CRM Job Report February 2023

Tracking CRM employment demand, wages & required education

This Monthly Job Report was created by Ran Boytner & Dannee Sevonto for the Twin Cairns Intelligence Unit™. All Copy Rights are Reserved to the Twin Cairns Intelligence Unit™.

Twin Cairns Performance

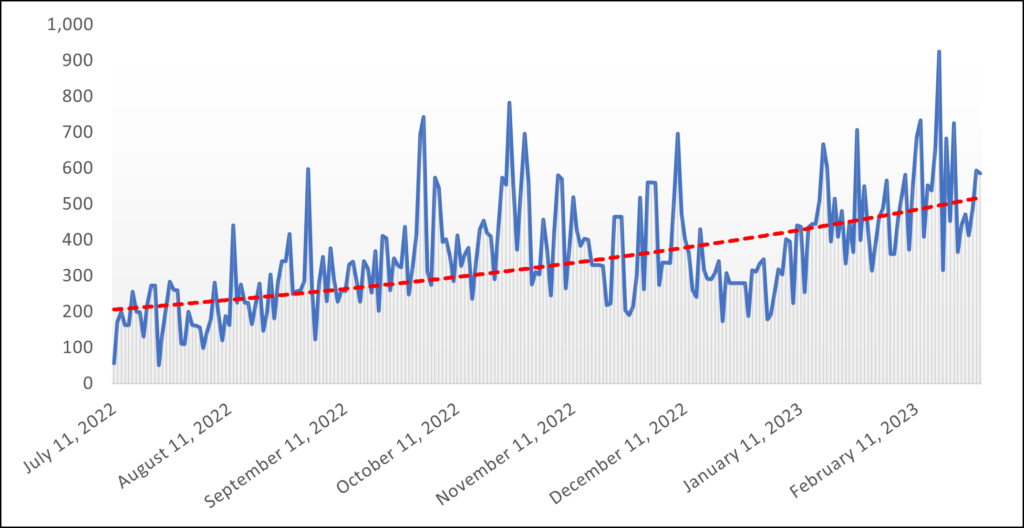

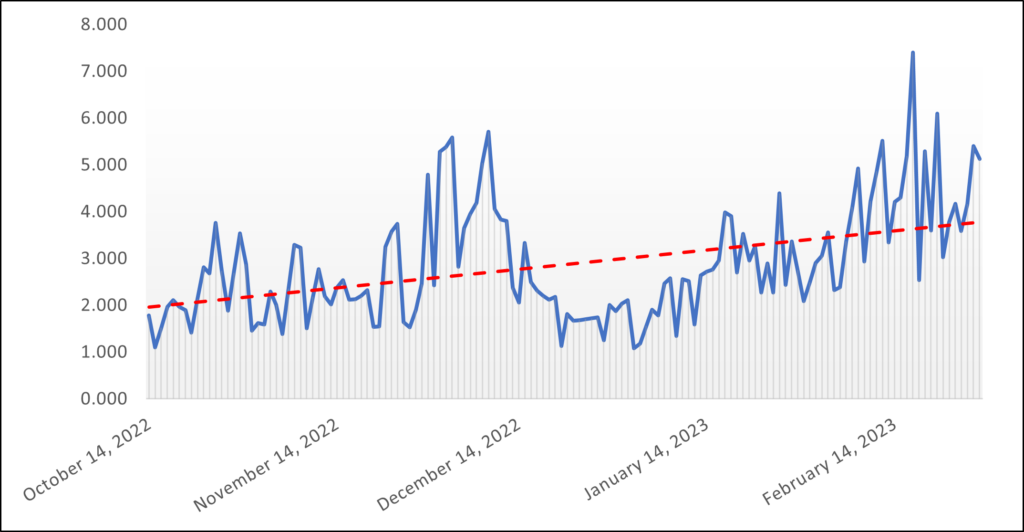

Twin Cairns viewership is increasing significantly, from ca. 200 views/day recorded in mid July 2022 to an average of 500 views/day by February 2023 (Fig 1). Not only that the overall number of views is increasing, so are the number of views per job (Fig 2). By the end of February 2023, each job was viewed, on average, 3.5 times per day.

Number of Jobs Posted

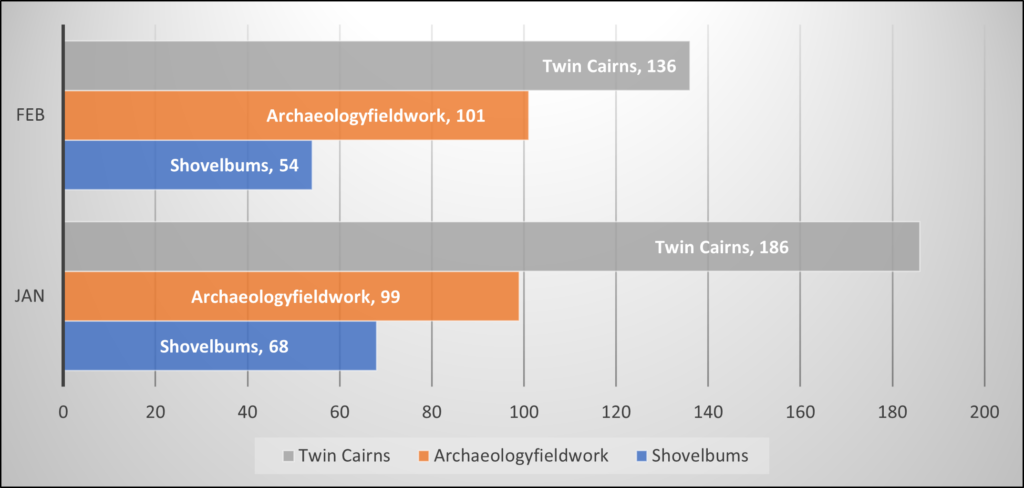

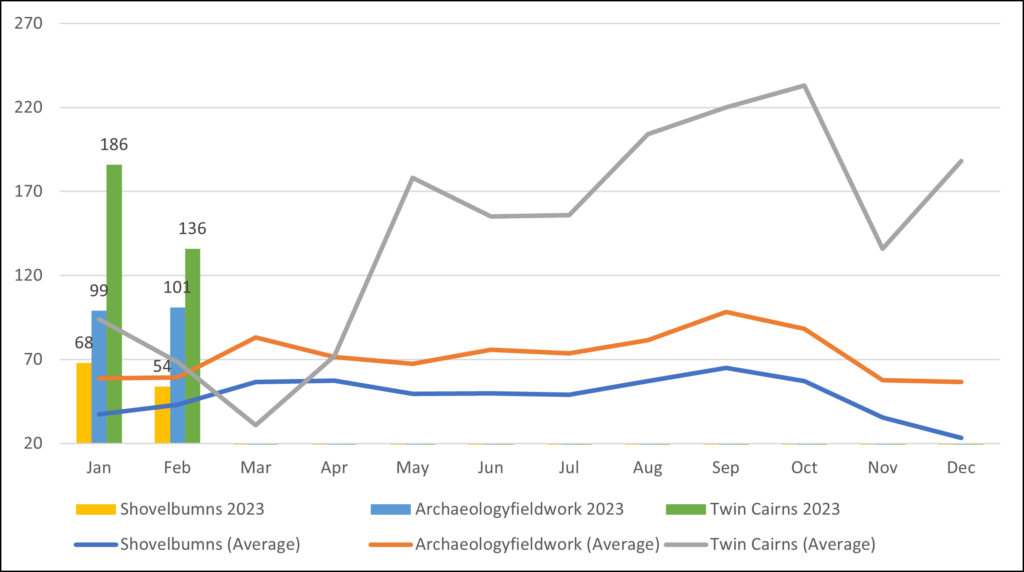

The number of CRM jobs posted for Feb 2023 declined from the previous month on all sites (Fig 3). But the number of jobs posted in Feb 2023 are much higher than the historical monthly average (Fig 4).

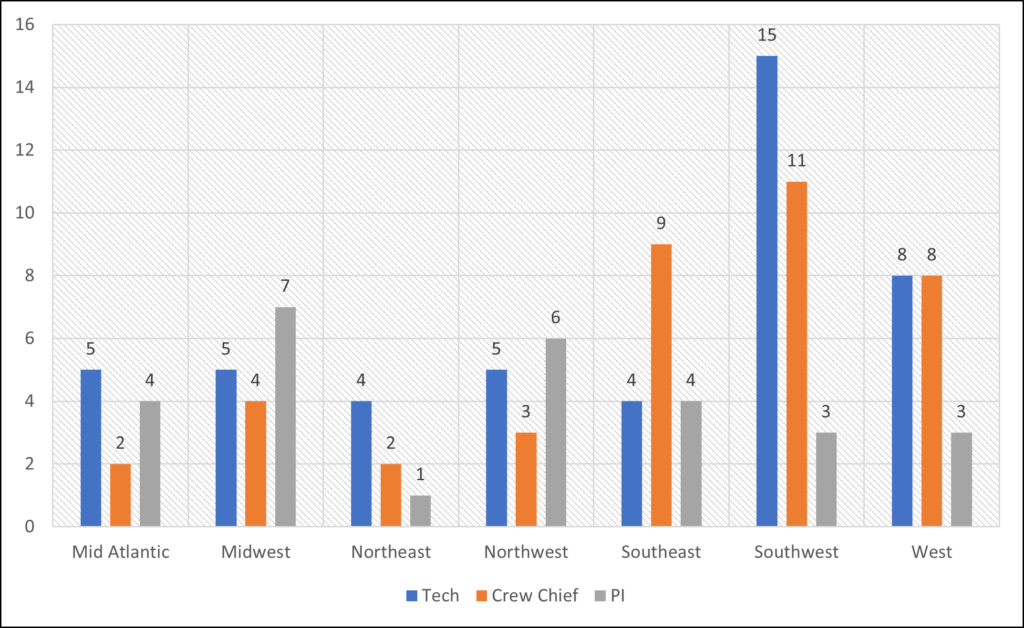

Jobs Posts by Region

Per usual for winter, most CRM jobs were offered in the warmer parts of the US: Southeast, Southwest and the West (Fig 5). At the same time, many positions were published for the Midwest and Northwest, indicating both high demand and preparations for projects to begin in the spring.

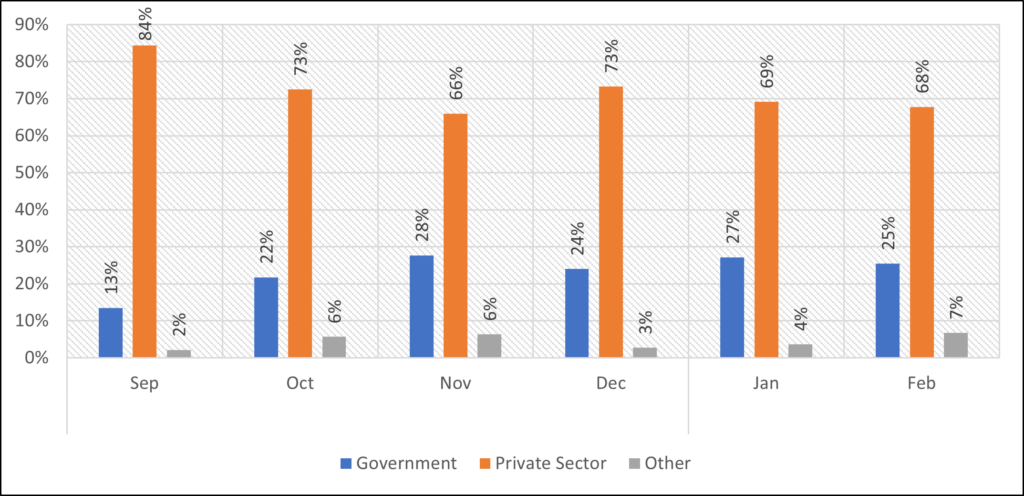

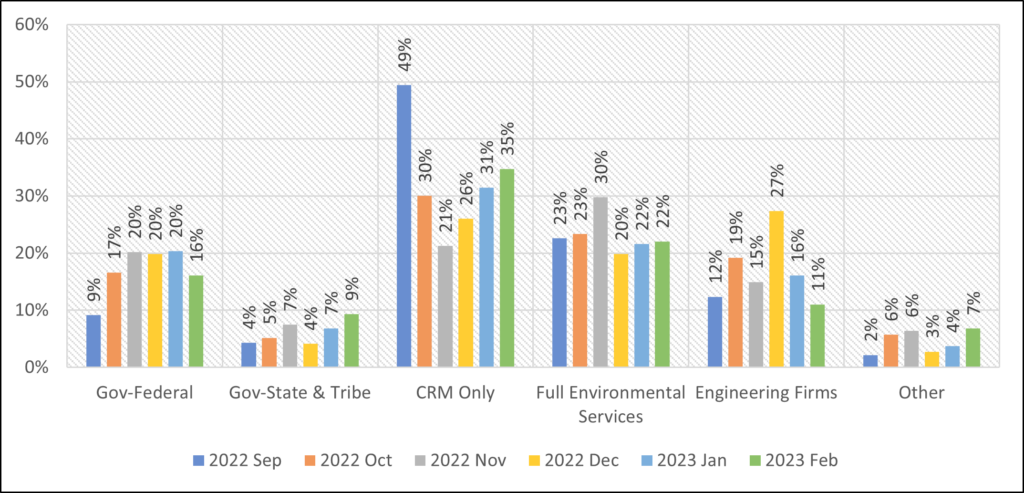

Employer Types

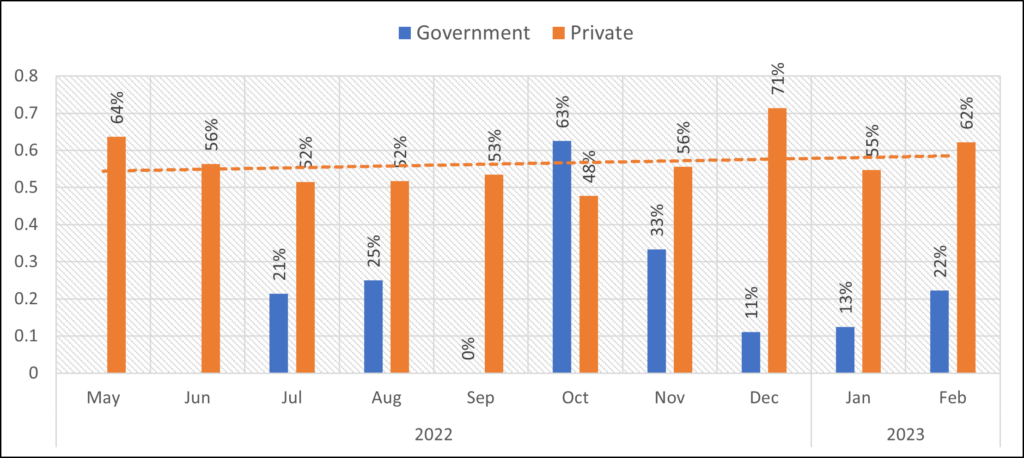

The private sector continues to dominate hiring, with 68% of all hires (Fig 6). Government hiring continues to be robust, both at the federal and state/tribe levels (Fig 7). Most of private sector hiring is done by CRM companies, with full environmental services companies coming a strong second.

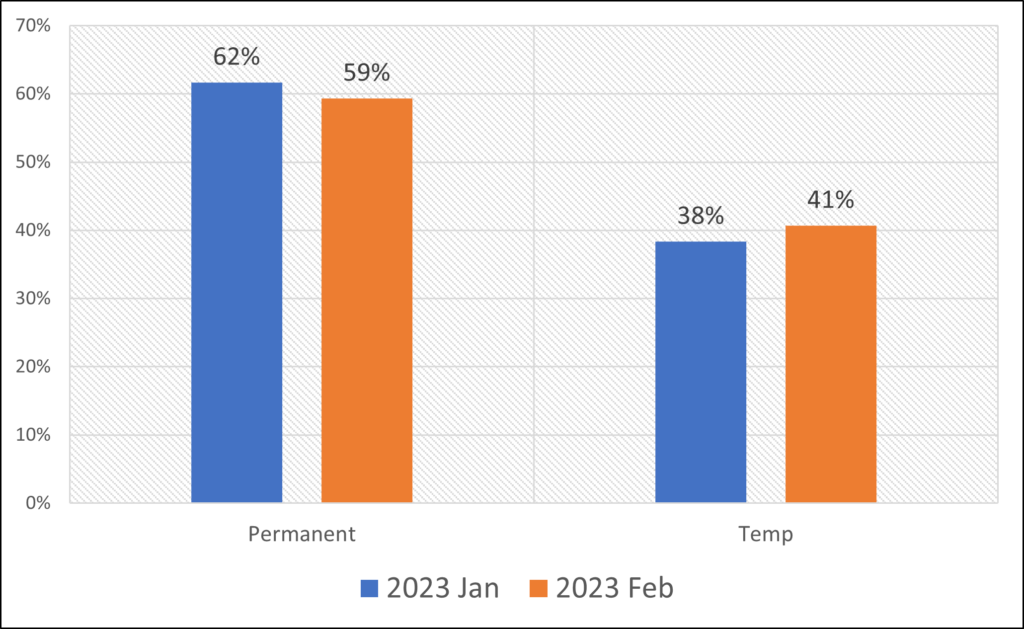

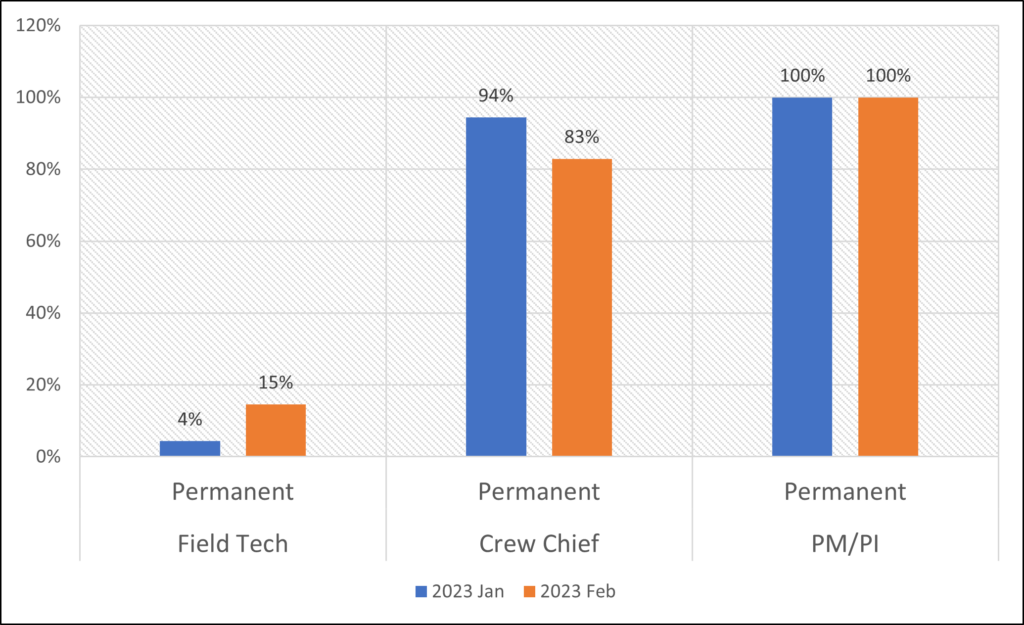

Position Duration

For Feb 2023, most CRM positions were offered as permanent jobs (Fig 8). The distribution of permanent jobs, however, was not equal for all position types. For Field Techs, the number of permanent positions increased from 4% in Jan to 15% in Feb but for Crew Chiefs, it fell from 94% to 83% (Fig 9).

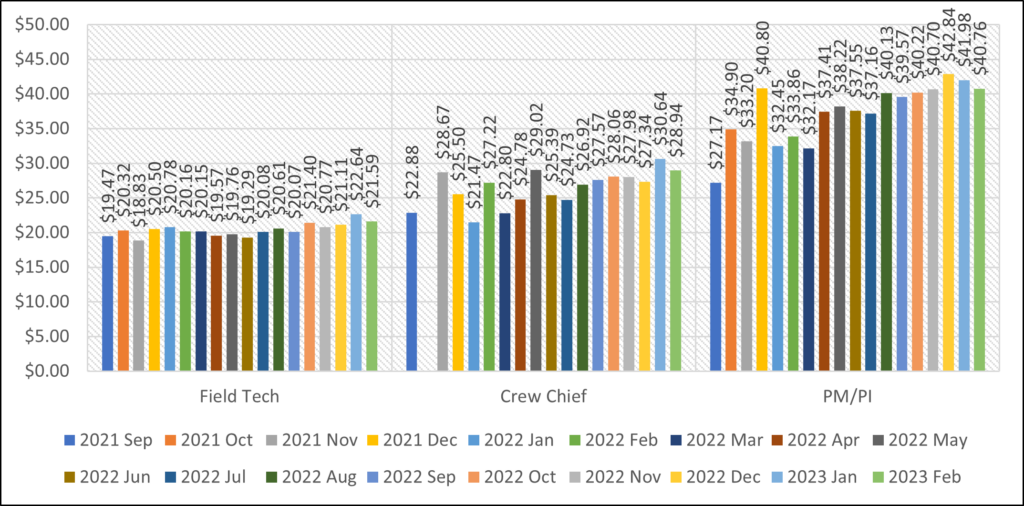

Wages

Nationwide, hourly wages declined for all positions in Feb (Fig 10). The two-month decline for PM/PI hourly wages may indicate a pattern, although overall wages for PM/PI’s are increasing.

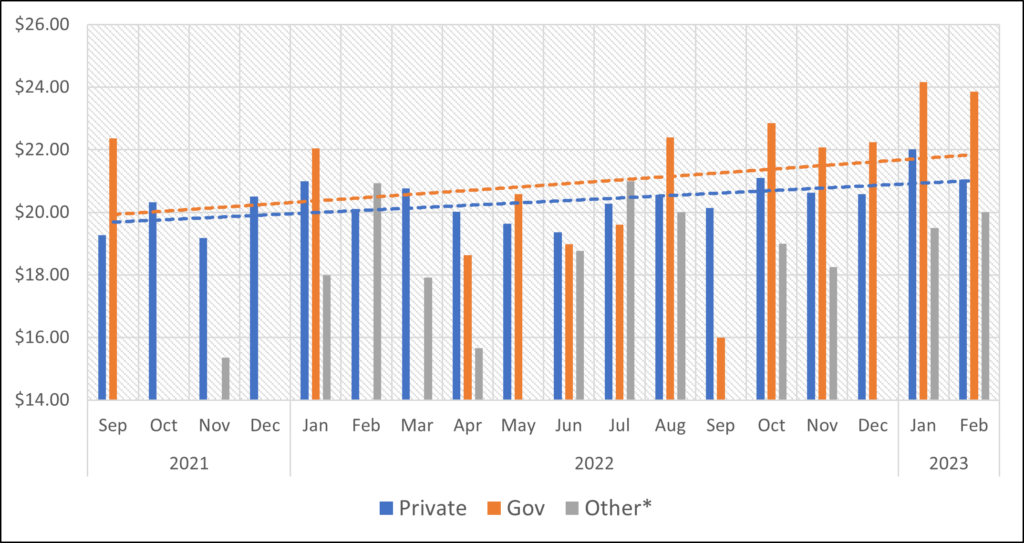

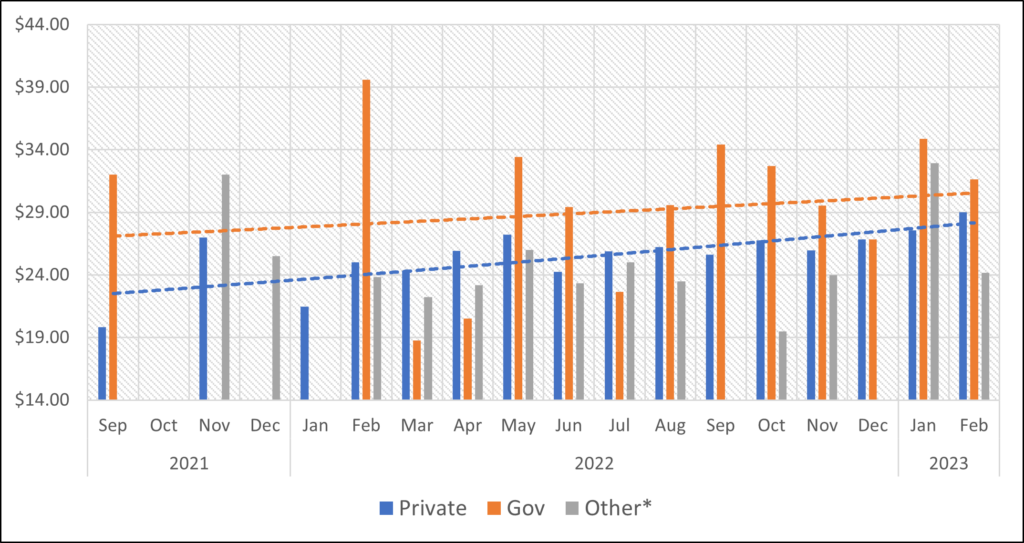

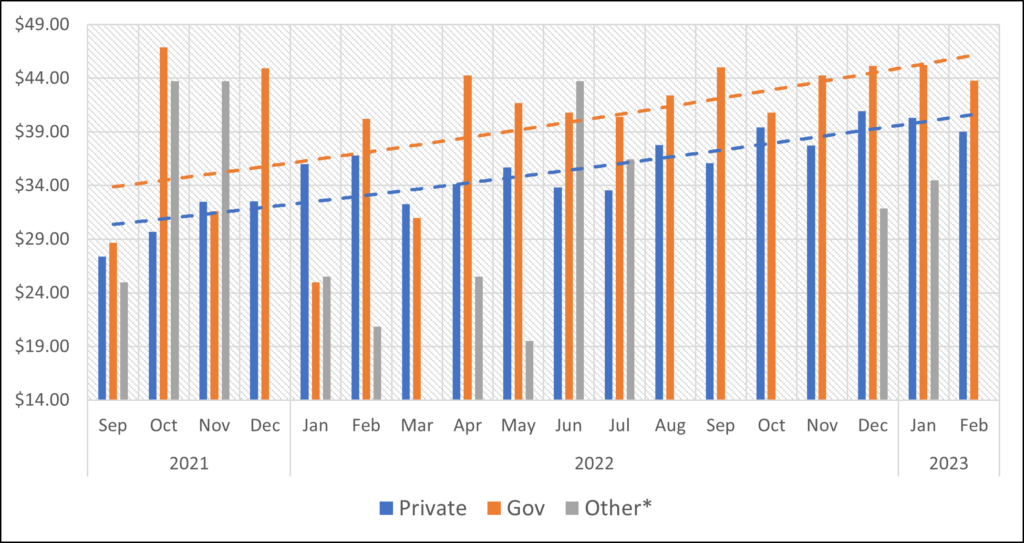

Government vs. Private Sector Wages

Both government and private sector wages for Field Techs declined in Feb, but wages for CRM employment in universities and nonprofits increased, trying to catch up (Fig 11). For Crew Chiefs, government, university, and nonprofit wages declined while those in the private sector increased (Fig 12). For PM/PI, the decline in both government and private sector wages is evident (Fig 13).

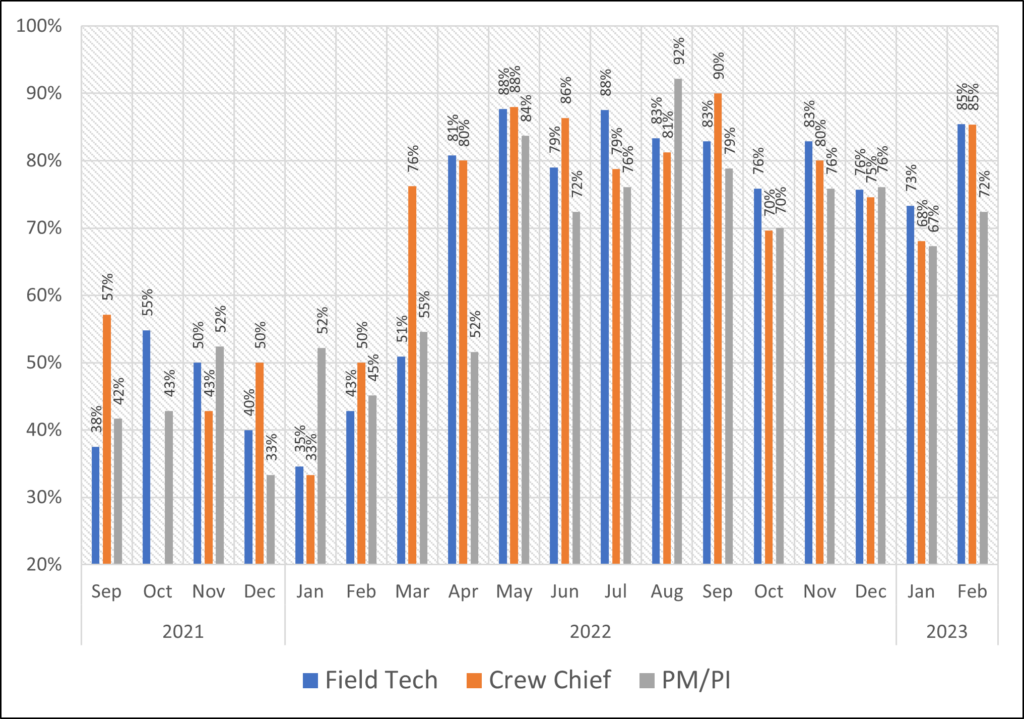

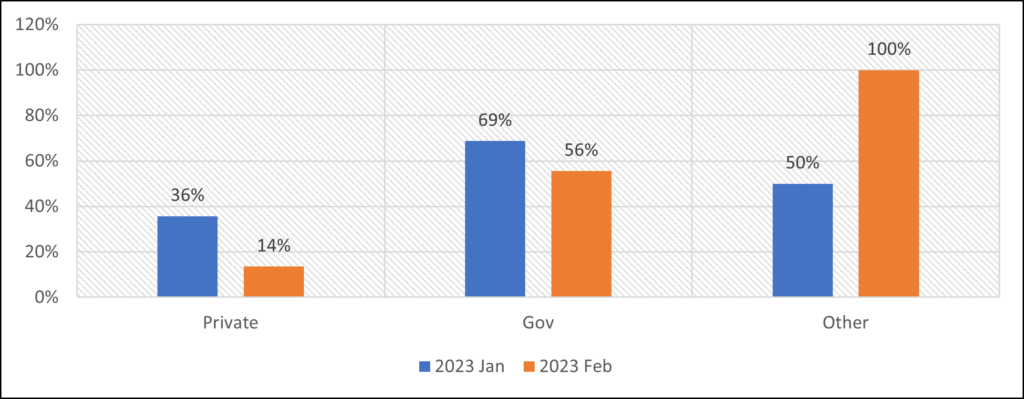

Published Wage Data

After a three-month decline in the portion of job posts that include wage information, the number bounced back for all employer types (Fig 14). 85% of all jobs posted by government agencies of private sector companies included wage data, a trend we strongly encourage.

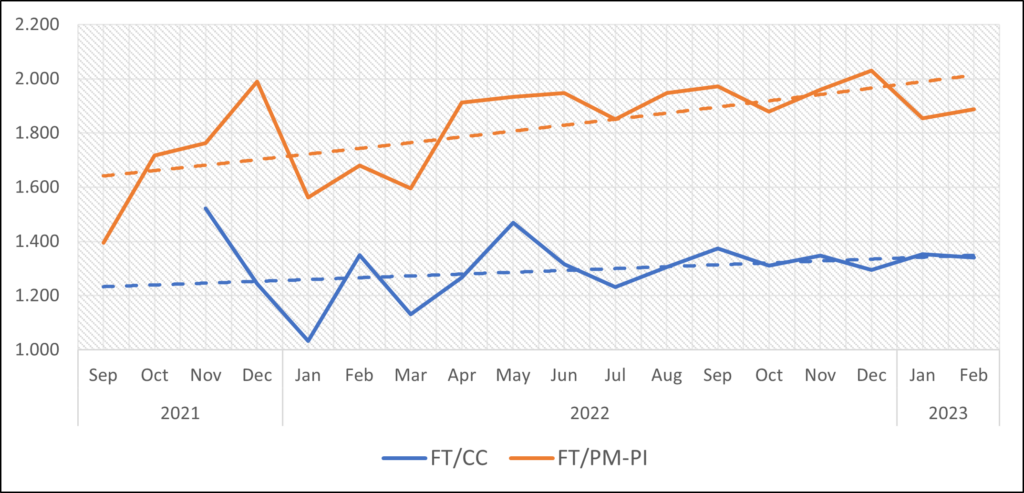

Wage Differentials

Wage differentials between Field Techs & Crew Chiefs, and between Field Techs & PM/PI’s is increasing (Fig 15). The gap is especially widening in pay differentials between Field Techs and PM/PI’s.

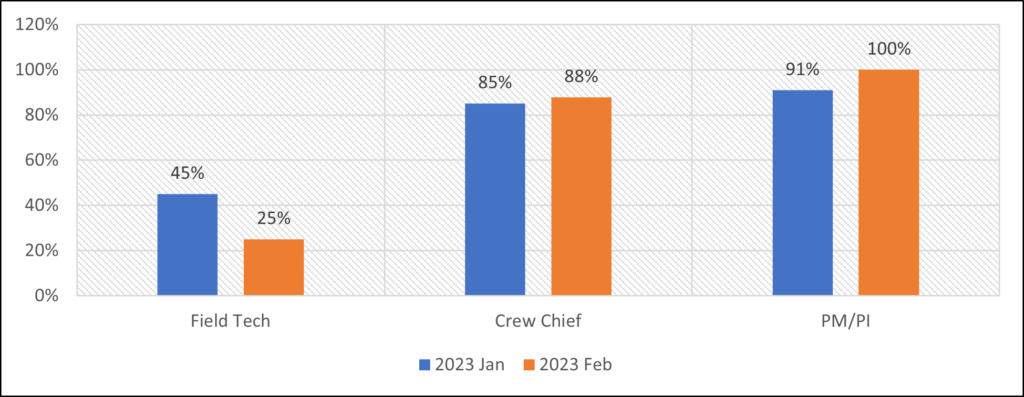

Benefits

Only a quarter of all Field Tech positions offered any benefits, a decline from Jan (Fig 16). The portion of employers offering benefits to Crew Chiefs and PM/PI’s increased, indicating increased competition for talent. The decline in benefit offering was particularly acute for Field Techs in the private sector, where only 14% of companies were offering benefits (Fig 17).

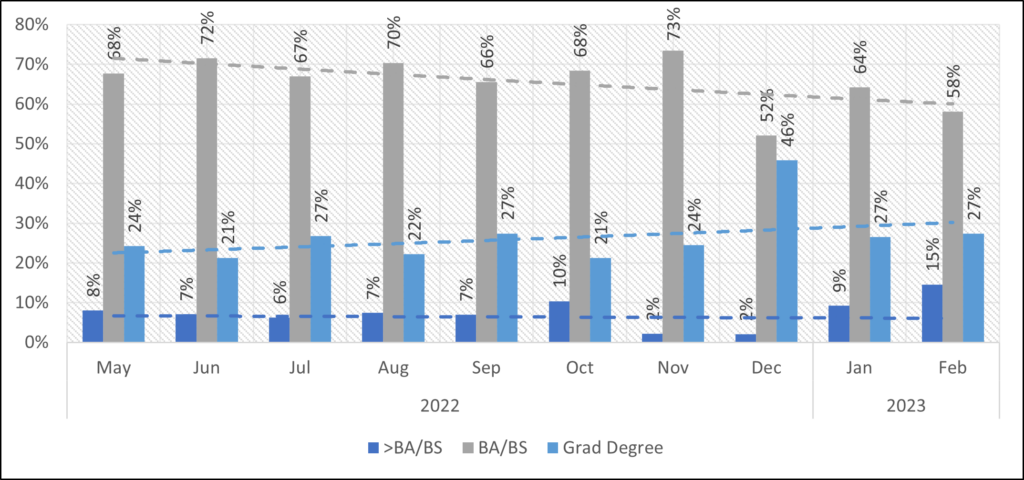

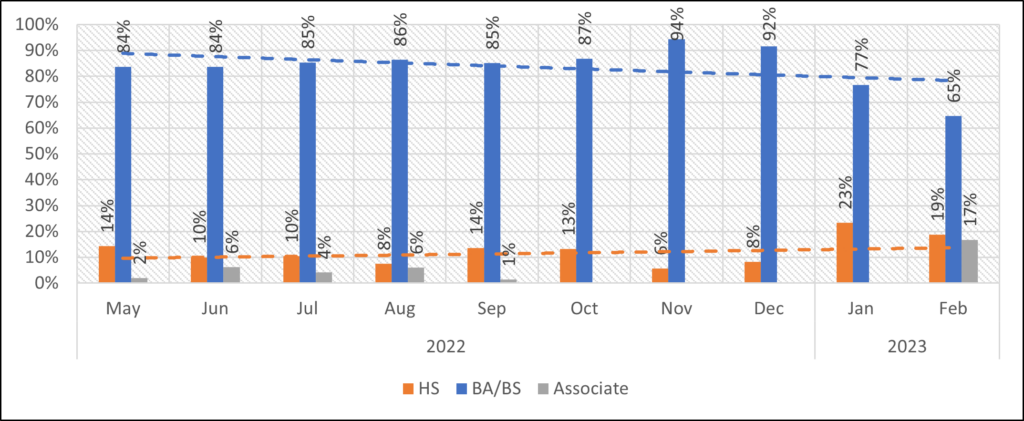

Education Requirements

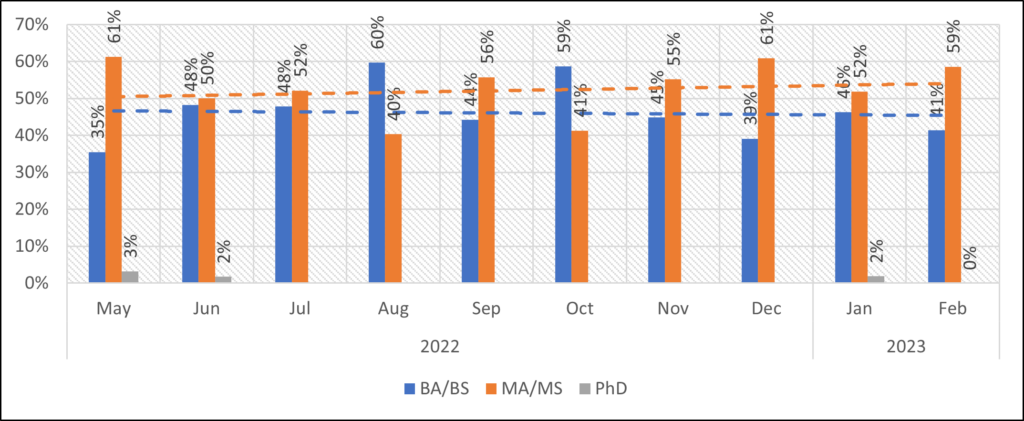

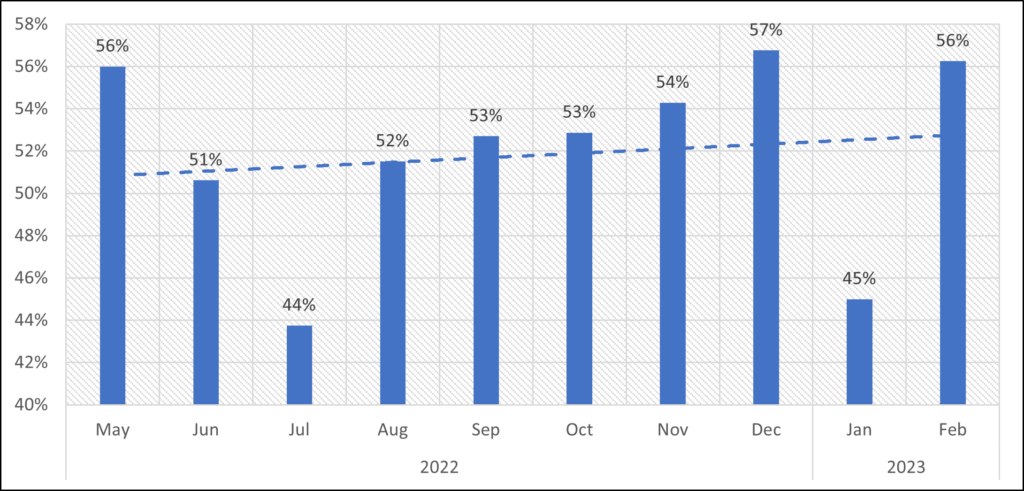

Across the CRM sector, graduate degree requirements increased (Fig 18). At the same time, the requirement for a bachelor’s degree declined, with 15% of all positions offered to individuals with high school or associate degree only.

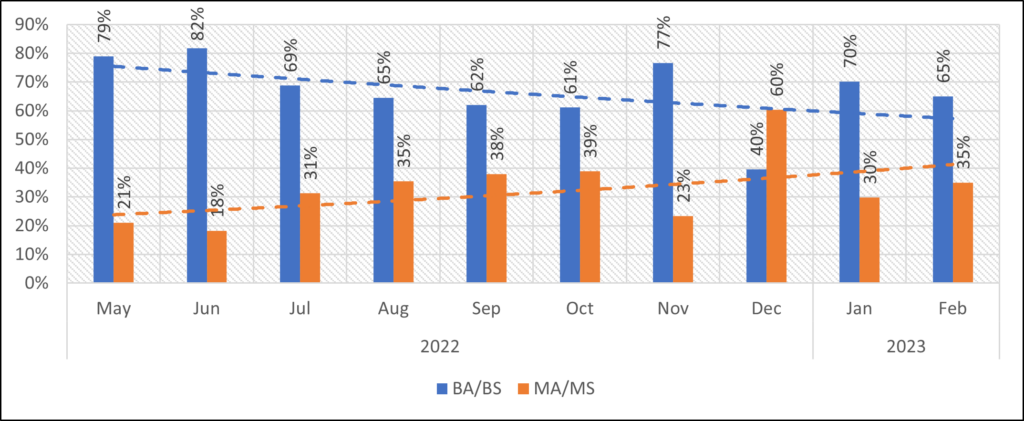

For Field Techs, only 65% of all job posts in Feb required a BA/BS degree (Fig 19). But for Crew Chiefs, the requirement for an MA/MS degree increased from 30% in Jan to 35% in Feb (Fig 20). This rate is still lower from the 60% of job requiring MA/MS degree in Dec 2022, but the trend is clearly to increased demand for graduate degrees. Similar trend can be seen in education requirements for PM/PI’s, with slightly increased demand for graduate degrees (Fig 21).

Training Requirement (Field School) for Field Techs

The requirement for a field school experience bounced back to usual levels in Feb (Fig 22). The field school requirement for Field Techs fluctuates dramatically for government positions, as many of those are training programs and may come in lieu of field schools (Fig 23). Within the private sector, the field school requirement is getting slightly stronger and reached 62% of all Field Tech job posted in Feb.

Better data, better decisions, better employment & employees