CRM Job Report October 2022

Tracking CRM employment demand, wages & required education

Twin Cairns is Evolving

The Twin Cairns research facility – gathering data of jobs & wages for the CRM sector – has been spun off to an independent unit. It is now the Twin Cairns Intelligence Unit. The unit will continue to publish the monthly job report on the Twin Cairns Newsletter and Blog posts. Companies and individuals interested in deeper, more granular data search and analysis, can contact the unit here.

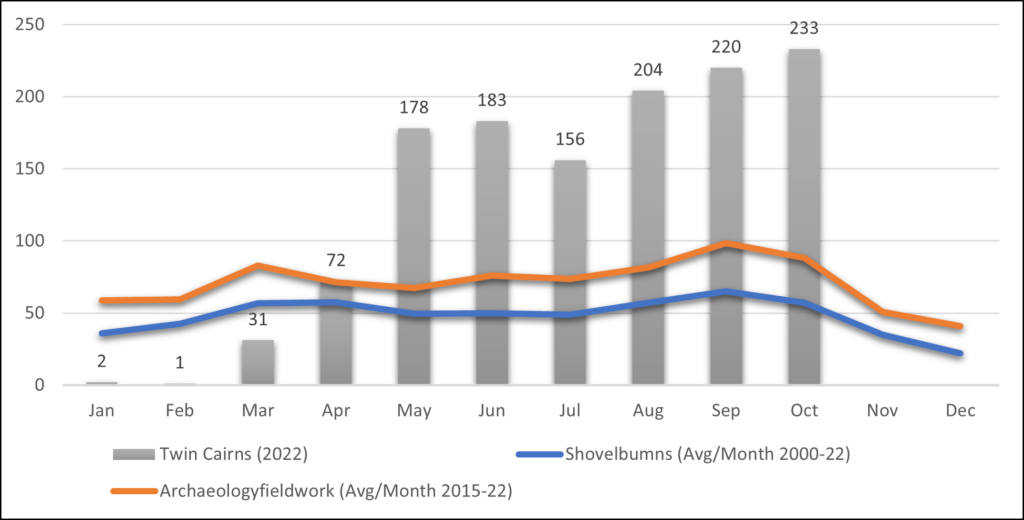

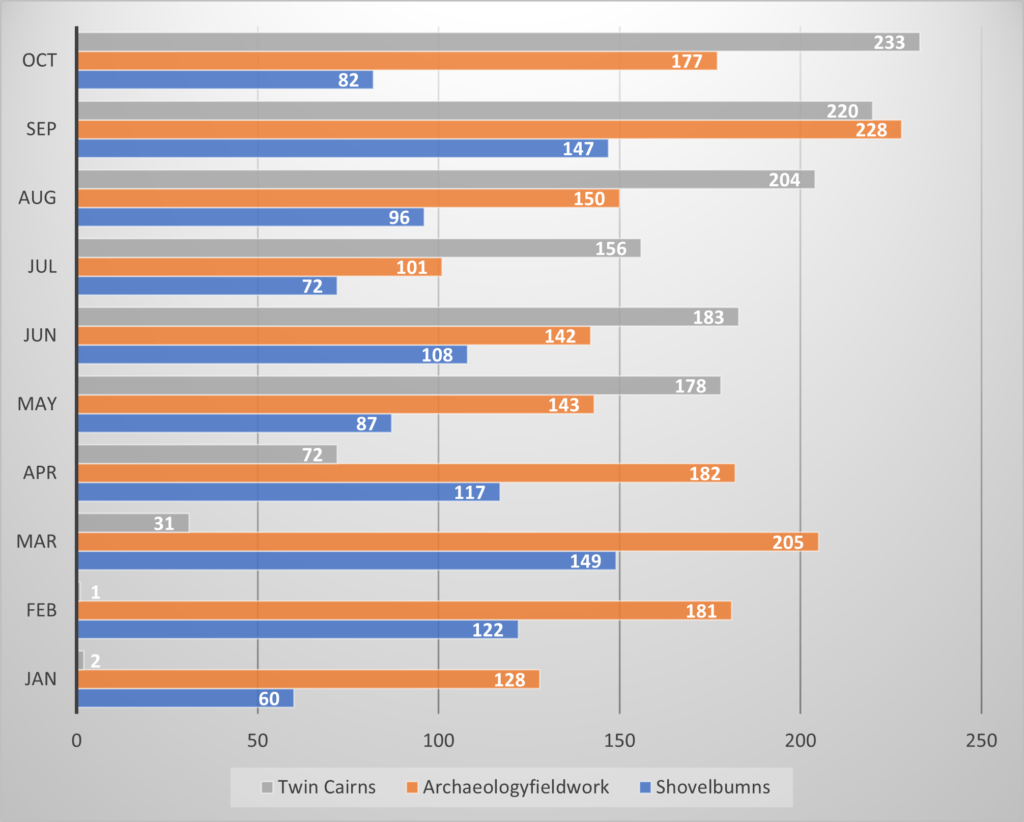

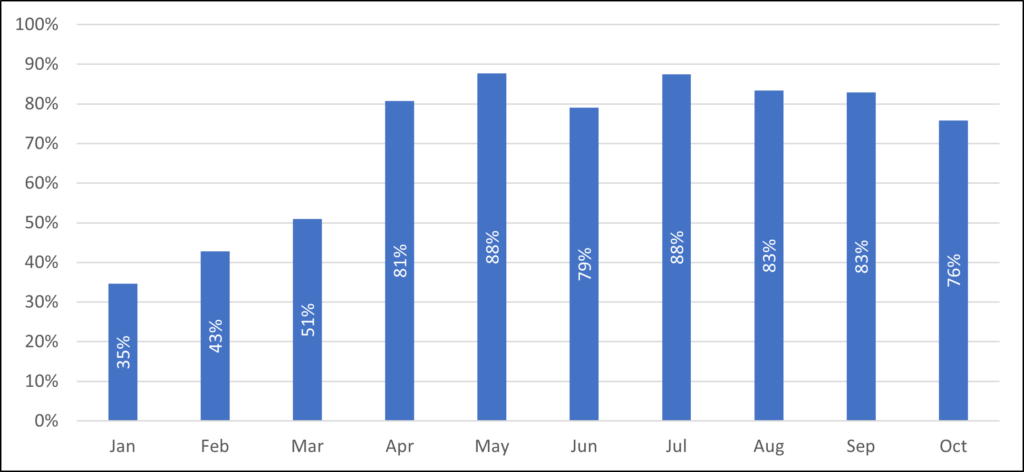

The number of CRM jobs posted online for October was the largest recorded for any month on record (with the single exception Feb 2015, when 264 jobs were posted on the archaeologyfieldwork.com)(Fig 1-2). October is traditionally an off peak month, when the number of jobs offered begin to decline – due to ensuing winter conditions in northern latitudes and the usual pause for the holidays. But such was not the case this month, when 233 jobs were posted on the Twin Cairns site.

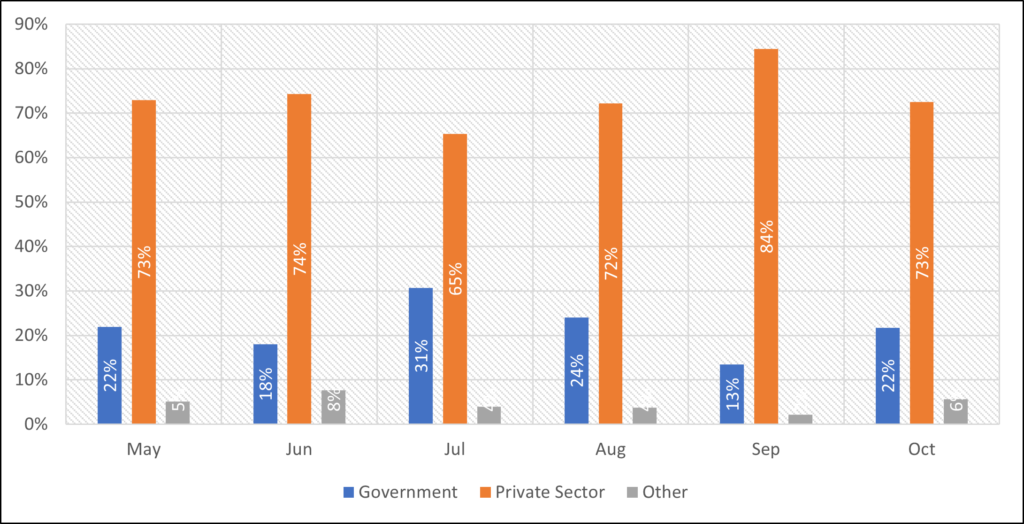

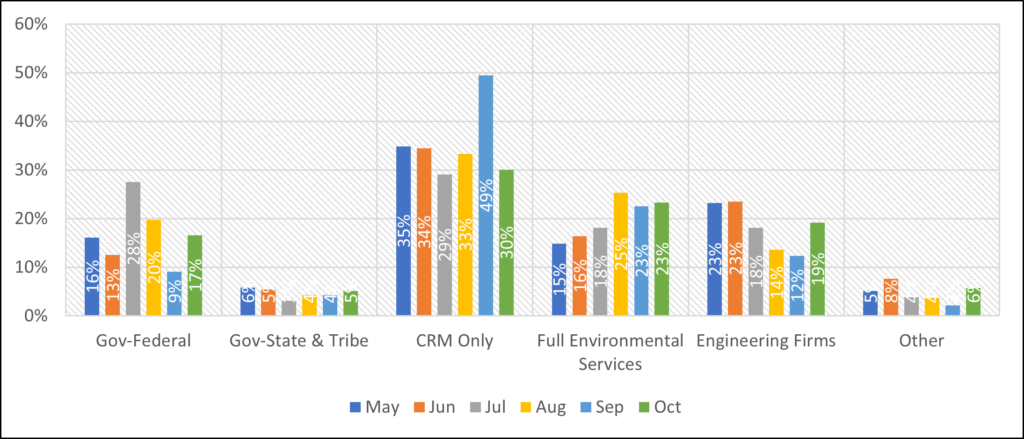

Government hiring increased again, especially by federal agencies (Fig 3-4). Within the private sector, engineering companies increased hiring, while full environmental services and companies focused exclusively on CRM reduced hiring and the number of job posts.

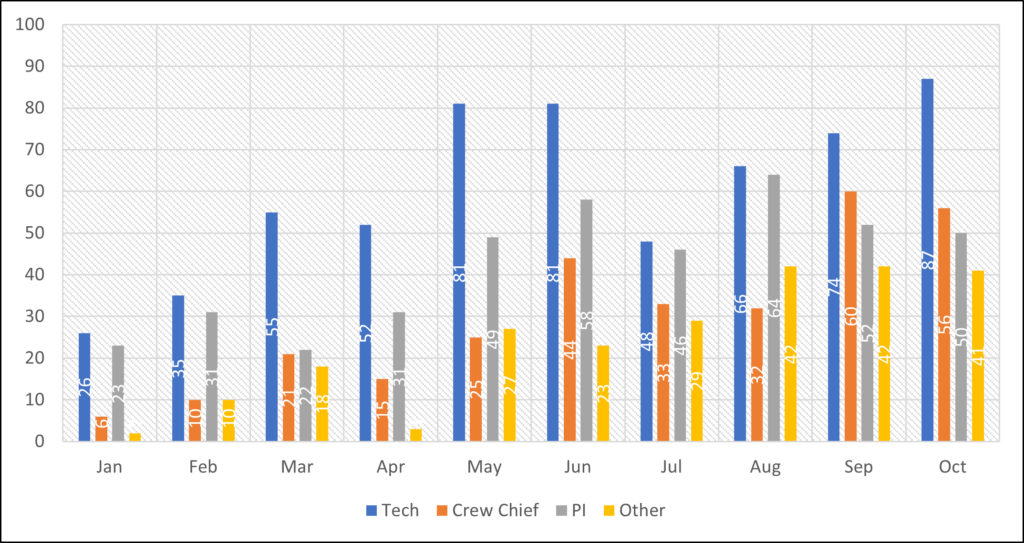

Demand for all CRM position types continued to be strong (Fig 5). Demand for Field Techs was particularly strong, following by a robust demand for Crew Chiefs and a stable demand for PM/PI’s. Demand for related CRM positions – GIS techs, museum curators, etc – continued to be strong and stable – 42 such positions were published in Oct.

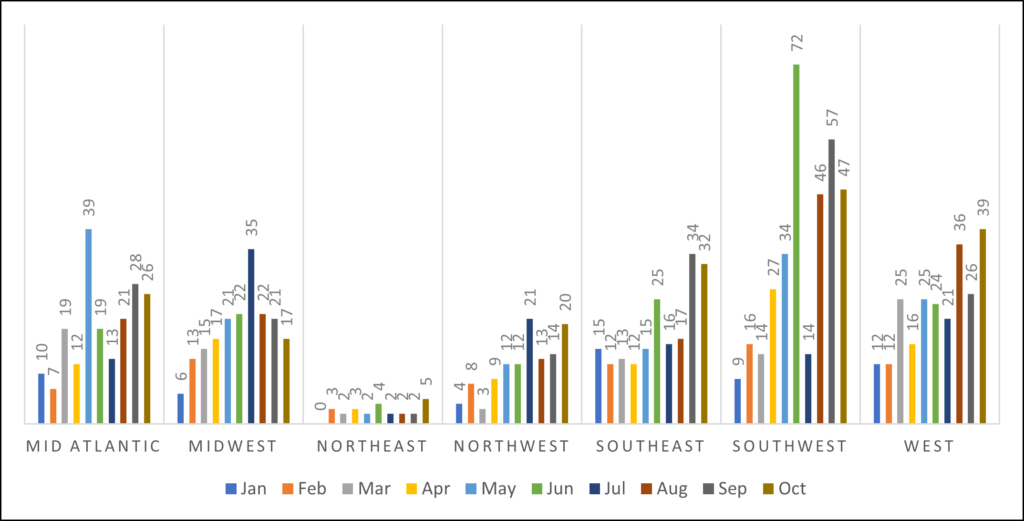

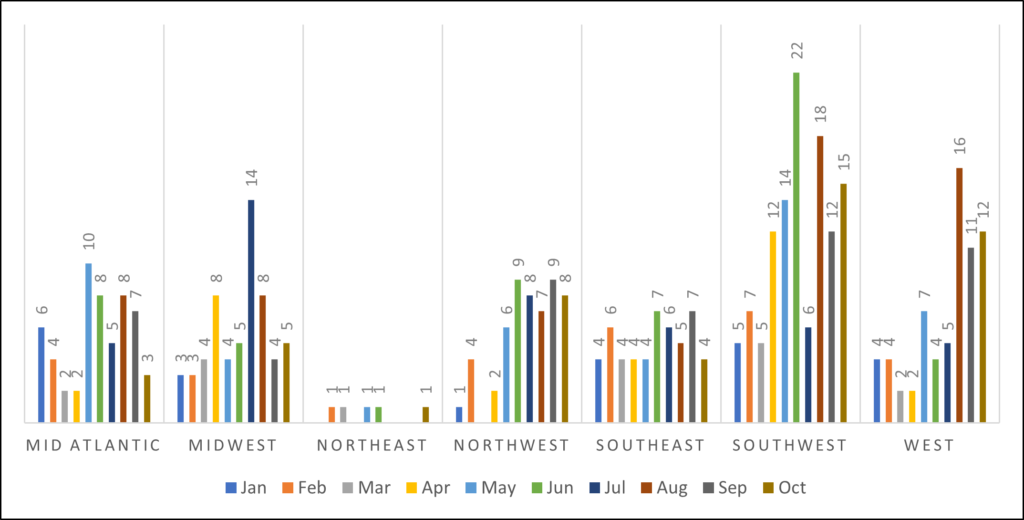

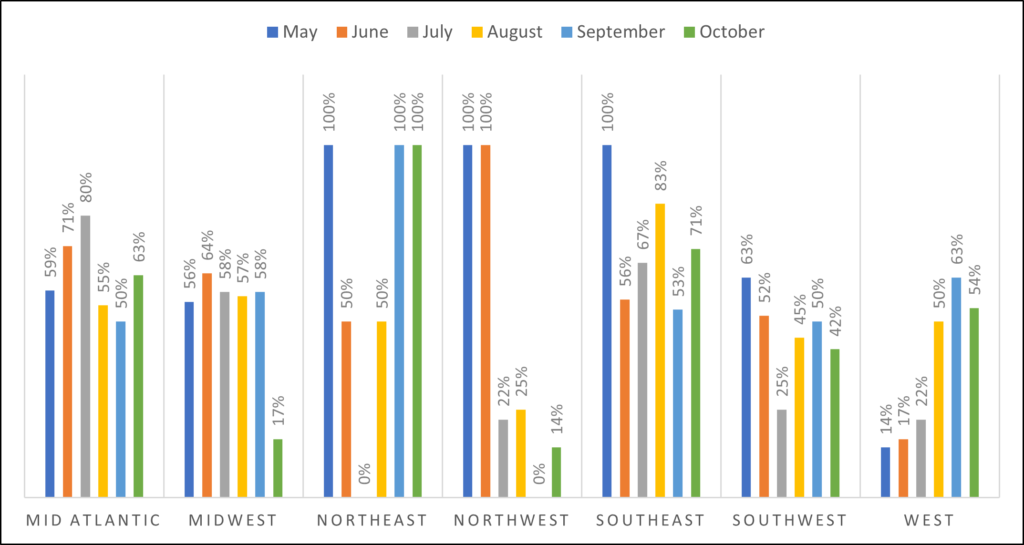

The largest number of jobs were offered for positions in the Southwest, Southeast and West (Fig. 6). In the Northeast, demand for CRM jobs continued to be anemic. Driving growth in both the West and the Southwest is a continued need for PM/PI’s (Fig. 7).

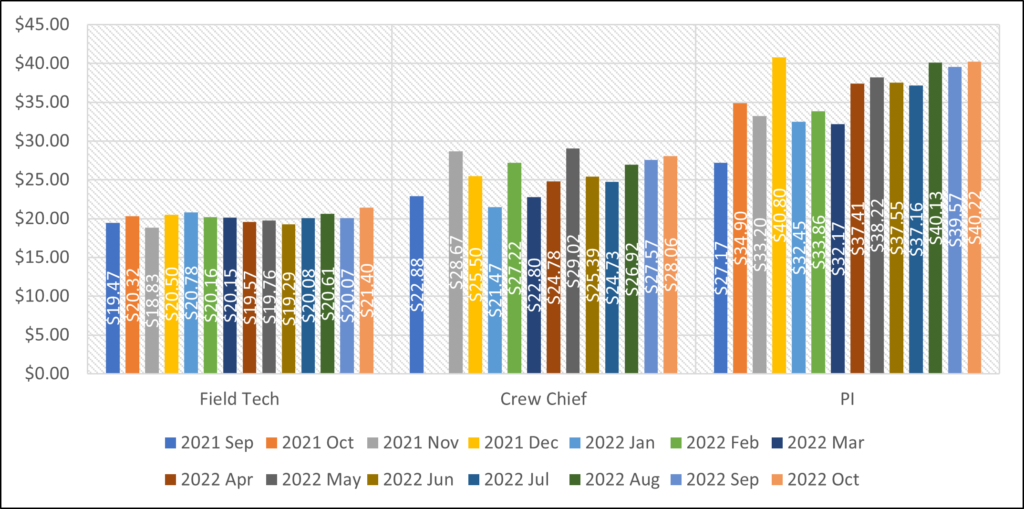

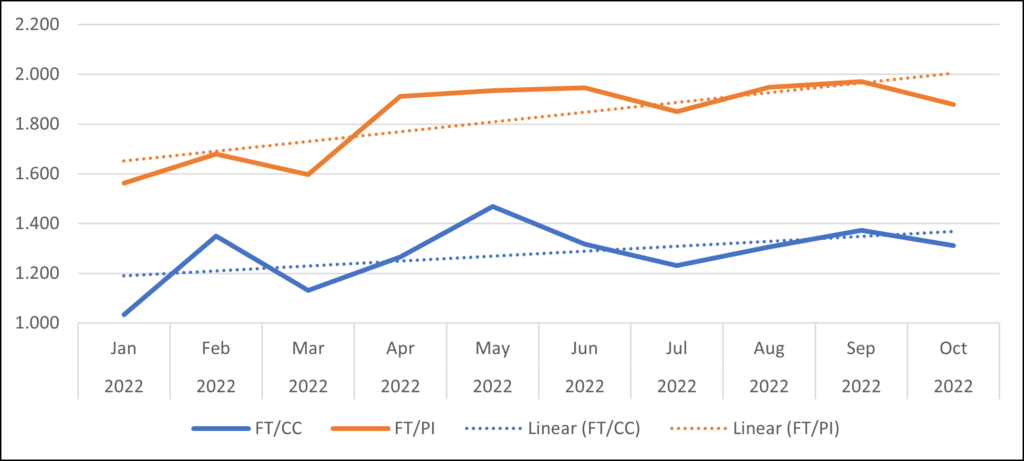

Nationwide, average hourly wages for Field Techs grow in October– from $20.07 to $21.40, a 7% increase from Sep (Fig. 8). This is the highest average Field Tech wages recorded since we began tracking wage data in Sep 2021. Average wages for both Crew Chiefs and PM/PI also grow, but only by 2% for the month. The significant increase in Field Tech wages narrowed the ratio gap between them and Crew Chiefs and PM/PI’s (Fig. 9). It is not yet possible to estimate whether such trend is anecdotal or a harbinger of increased demand, and higher wages, for Field Techs.

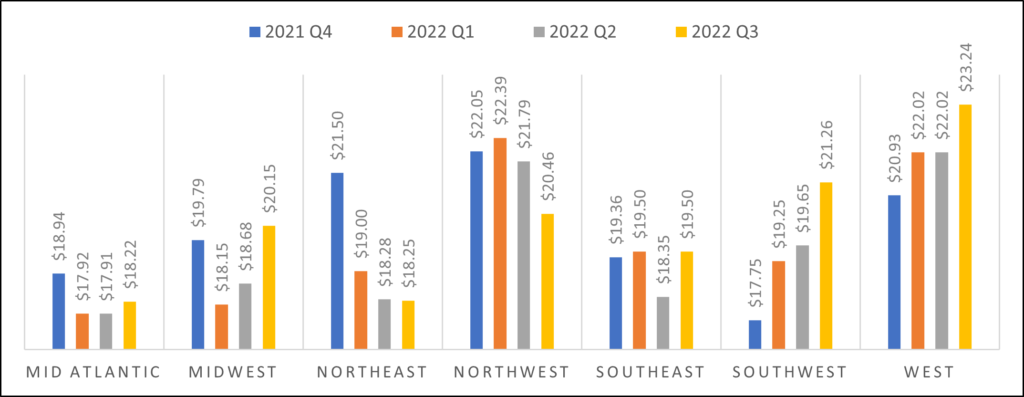

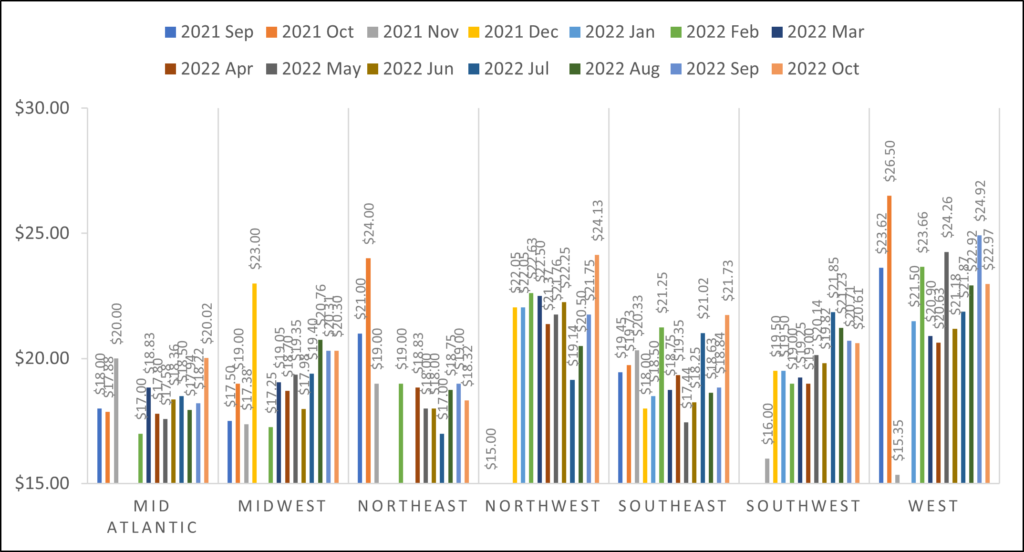

Notwithstanding the above, national data mask surprising diversity in regional wage differences (Fig. 11). While hourly wages declined in the Northeast and Northwest and are stagnant in the Mid Atlantic, Midwest and Southeast, they are increasingly growing in the Southwest and West.

Driving the increase in wages for Field Techs is a regional catchup. Wages increased dramatically in the Southeast, Northwest and Mid Atlantic as firms in these regions are trying to compete with higher wages offered by firms in the Southwest, and especially in the West (Fig. 10).

Just slightly over half of all job posts for Field Techs required a field school, a stable number from previous months (Fig. 11). But this national data mask a challenging regional variation. Field school requirement declined in the Midwest and Northwest to below 20%, a dramatic change that likely reflect severe scarcity of eligible employees (Fig. 12). Field school requirement declined in the Southwest and West as well, but not in the dramatic fashion observed elsewhere.

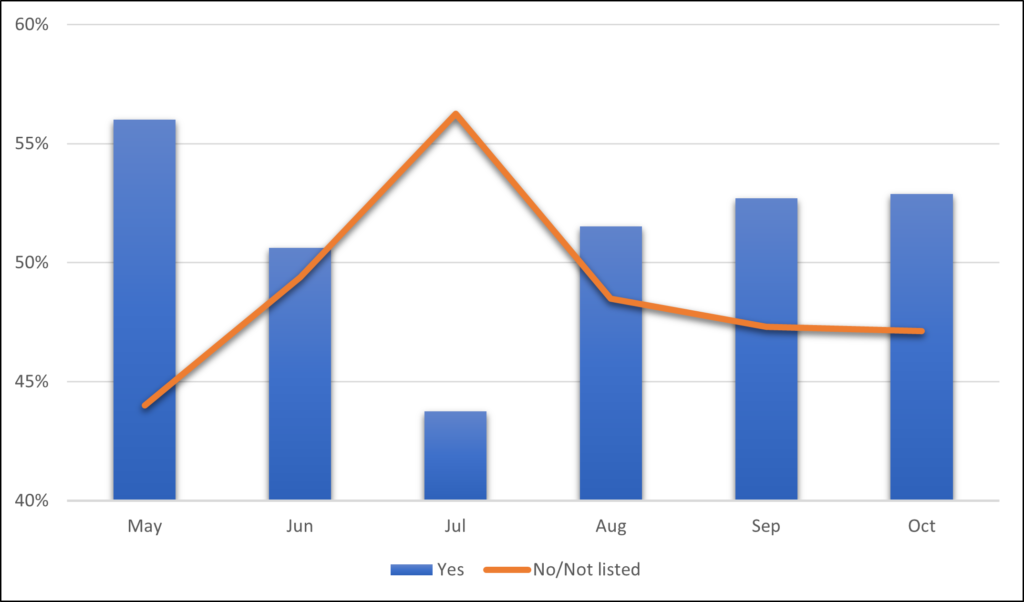

Employers are still publishing wage information for most job posts (Fig. 13). With laws passed in New York and California mandating publication of wages for all job posts, it is unclear why we recorded a 7% decline in job wage publications. We will continue to track this data point and hope to see a reversal of this trend.

Summary

The October data reflect a continued growth for the CRM sector. The increase in Field Tech wages is an encouraging sign that the sector is working harder to attract and retain aspiring CRM professionals. Yet the significant decline in the field school requirement is concerning. As more CRM projects comes online and large infrastructure projects are beginning to be planned and executed, it is vital that we get a qualified, well trained and dedicated workforce that can best preserve our shared heritage for future generations.

Serving the CRM sector with job posts and actionable data.