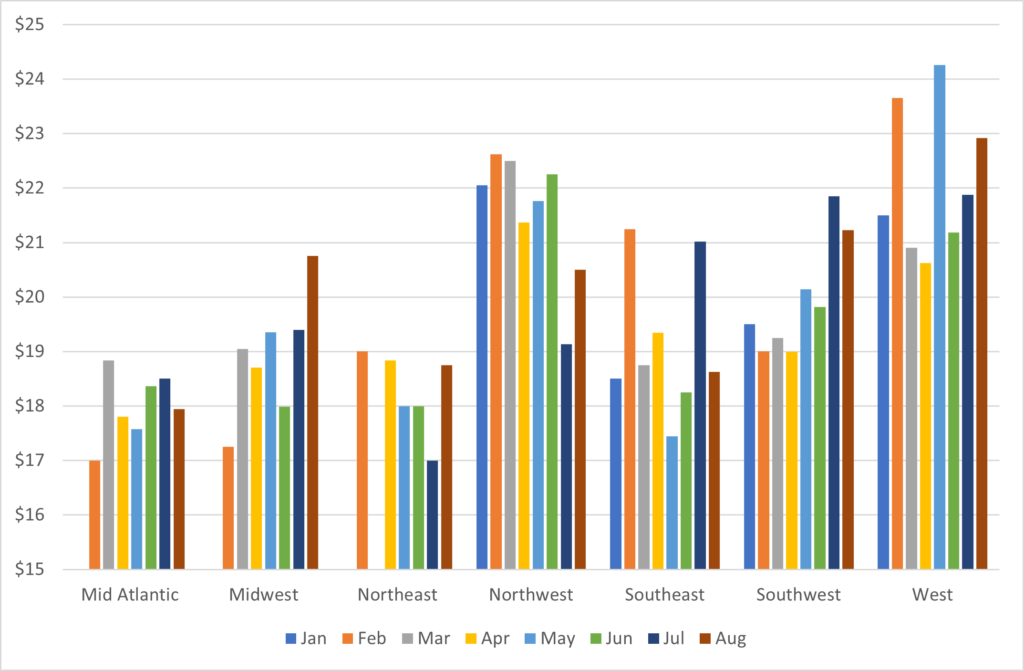

Nationwide, average hourly wages for Field Techs increased in August again, from $20.08 to $20.61, a 2.6% increase (Fig. 8). Yet, this increase is still below average wages paid in January of this year, at $20.78 per hour. It seems that Field Tech wages are returning to levels published at the beginning of the year, but that Field Techs are unable to gain wage increases despite inflation and labor shortages.

The highest salaries are paid in the West, followed by the Northwest. Salary pressure, especially for Field Techs, are pushing wages rapidly higher in the Southwest (Fig. 9). By August, average hourly wage for Field Tech in the Southwest was $21.23. In the West, it was $22.92 per hour. In contrast, hourly wage in the Mid Atlantic were only $17.94. This is a 28% regional difference that we are uncertain how to explain. The Mid Atlantic may offer lower cost of living, but not by such a huge gap

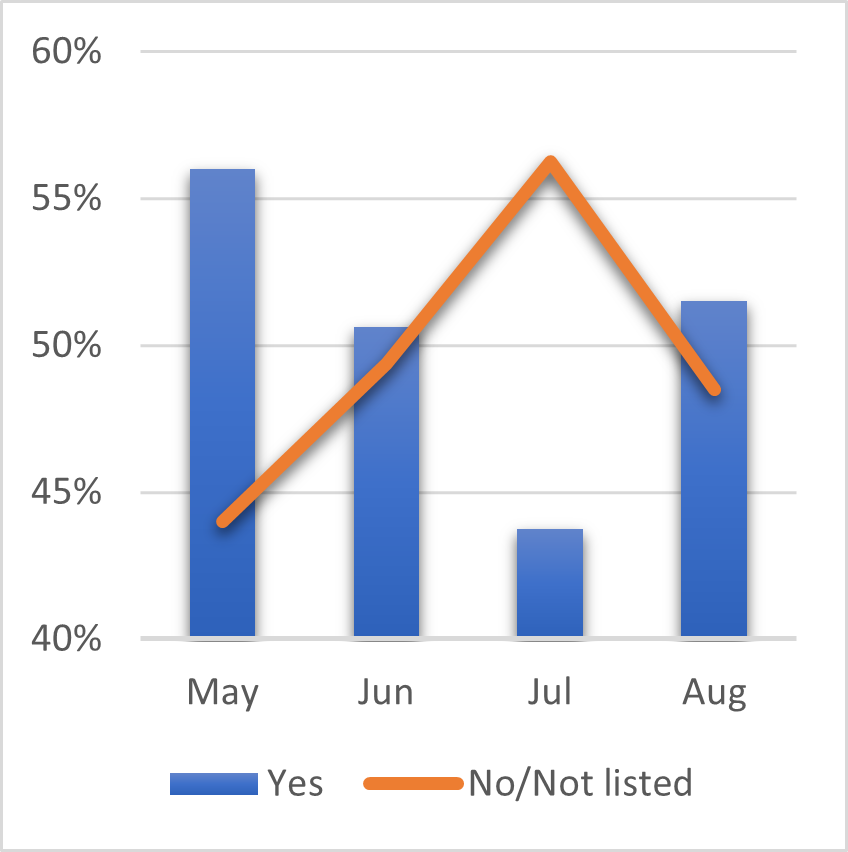

Only 48% of all job posts for Field Techs in August required a field school reflecting the reality that field school are hard to come by due to both pandemic and costs (Fig. 10). This is an 8% decline from July, but more in line with numbers recorded in May and June.

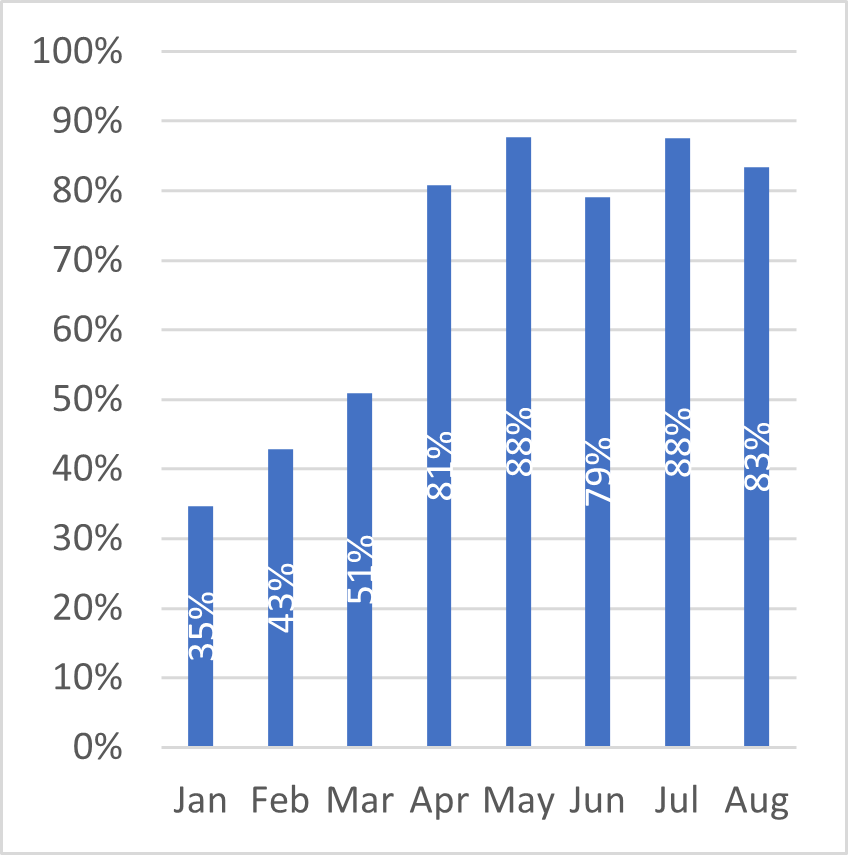

Employers are still publishing wage information for almost all job posts, a continued positive trend (Fig. 11). On August 30, California lawmakers passed legislation requiring all employers based or hiring in the state to post salary ranges on all job listings. Governor Gavin Newsome has until Sep 30 to decide whether to sign this legislation into law. If he will, it is likely that other states will follow with similar legislation.

Summary

The August data suggest that the cooling off pf the CRM job market we thought we observed in July was incorrect. Demand is back and it is robust. Notwithstanding the above, a strong correlation between demand and wages is evident at the mid management level – wages for PM/PI’s and Crew Chiefs are growing. Yet the same is not true for entry level positions at the Field Techs category. Wages are mostly stagnant and there seem to be a slight reduction in minimum requirements to enter the CRM workforce. Fewer positions require a field school training and over 10% of positions do not require a bachelor’s degree.

The American Cultural Resource Association has taken note. In its forthcoming annual meeting, ACRA is dedicating a session to university partnership and CRM employment issues (Session 12). It will be interesting to learn how ACRA members think and wish to address this issue.