CRM Job Report September 2022

Tracking CRM employment demand, wages & required education

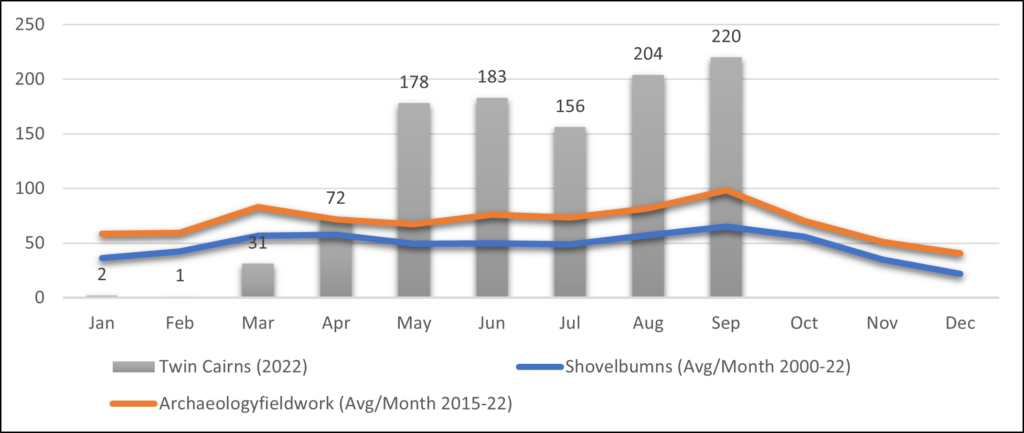

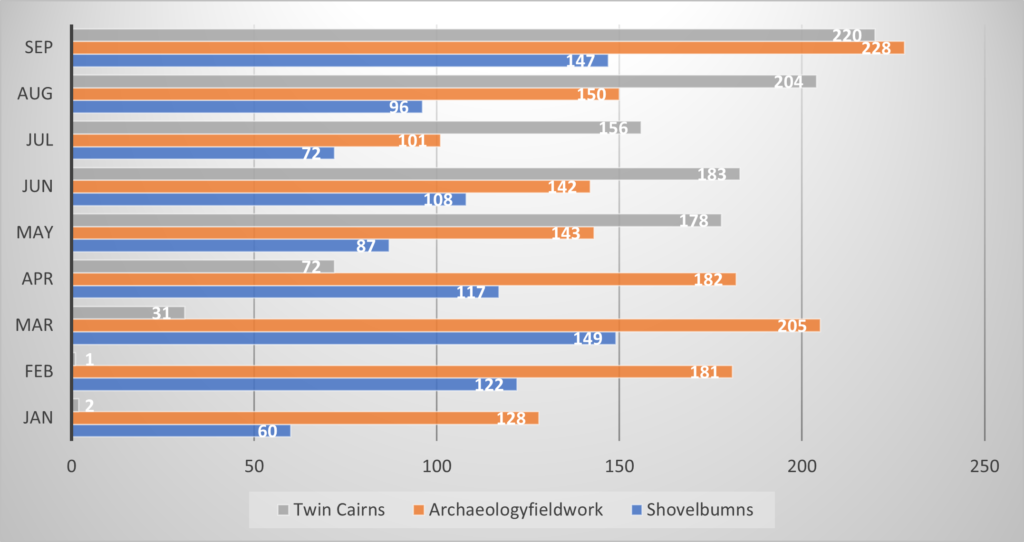

The number of CRM jobs posted online for September is a record for the year and one of the highest ever recorded (Fig. 1-2). September is traditionally the month with most jobs posted, so such results are not surprising. In total, 220 jobs were posted on the Twin Cairns site for the month and 228 were analyzed for this report.

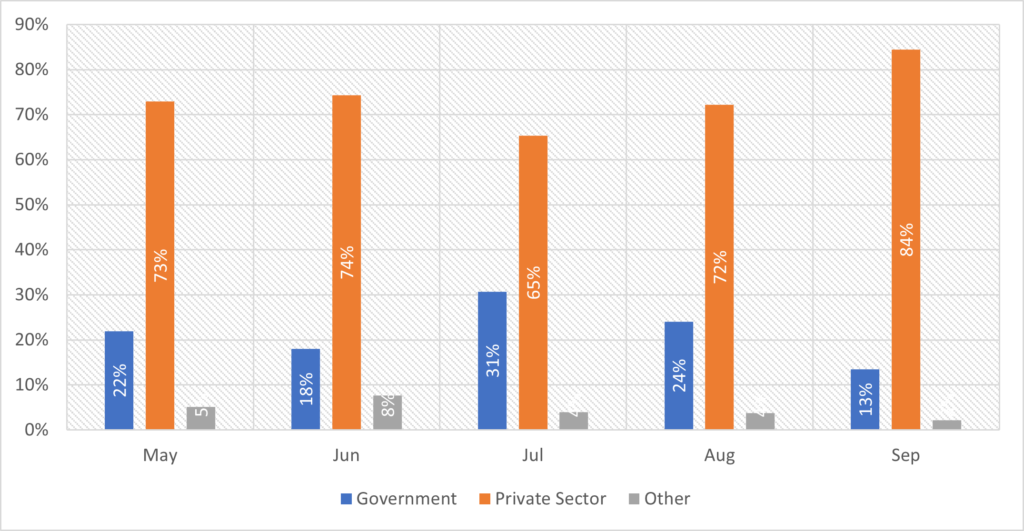

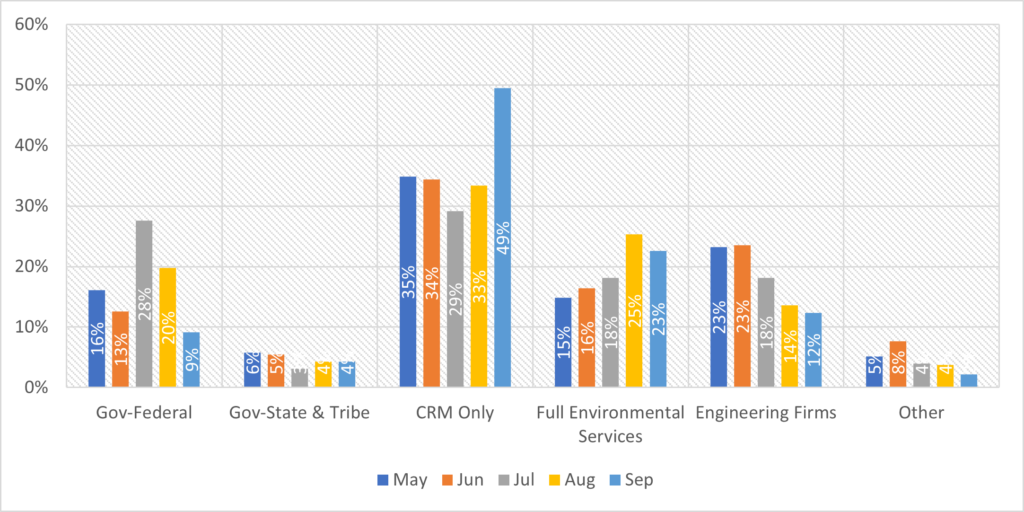

Government hiring, especially at the federal government, declined during September (Fig. 3-4). The private sector hiring increased during the same time, with most hiring done by companies providing CRM services exclusively. Robust hiring by companies providing full range of environmental consulting and companies providing engineering services continued.

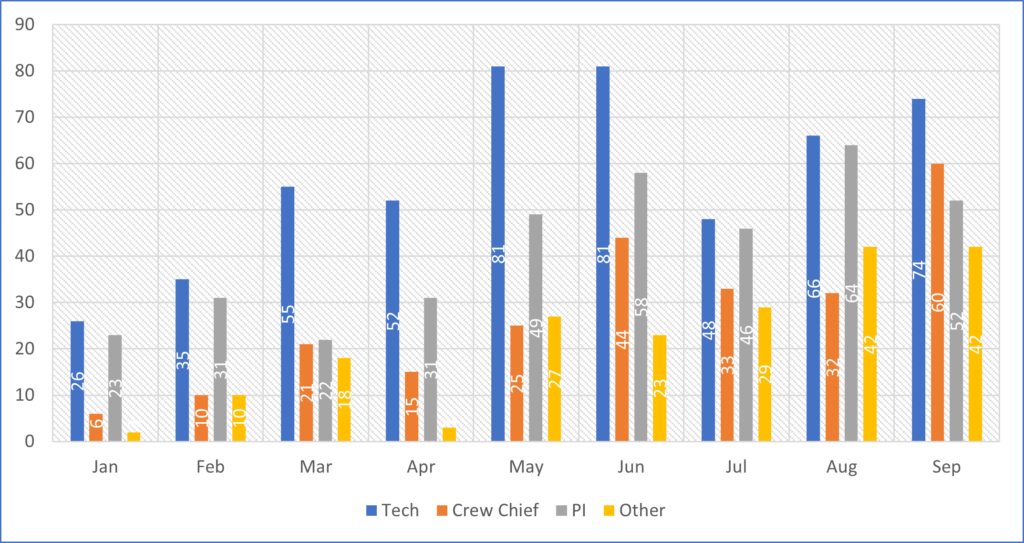

Demand for all CRM position types continued to be strong, with heighted demand in September for Crew Chiefs (Fig. 5). The strong demand is not limited to direct CRM jobs, but include CRM supporting jobs – lab technicians, GIS specialists, etc. (defined as ‘other’ in the chart below).

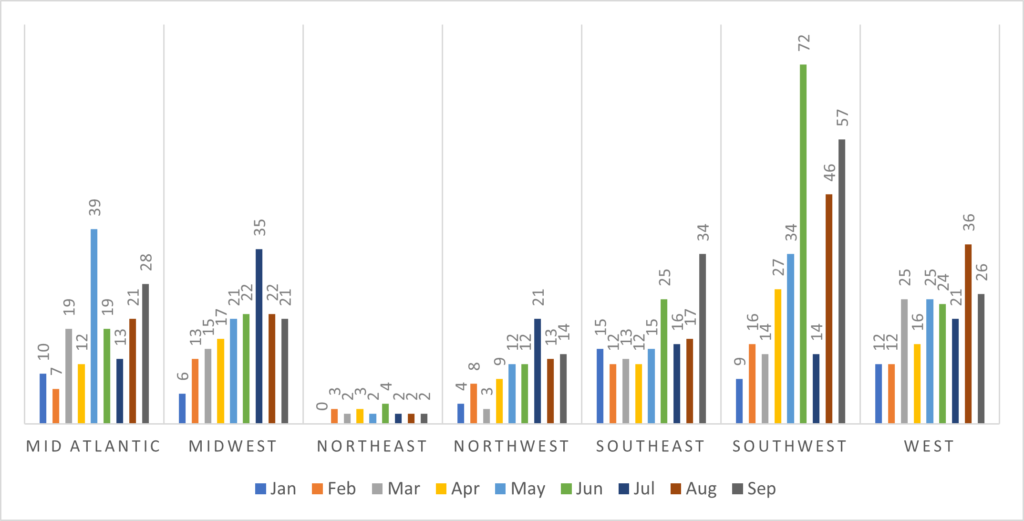

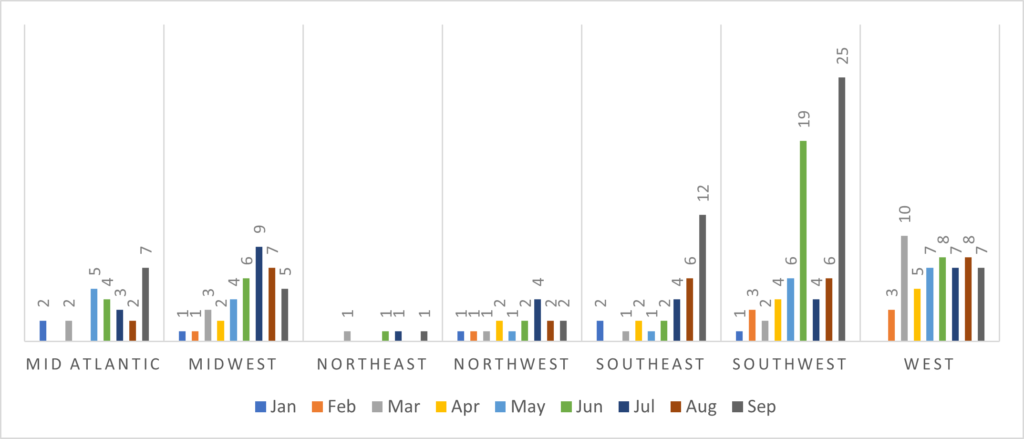

The largest number of jobs were offered for positions in the Southwest, Southeast and West (Fig. 6). In the Northeast, demand for CRM jobs continued to be anemic. Driving growth in both the Southwest and Southeast is an increased demand for Crew Chiefs (Fig. 7).

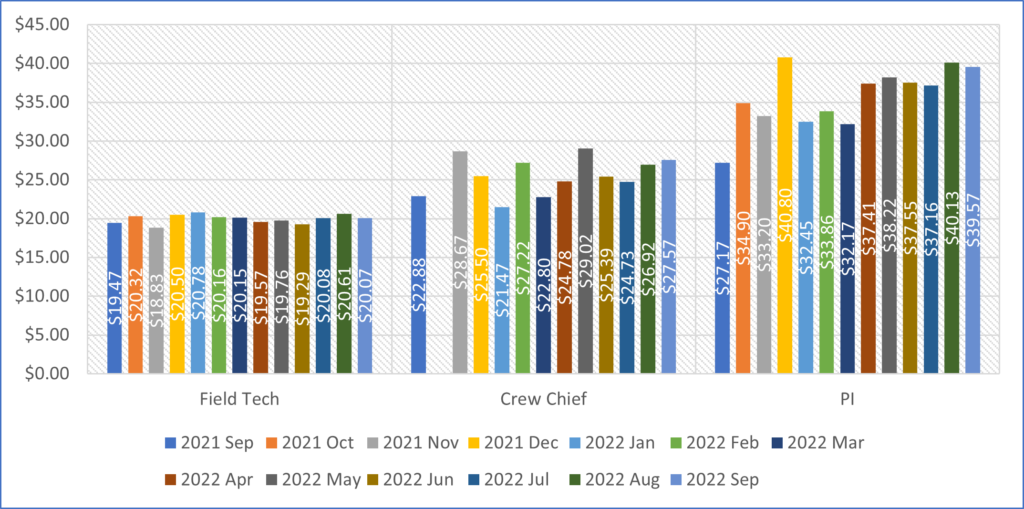

Nationwide, average hourly wages for Field Techs decreased in September – from $20.61 to $20.07, a 2.6% decline with a return to average pay recorded July (Fig. 8). Reflecting the increased demand for Crew Chiefs, their average hourly wages increased from $26.92 to $27.57, a 2.4% growth for the month and a 28% overall increase since the beginning of FY 2022.

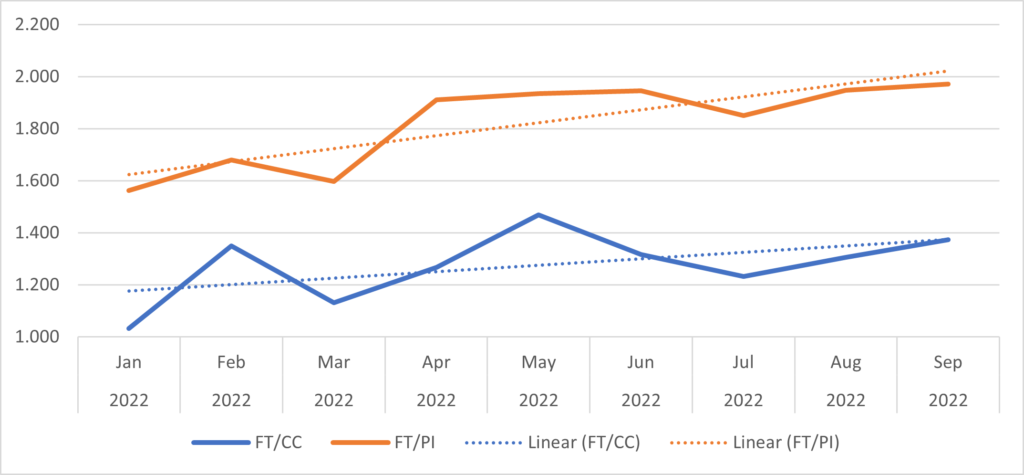

We now have sufficient data to compare wages data by quarter. Despite increased demand for Field Techs, their hourly wages fall by 3.2% from Q1 to Q3 of this year (Fig. 9). Hourly wages data for both Crew Chiefs and PM/PI’s continued to grow, outpacing inflation rate and increasing the wage ratio gap between both position types and Field Techs (Fig. 10).

| FY 2022 | Field Tech | Crew Chief | PM/PI |

| Q1 | $20.36 | $23.83 | $32.83 |

| Q3 | $19.71 | $26.38 | $37.64 |

| Differences | $(0.65) | $2.55 | $4.81 |

| % | -3.2% | 10.7% | 14.7% |

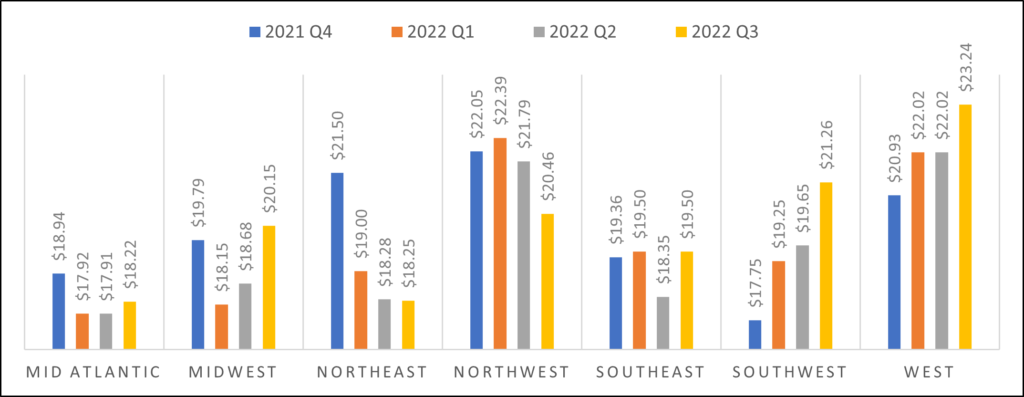

Notwithstanding the above, national data mask surprising diversity in regional wage differences (Fig. 11). While hourly wages declined in the Northeast and Northwest and are stagnant in the Mid Atlantic, Midwest and Southeast, they are increasingly growing in the Southwest and West.

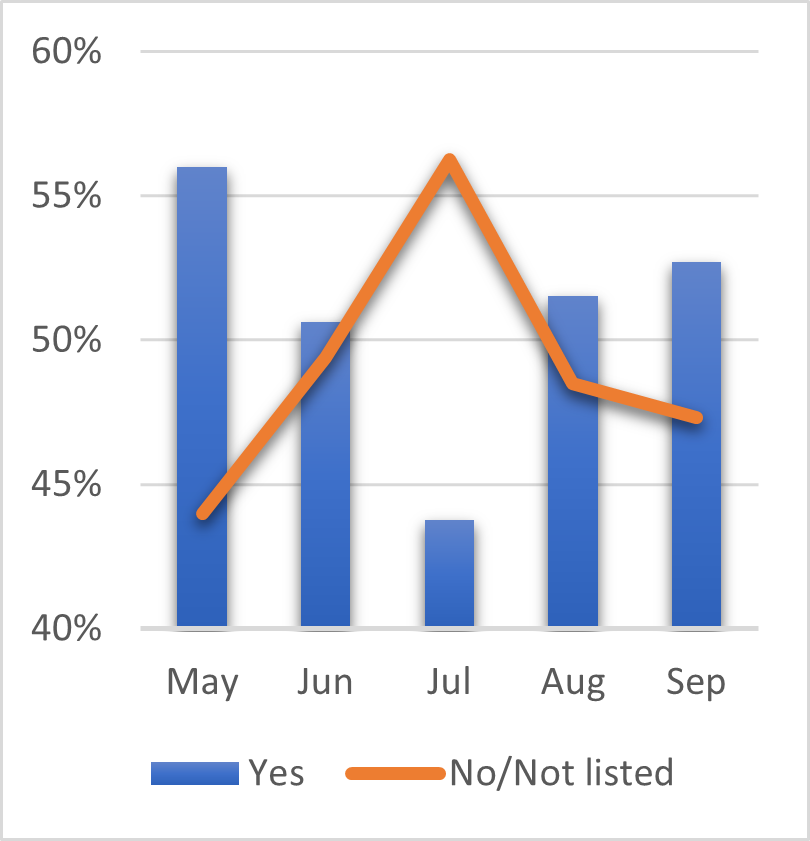

Only 53% of all job posts for Field Techs in September required a field school as a requirement for hiring, reflecting the reality that field schools are hard to come by due to both pandemic and costs (Fig. 12). Although this is a slight improvement from August, the trend is still concerning. Reduction in training requirement for entry level Field Techs would lower the quality of their work and output – a concern for the entire sector.

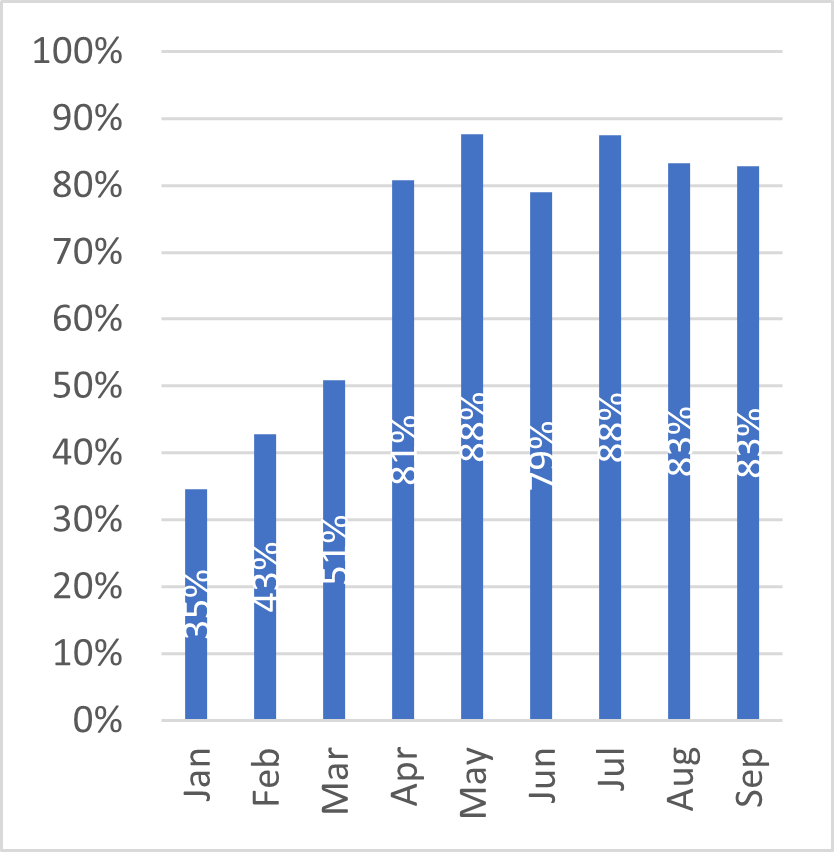

Employers are still publishing wage information for most job posts, a continued positive trend (Fig. 12). Jobs posts on Twin Cairns without wage information usually generate about 30% less views, an indication to companies that publishing wage information may actually increase the application pool.

Summary

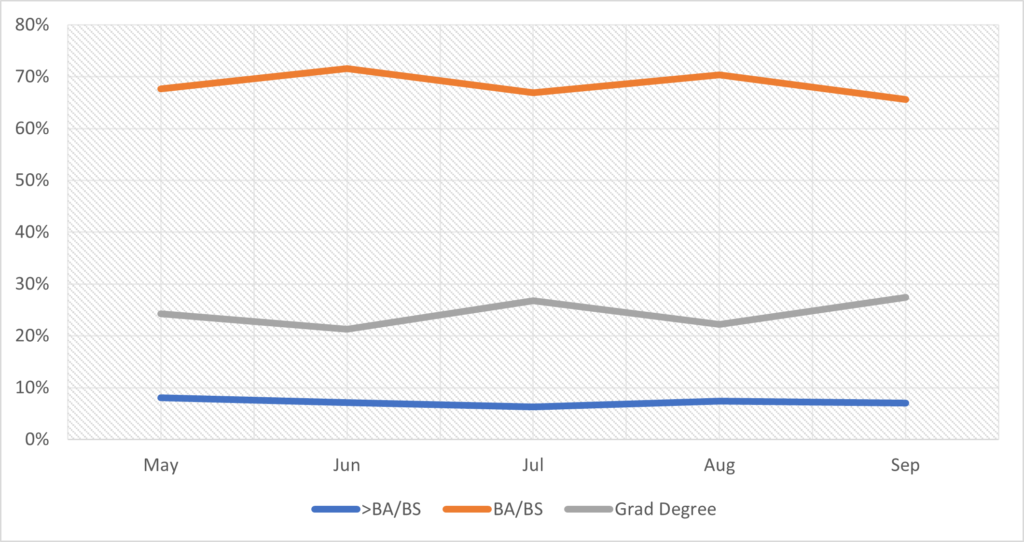

The September data indicates continued growth for the CRM sector. The decline in Field Tech wages is of significant concern as it may be an indication of reduction in quality of the CRM labor force. Since there are no indications that the hiring pool expanded, it is unlikely that increased supply is driving wages down. Education requirement seems to suggest that a decline in the requirement for a BA/BS is the result in the increased requirement for MA/MS degrees (Fig. 14).

We will continue to monitor this issue and urge CRM leaders to take note. Quality reduction in CRM work will serve the benefit of no one, especially not that of the public. As the sector matures and expands, we must ensure that the quality of its work remains, at a minimum, at current level. If possible, the expansion and growth should yield even better quality of work, helping to preserve our shared cultural heritage for future generations.

Serving the CRM sector with job posts and actionable data.