CRM Job Report June 2022

Tracking CRM employment demand, wages & required education

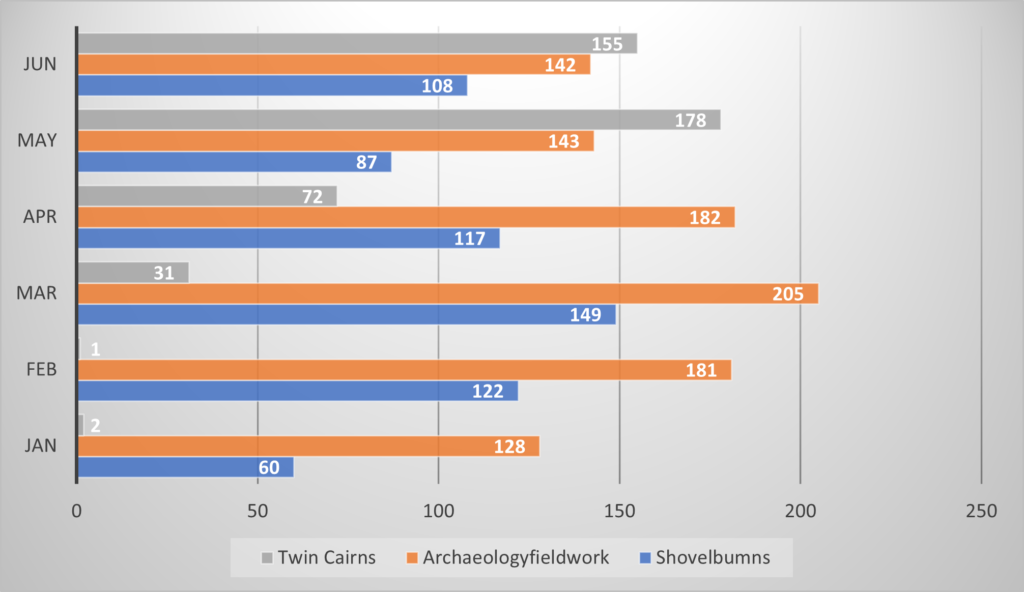

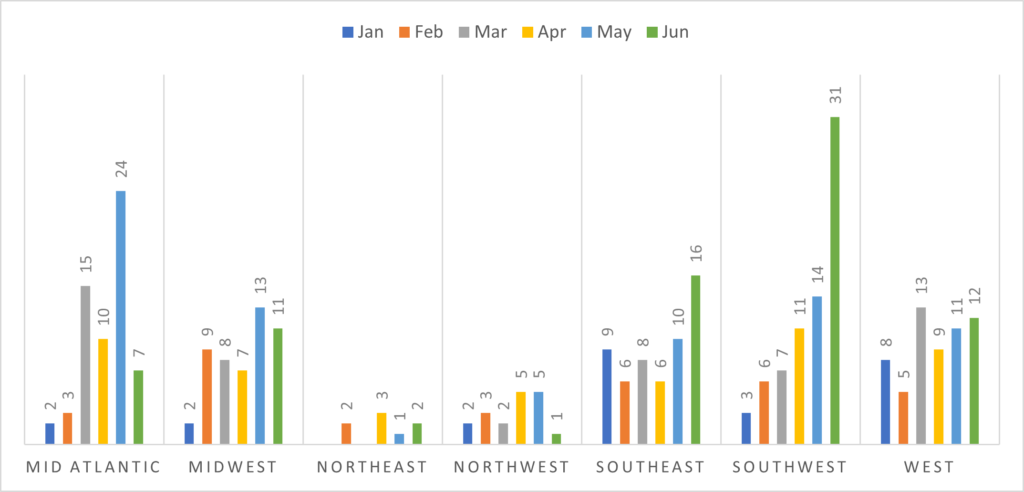

The number of CRM jobs continues to grow to the highest level ever recorded in any existing databases. In June, Twin Cairns Research analyzed 206 CRM job posts, seeking employees for both government and private sector positions. These jobs were posted on three dedicated CRM job boards (Fig. 1)(note that many jobs were posted on multiple job boards).

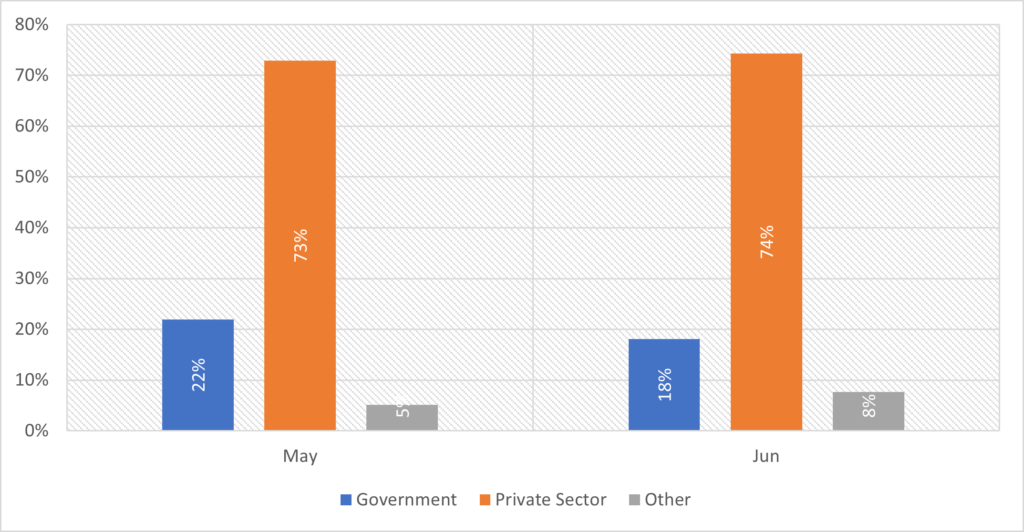

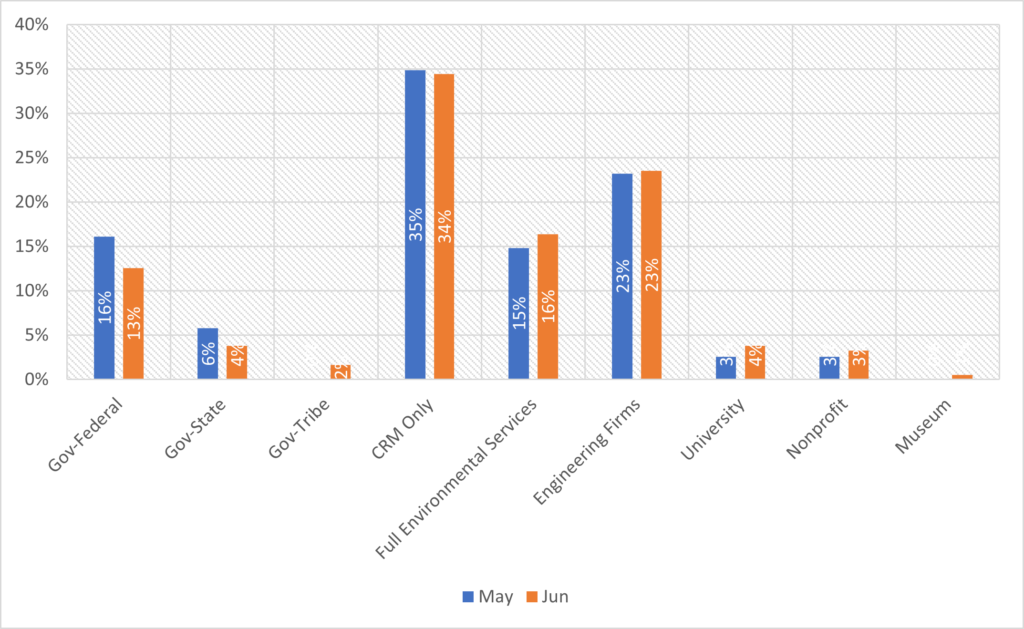

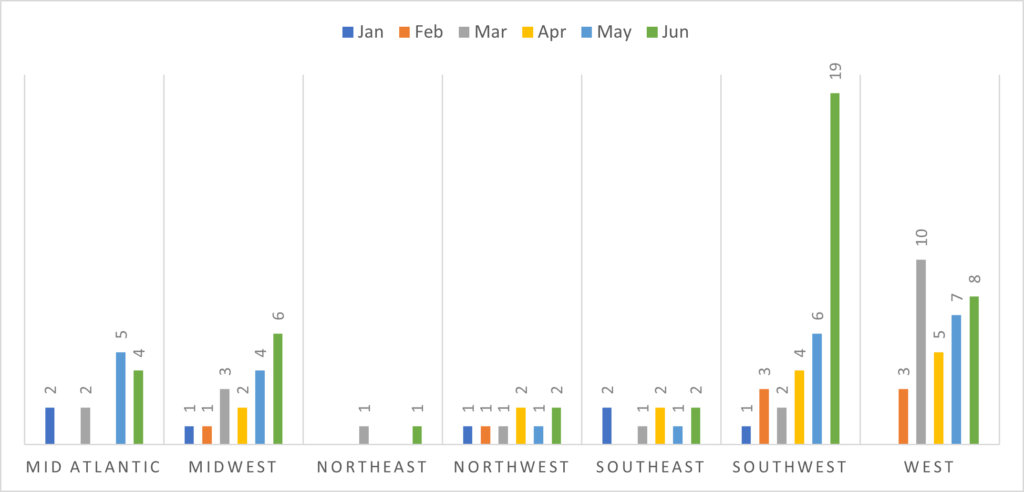

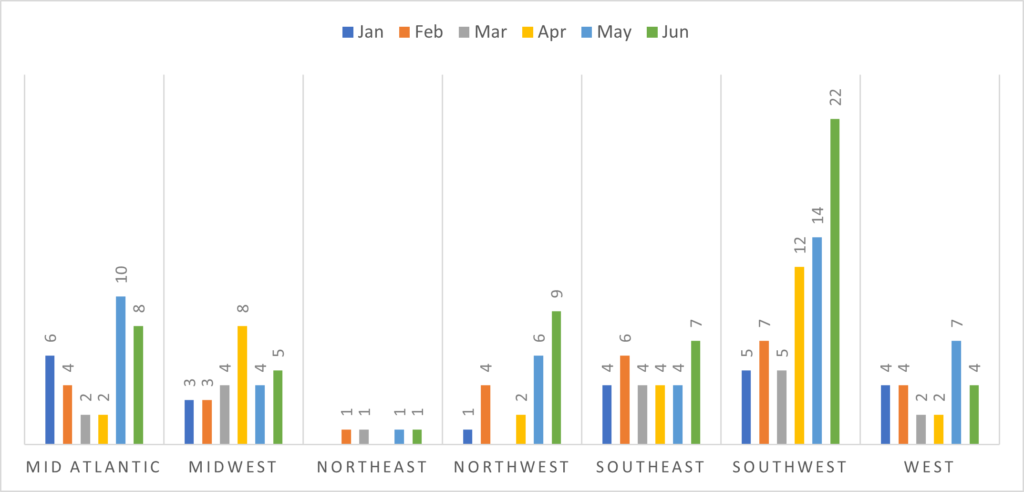

Although we lack longitude historical data for strong comparison, government seems to continue a strong hiring spree and recruit employees to ensure oversight capabilities as funding from the 2020 Great American Outdoors Act and the 2021 Infrastructure Investment and Jobs Act begins to flow (Fig 2). This bodes well for the CRM sector as government oversight and compliance will NOT be an obstacle for the sector’s growth, as some members of the community suggested will be the case when the Infrastructure Act was passed in congress. This is particularly true for federal agencies, who are making the bulk of government hires (Fig. 3).

Within the private sector, companies focusing on CRM services only lead in hiring, indicating a robust demand for their services. At the same time, engineering companies continue to grow their CRM sections and continue robust hiring for professionals in the field. The trend indicates that subcontracting of work by large engineering firms to CRM companies may be declining in the near future.

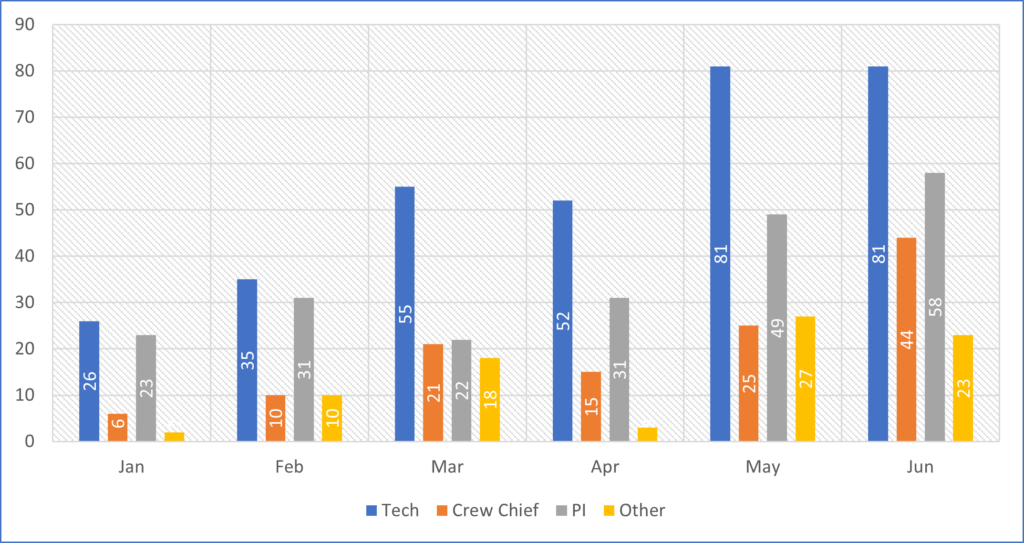

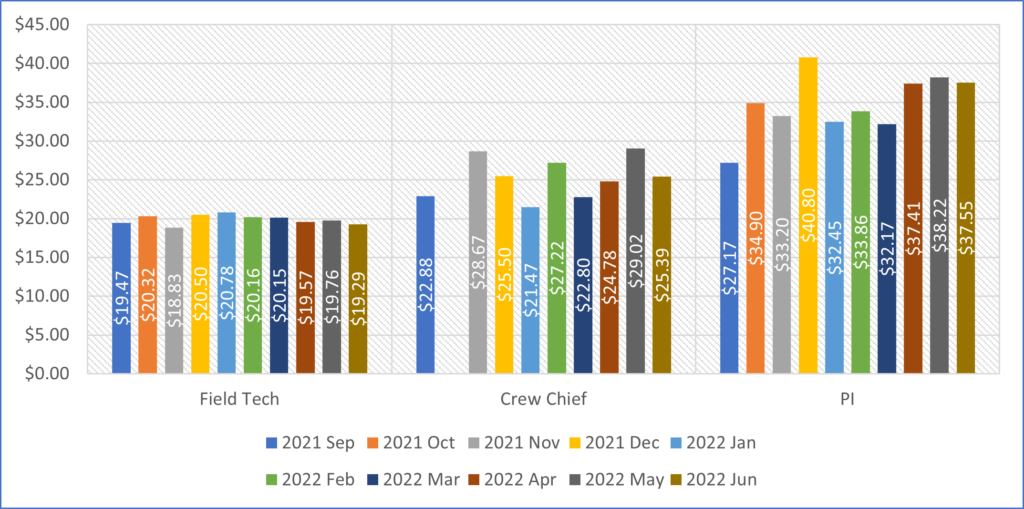

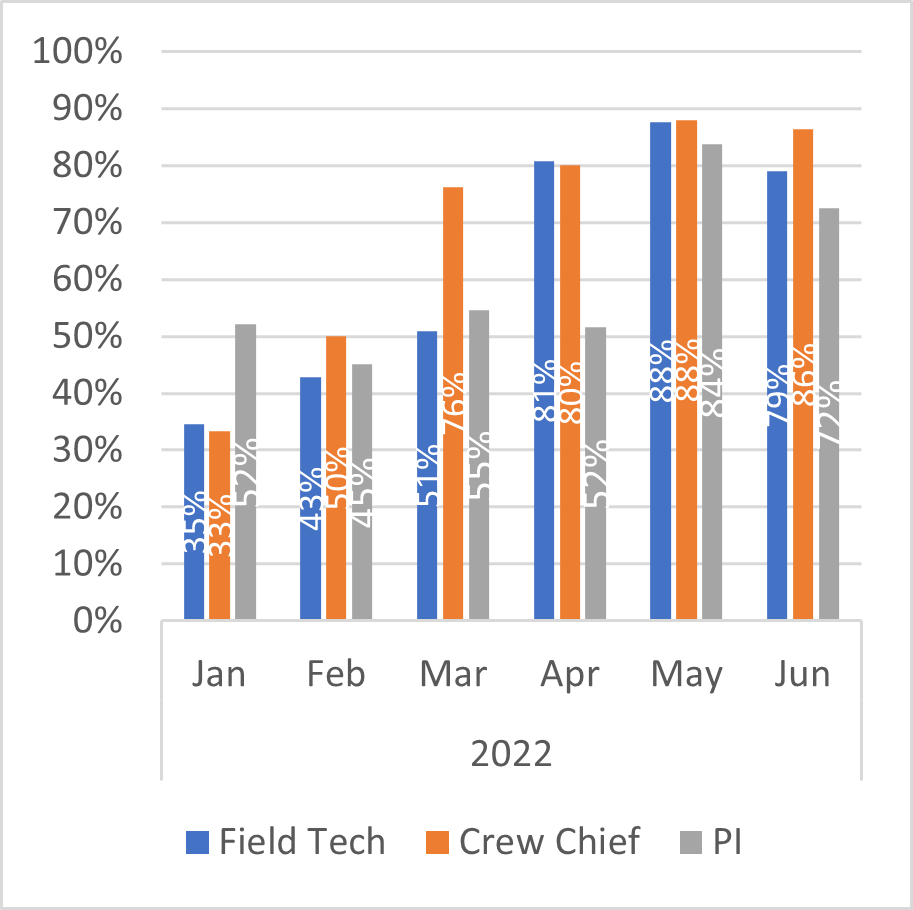

The demand for Field Techs is strong and stable. The demand for Crew Chiefs and Project Managers/Principal Investigators continues to grow by leaps and bounds (Fig. 4). Demand for Crew Chiefs in June – compared to May – increased by a whopping 76%, and demand for PM/PI increased by 18% over the same period.

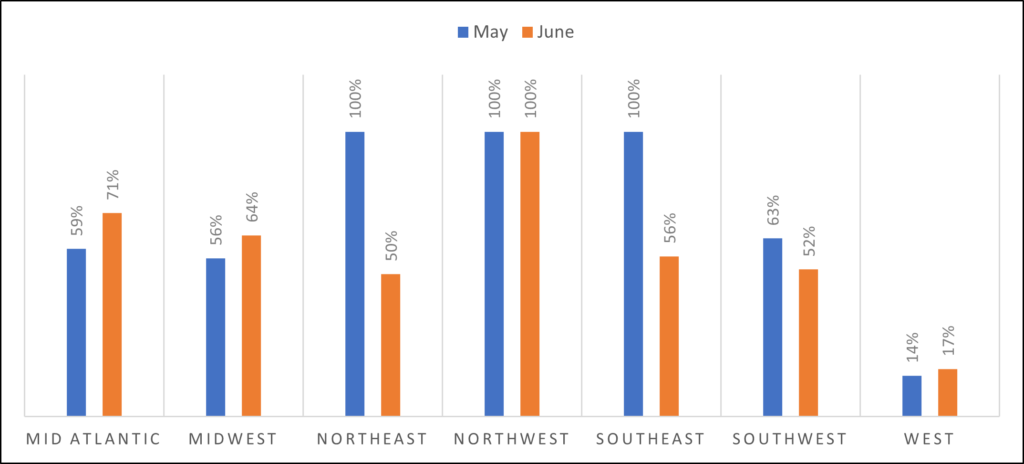

The Southeast and Southwest experienced the strongest demand for all position types (Fig. 5-7). Both the Northeast and Northwest show anemic demand (except for healthy demand for PM/PI in the Northwest), which is difficult to explain given enhanced demand everywhere else in the country. It may be that companies in these areas use informal peer networks and social media to recruit employees, reducing the need to post job announcements on formal job boards. It may also be that the high salaries paid in these regions allow companies to retain employees for longer periods and the need to publish and fill new positions is minimal.

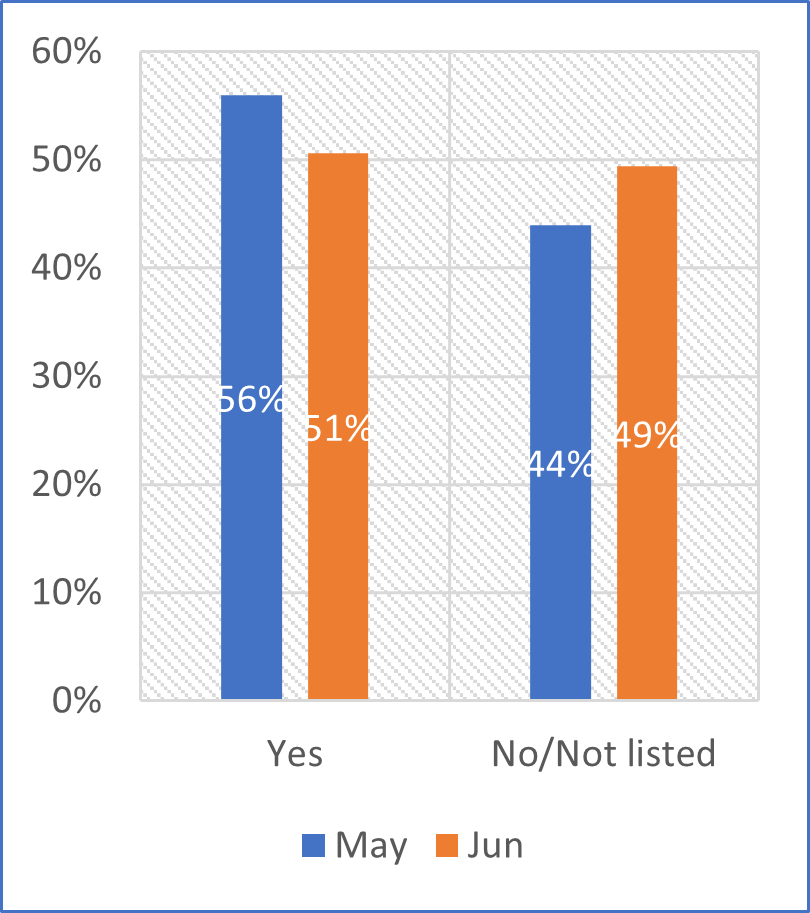

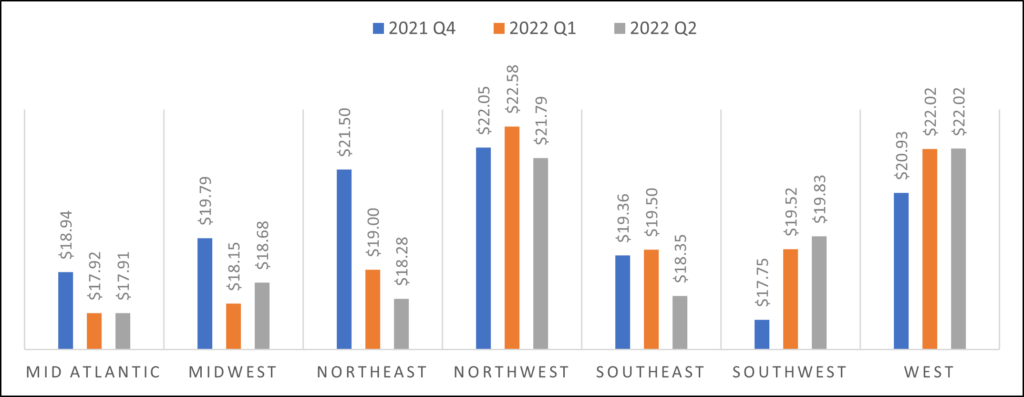

Wages for Field Techs continue to drop, despite robust demand and high inflation rate (Fig. 8). The decline in demand for field school and decline in publication of wages (Fig. 9-10) suggest that the sector is continuing its reduction in the quality, training, and education demands for entry level positions. Field school requirement for Field Techs in the West is extremely low (Fig. 11), while wages are still among the highest in the U.S. (Fig. 12). Scarcity of employees in the West (and cost of living?) is pushing education demands to extreme lows while forcing wages to national highs.

Wages for Crew Chiefs and PM/PI’s are increasing. Especially significant is the 38% increase in PM/PI wages from Sep 2021 to June 2022 (Fig. 8). This wage increase far supersedes current inflation rates and likely represent an acute shortage of qualified PM/PI in the sector. Such demand and rewards present great opportunities for individuals with graduate degrees in archaeology/anthropology (MA/MS or PhD) to enter the sector and easily find well paid jobs.

To summarize, the data indicates a continued growth in the CRM sector, but with splitting trajectories. For management positions, wages are increasing, and companies are competing over employees by offering high salaries and generous benefit packages – many companies now offer to pay for additional education of their employees. For entry level positions, the pattern is dichotically different. Wages are decreasing, as well as education and experience requirements. Companies care less about the quality of Field Techs, investing in middle and upper management positions to compensate for the reduction in field work quality. Some suggest that this correction is long due and that the sector needs to “professionalize” the Field Tech workforce by removing the education requirements and training in house Field Techs that will remain in that position for long periods of time. It is up to practitioners in the sector to debate whether this shift is where the sector should go. For our part, we will continue to collect data, observe, and publish results so companies and individuals can make informed decisions about the sector, observed patterns and increase competitiveness.