CRM Job Report August 2023

TRACKING CRM EMPLOYMENT DATA

By Ran Boytner & Dannee Sevonto

All Copy Rights are Reserved, Twin Cairns Intelligence Unit™

ARCHAEOLOGYFIELDWORK.COM GOES DARK!

On Sep 6, Jennifer Palmer announced that she is shutting down archaeologyfieldwork.com. Jennifer wrote: “I am no longer able to dedicate as much time as the site requires to keep up with postings”. Archaeologyfieldwork.com has been running since 1996, publishing many government jobs at both the federal and state levels (ShovelBums, another CRM job site, publishes almost exclusively private sector CRM jobs). The CRM sector is growing by leaps and bounds, and there are many more job postings this year than ever before – see Fig 6 of this Job Report. Having an updated site with all CRM jobs does require time and resources.

Archaeologyfieldwork.com was an important contributor to the community, providing CRM professionals with access to great government jobs that pay well and offer outstanding benefits. Twin Cairns is continuing this tradition, publishing both government AND private sector positions. Since Jan 1 of this year, we published 229 government, 782 private sector and 44 museum & nonprofit organization jobs (see Figs 12-13 of this Job Report for data from the past six months). We will continue to do so in years to come, providing the community with the broader possible, single sourced, CRM job board.

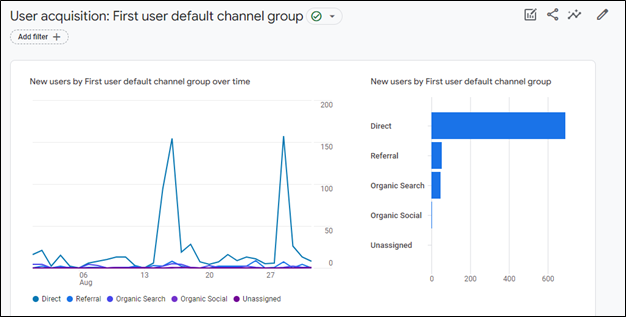

Twin Cairns Performance

This area provides independent data about numbers and access to the Twin Cairns Job Board. It is designed to allow users to evaluate access and ROI when searching for or posting jobs on the Twin Cairns Job Board.

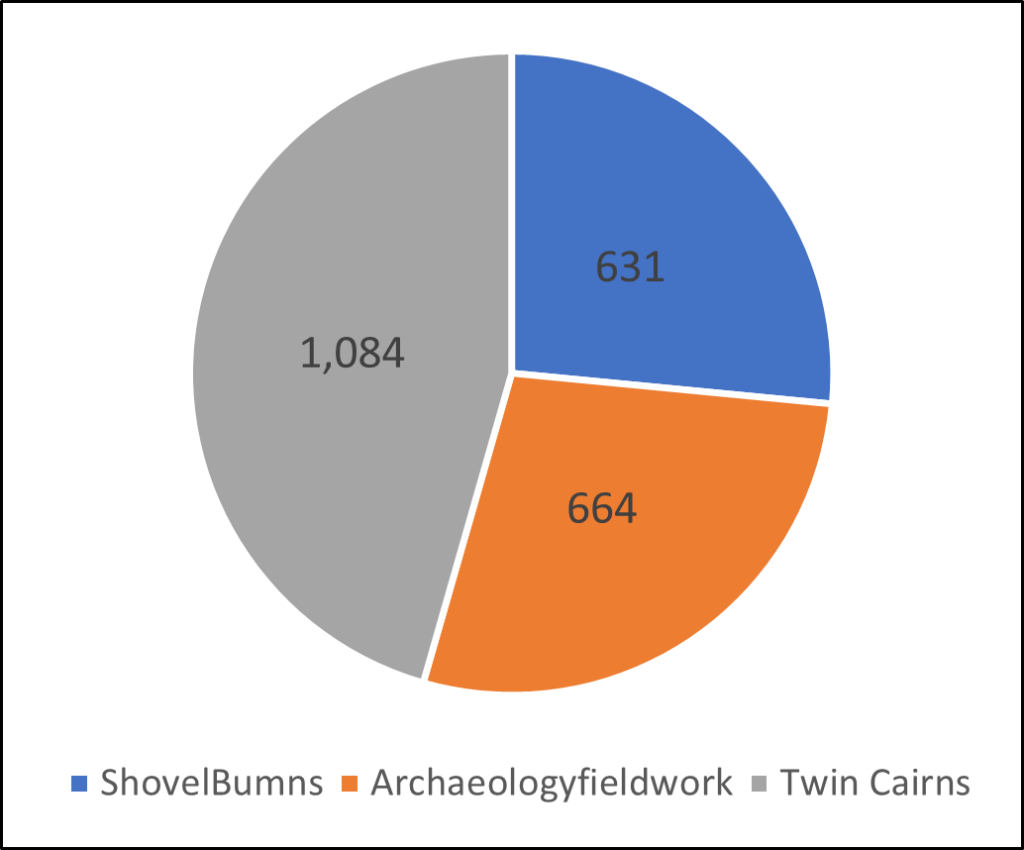

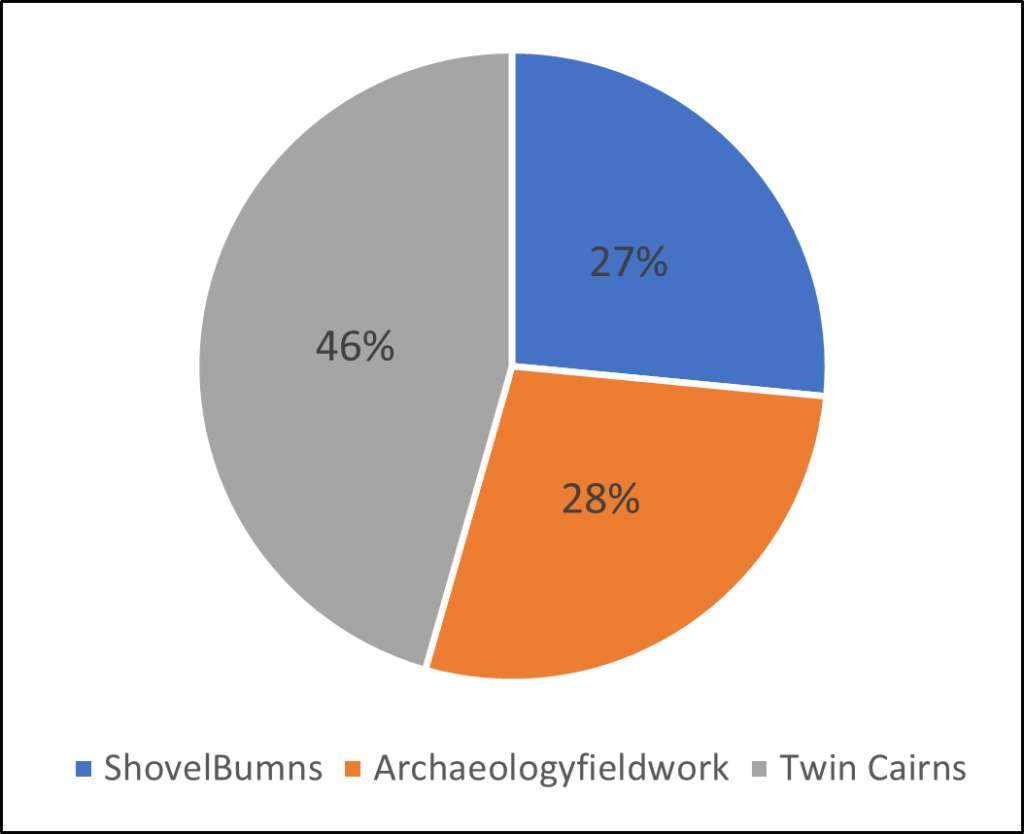

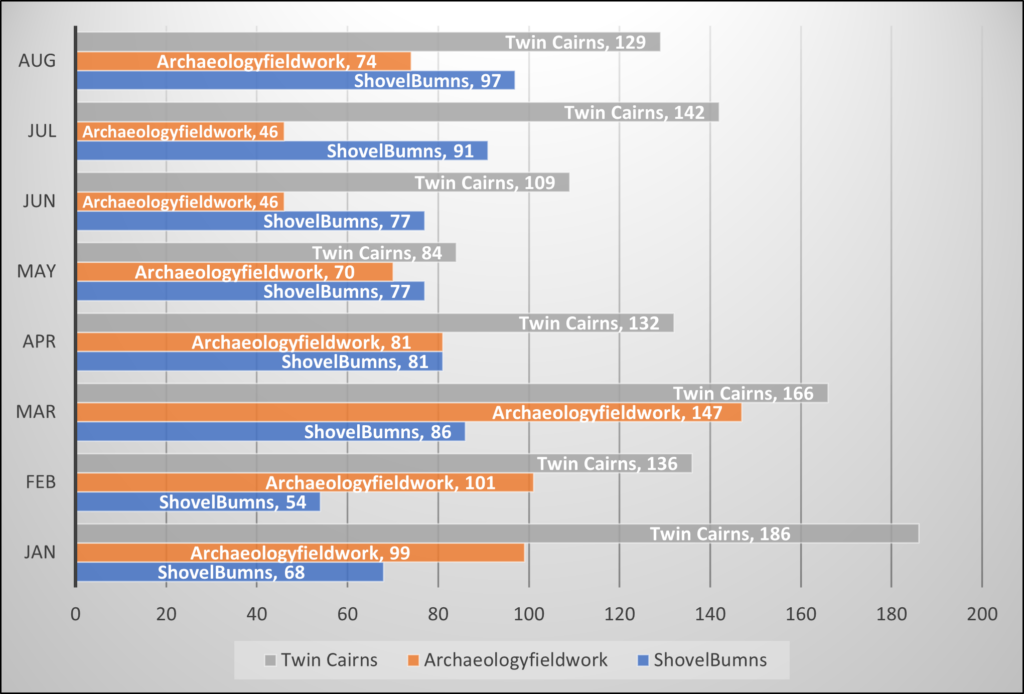

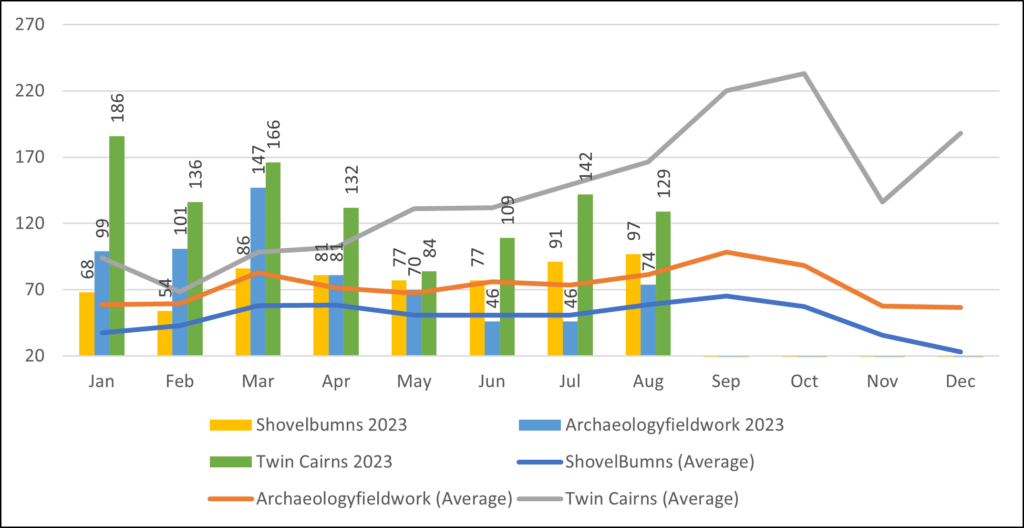

Number of Jobs Posted This Month

This area provides data about the number of jobs posts on the leading CRM job boards: Twin Cairns, ShovelBums and archaeologyfieldwork.com. We are aware that Indeed, Monster and other general job boards are used by CRM companies. However, these general job boards are generally used to manage the application process and are not where most employees first learn about a job.

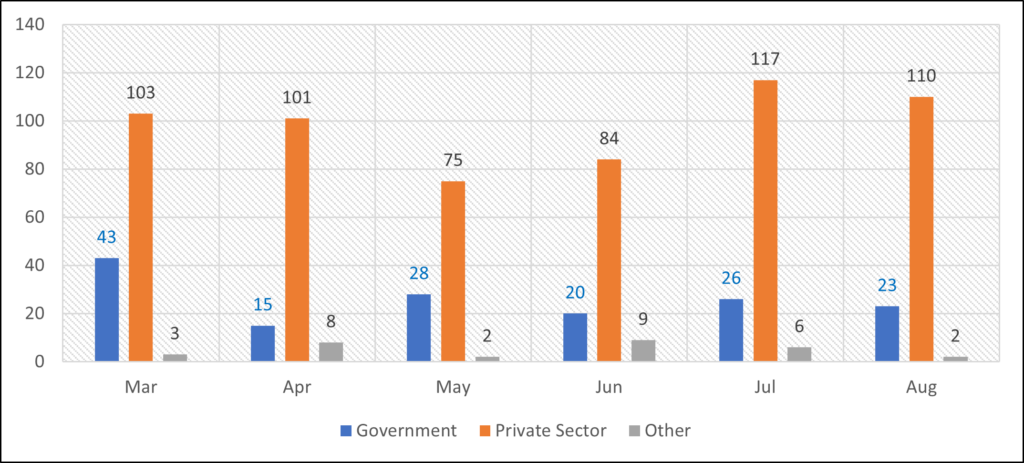

Job Posts

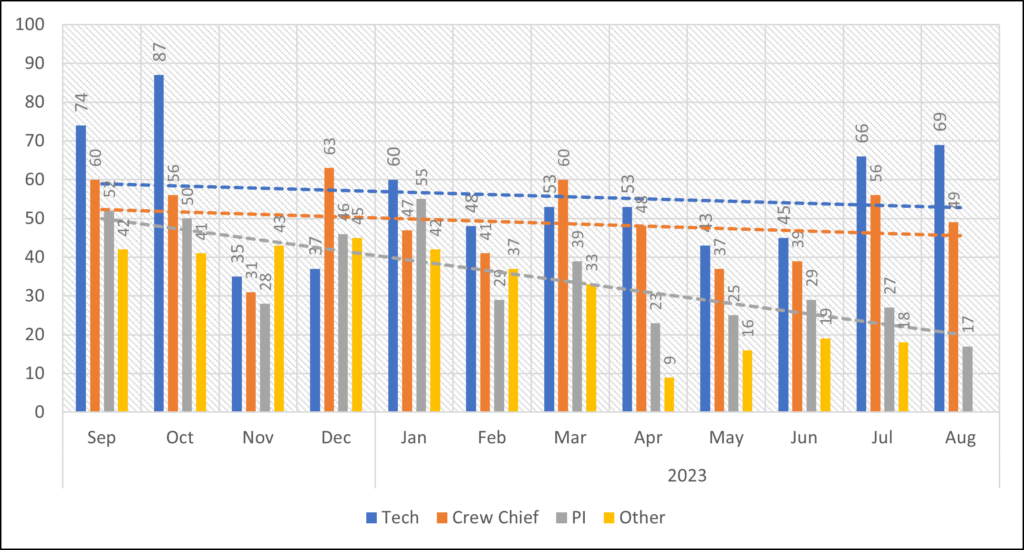

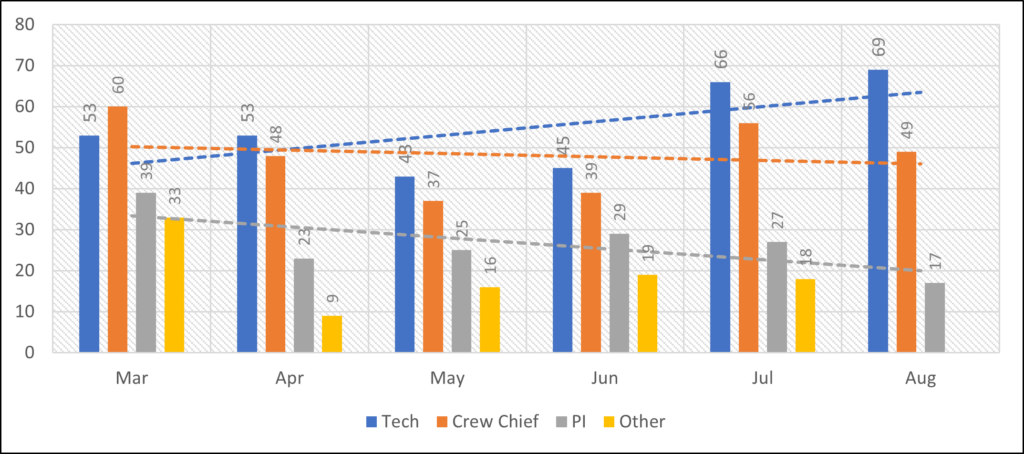

This area records the number of jobs posted for the past twelve & six months by job type. This data illustrates trends in hiring and demand for specific job types throughout the United States. The term ‘Other’ refers to jobs that do not involve field archaeology but are directly related to CRM (GIS, Lab Technician, Museum Curator, etc).

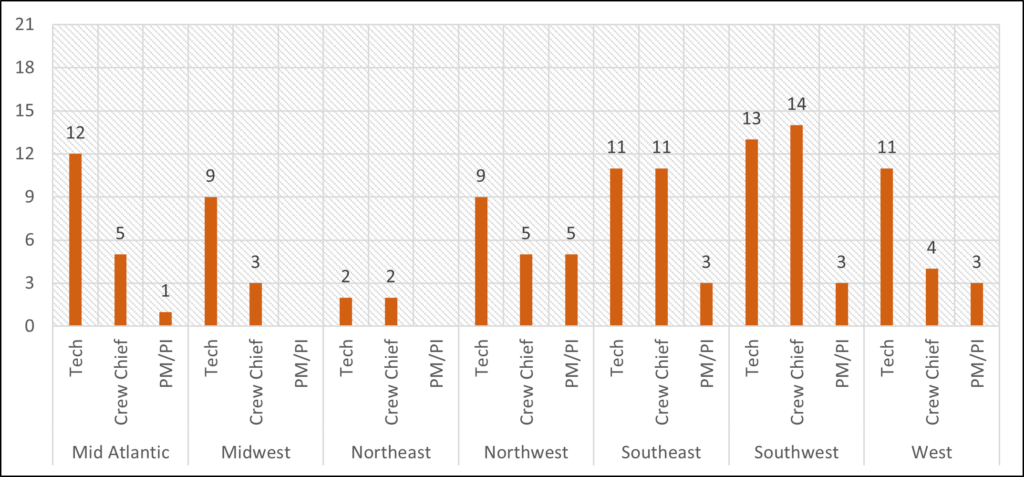

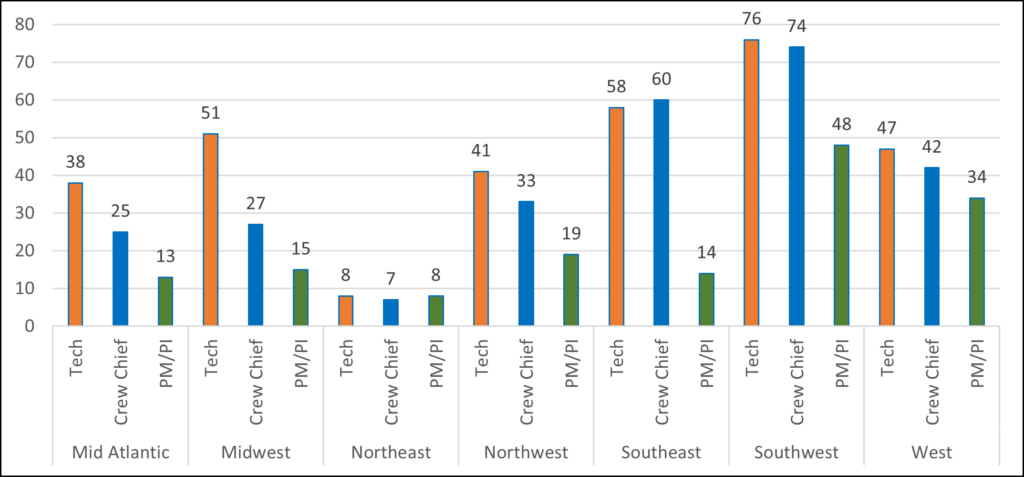

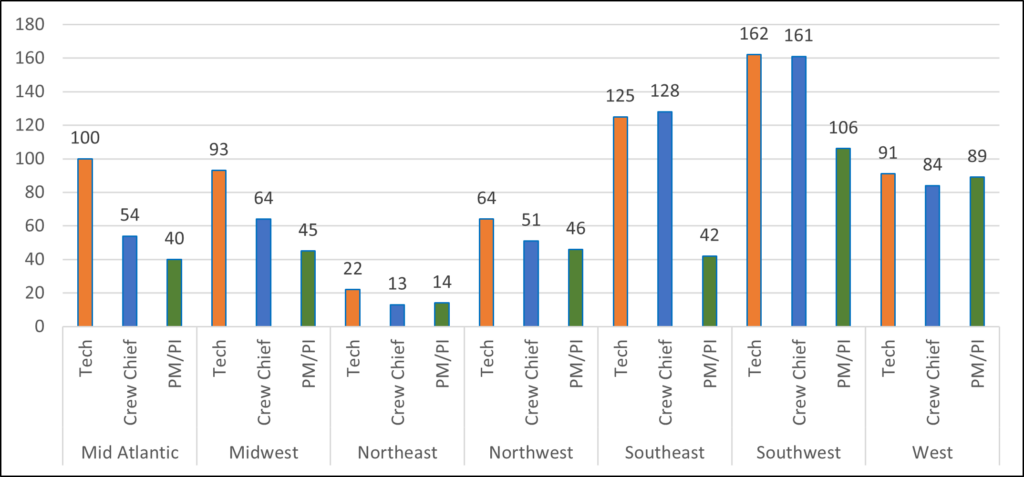

Monthly Job Posts by Region

This area breaks down the number of job posts by job type and by region for this month and the last 6 and 12 months. Users may track regional trends. A detailed regional breakdown is available on Twin Cairns Intelligence Unit© Quarterly Reports.

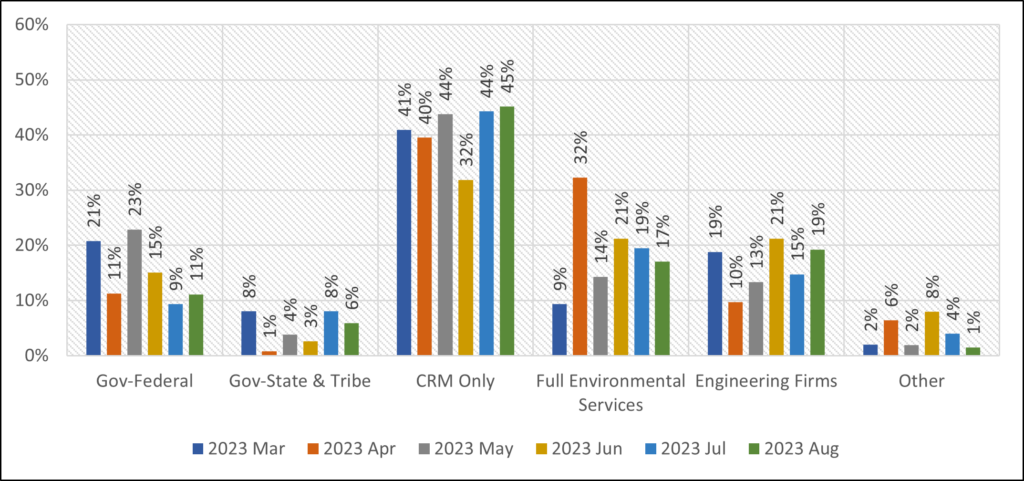

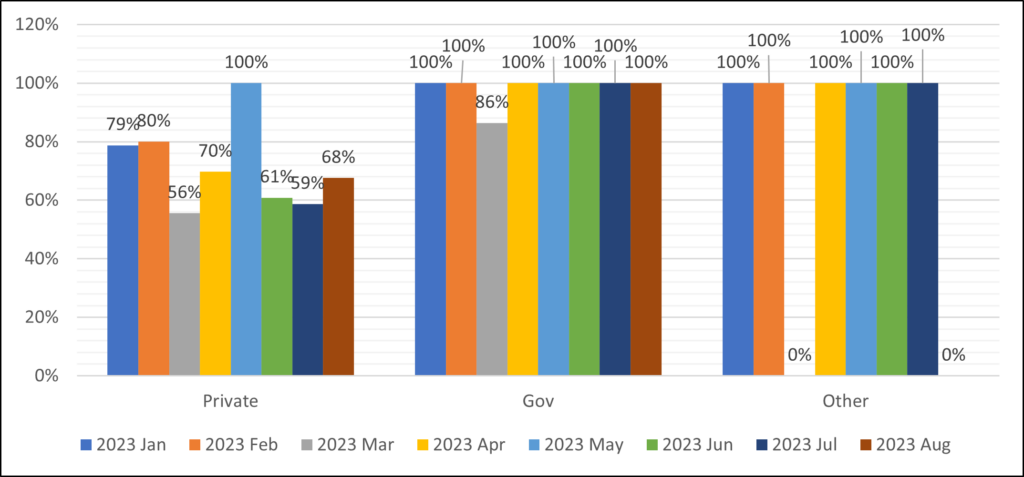

Employer Type

This area provides data about the type of employer hiring within the CRM sector for the past six months. ‘Others’ relate here to the small number of hiring done by nonprofits, museums & universities.

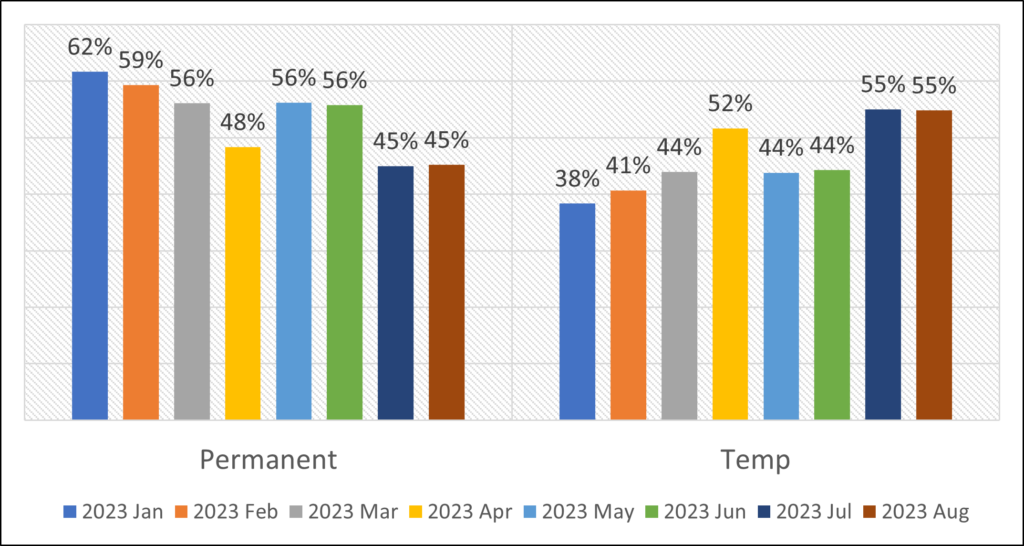

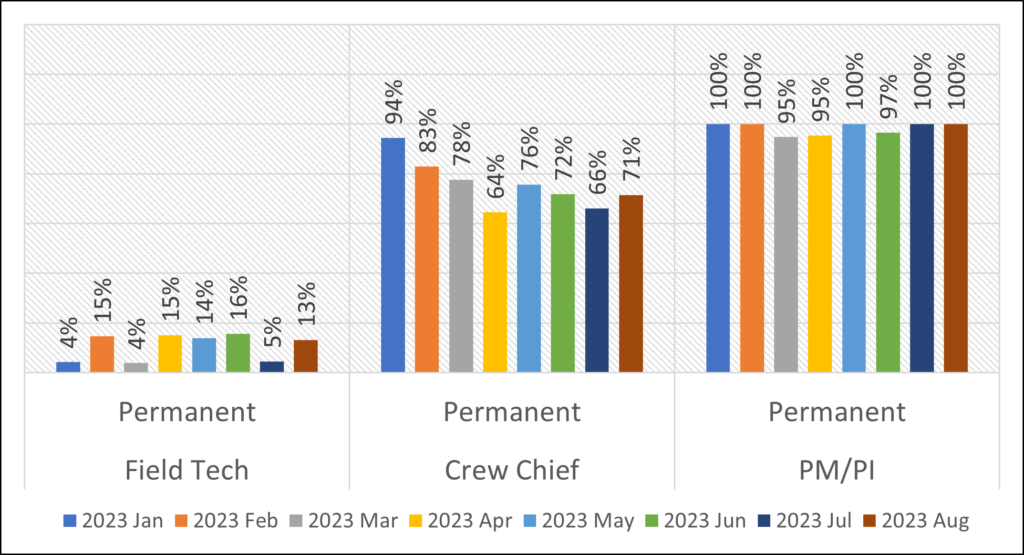

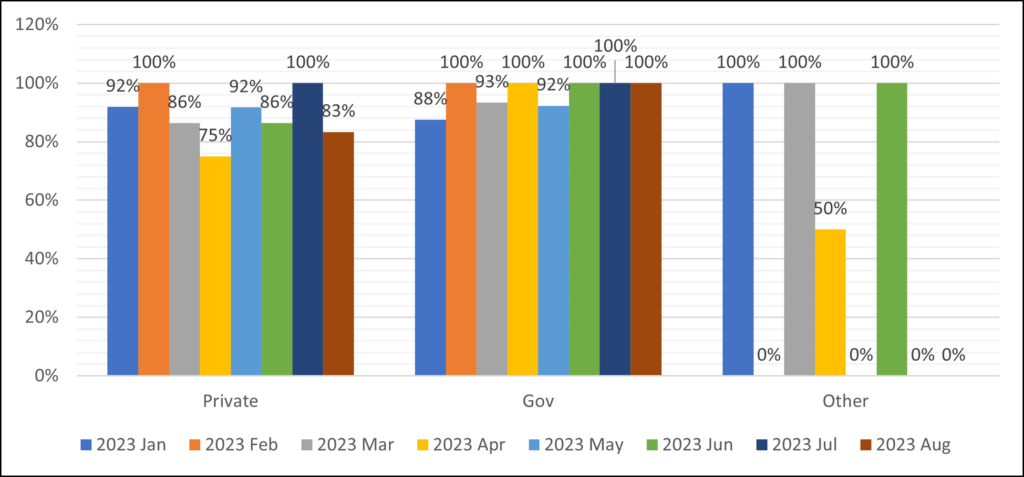

Position Type

This area presents data documenting duration of employment offered and breaks it down by position type. We are tabulating temporary vs. permanent job offers.

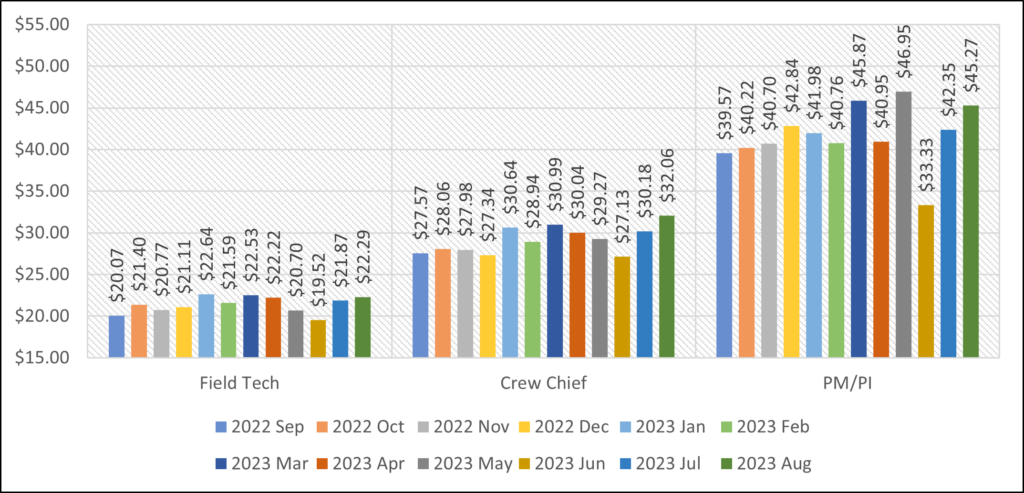

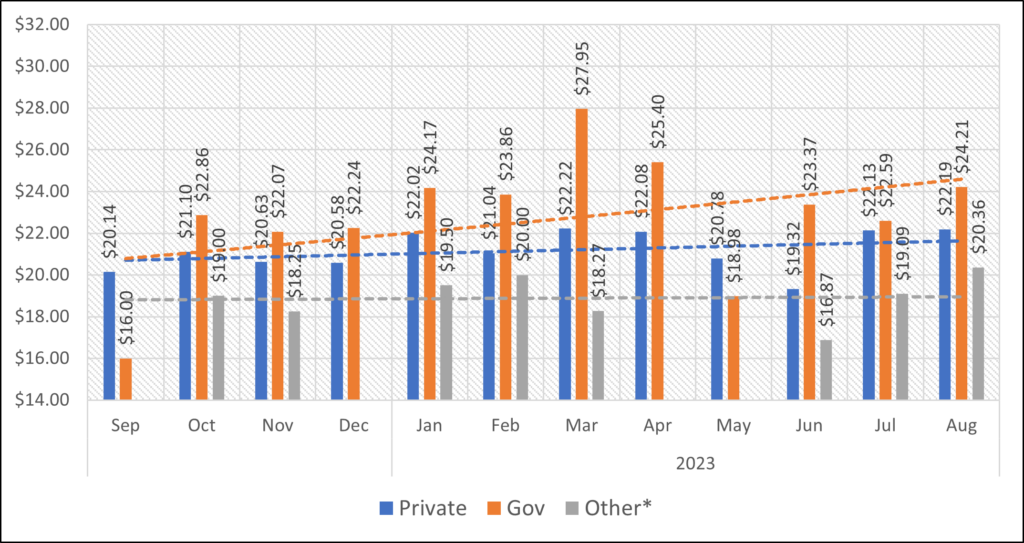

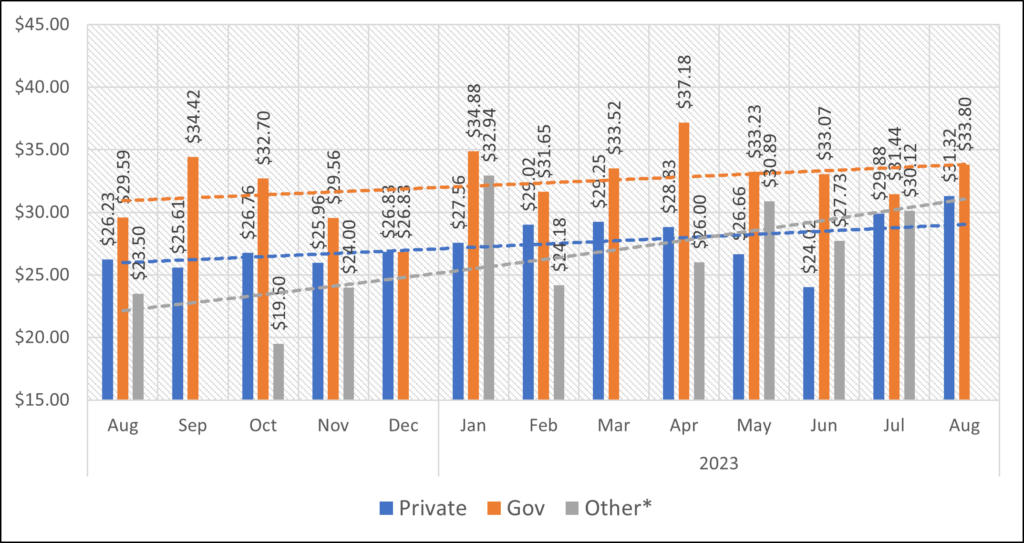

Wages

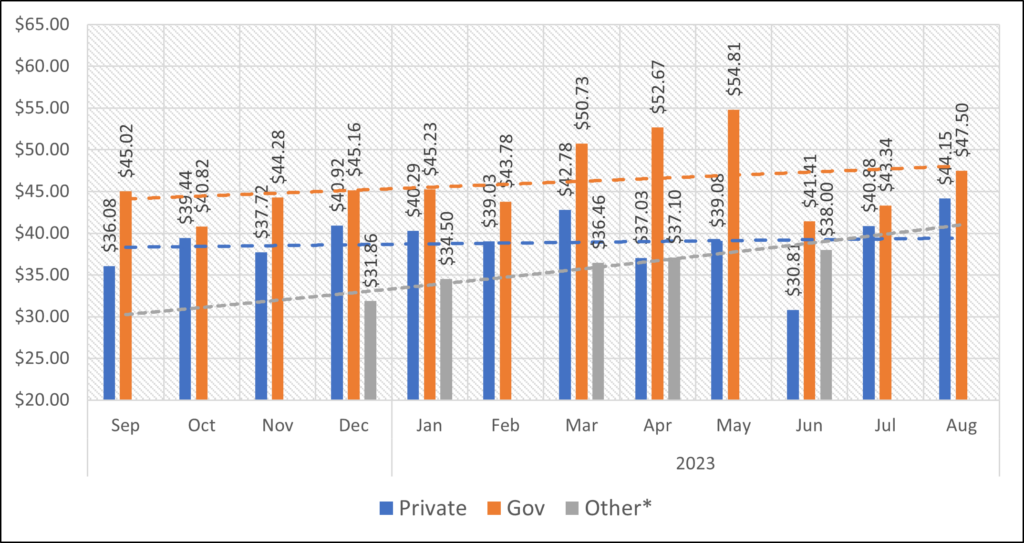

This area presents average hourly wages offered to CRM sector employees by position and by employer types. While some employers break down upper field management to Project Managers and Principal investigators, most job posts do not include such distinction. Therefore, we aggregate both categories into one class of employees. ‘Other’ refers to positions offered by nonprofits, museums & universities.

Published Wage Data

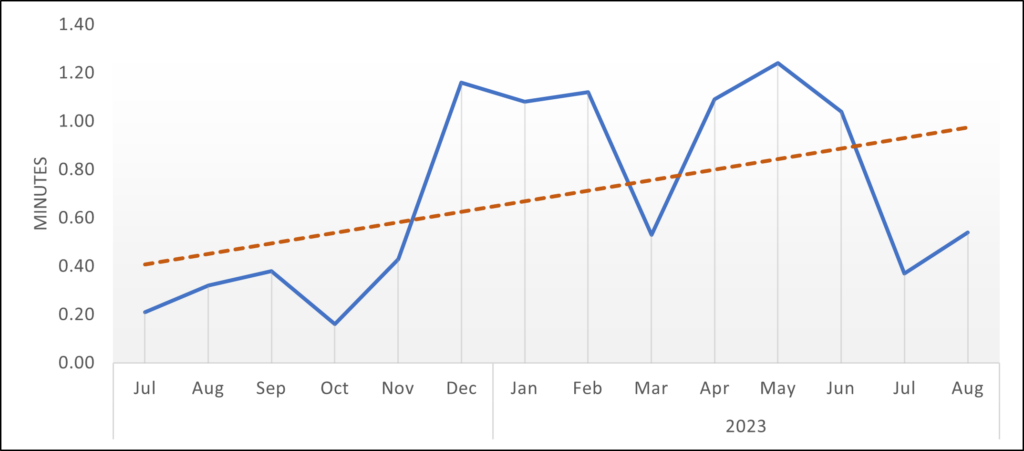

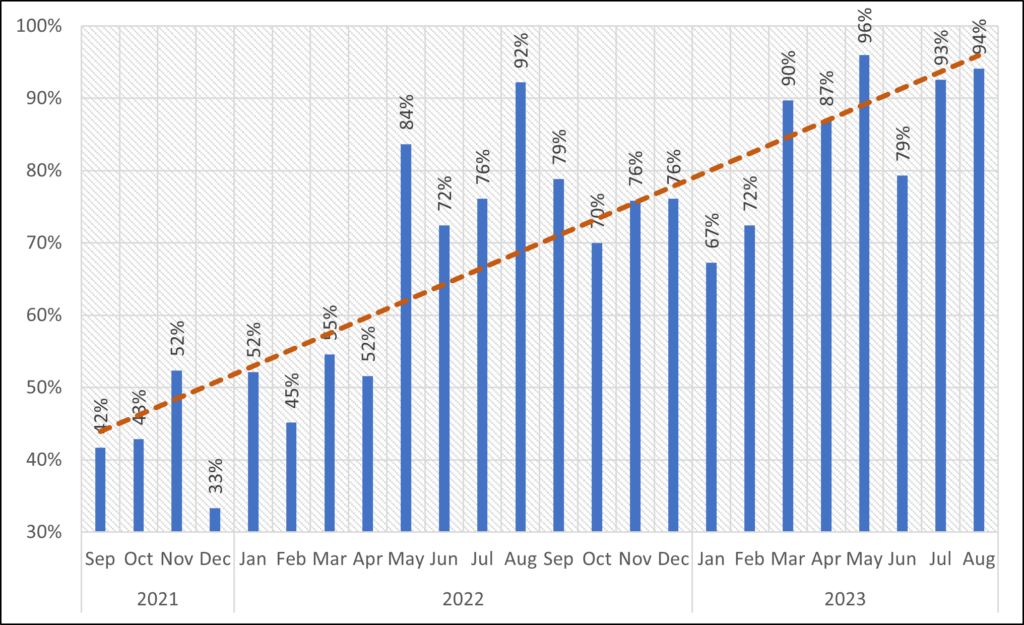

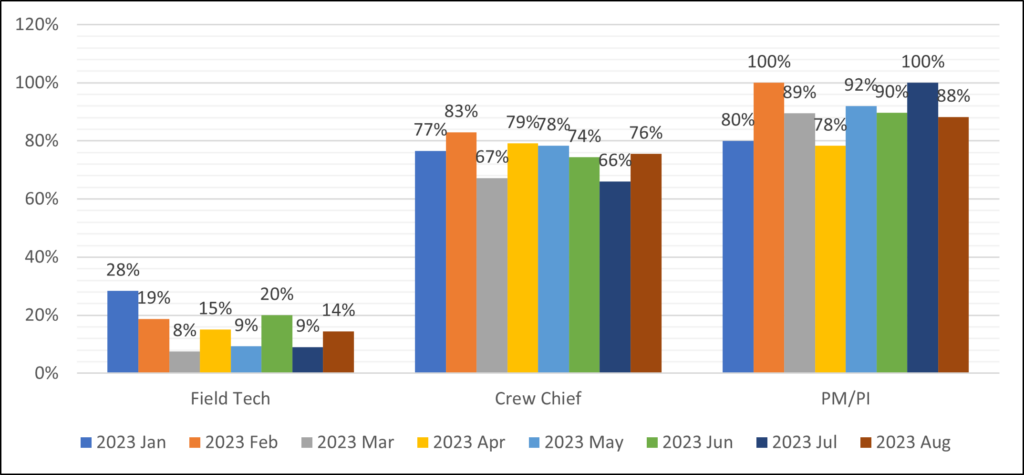

This area presents the publication of wage data and its inclusion in job posts. This area includes data for all job posts, then a breakdown of wage inclusion by position type.

Wage Differentials

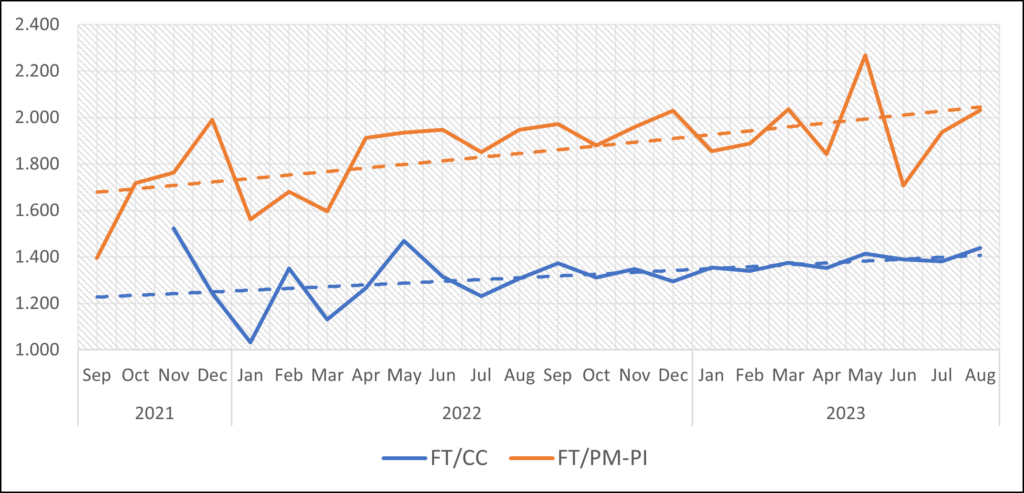

This area documents hourly wage differentials between Field Techs and other position types. The area tabulates wage differentials between Field Techs and Crew Chiefs and Field Techs and Project Managers/Principal Investigators.

Benefits

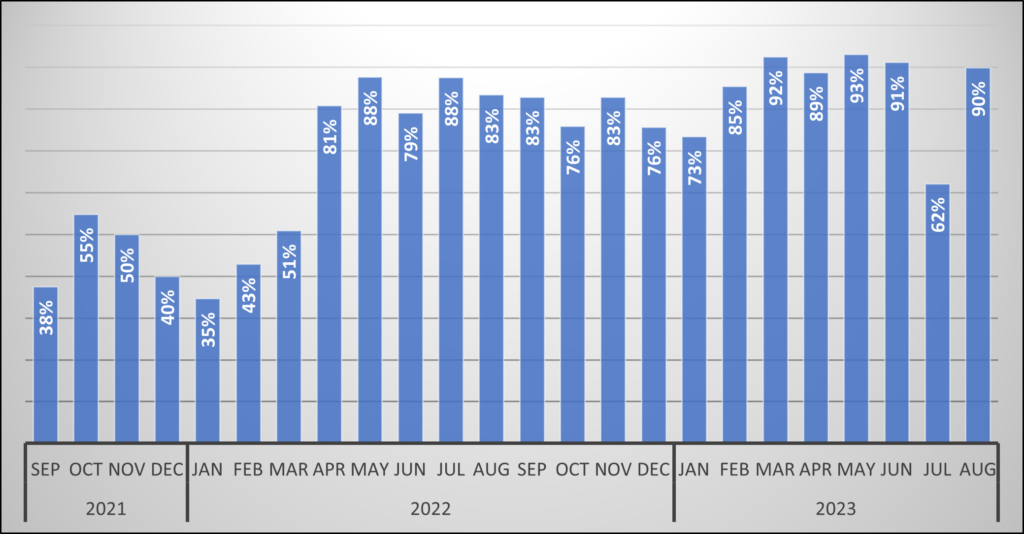

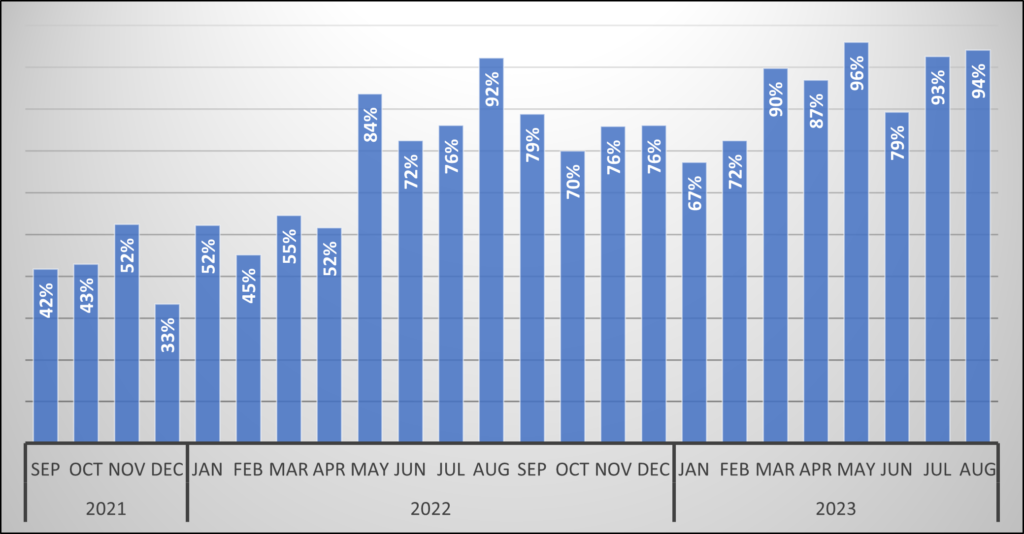

This area documents the percentage of jobs where employers list benefits as part of the job post. To be considered as offering benefits, the job post must include health insurance and paid days off. Some jobs offer contribution towards retirement plans (401K and similar). If this is the only benefit offered, we list such job posts as not providing benefits to employees.

It is possible that some job posts do not list but offer benefits to employees. Because benefits are not listed on such posts, these posts are tabulated as offering no benefits.

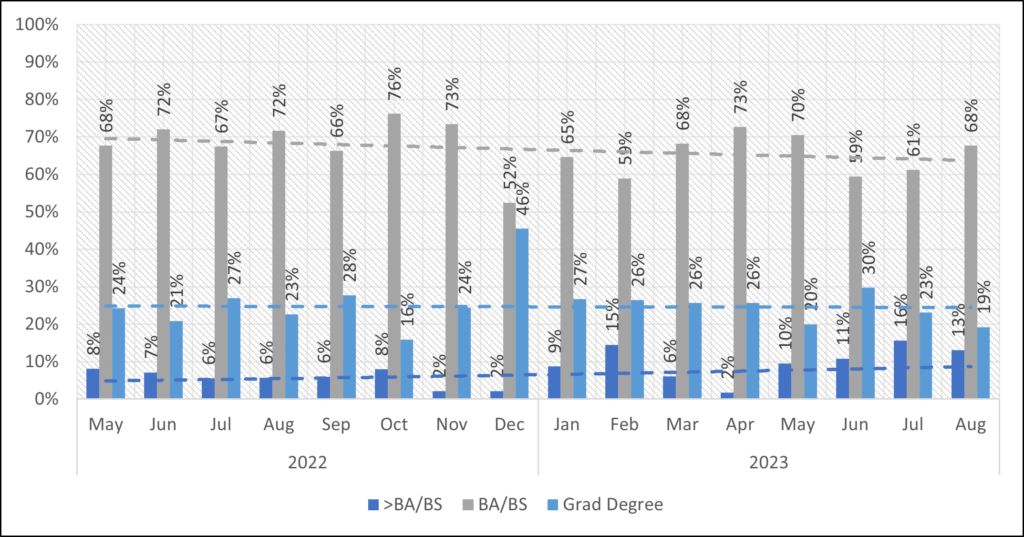

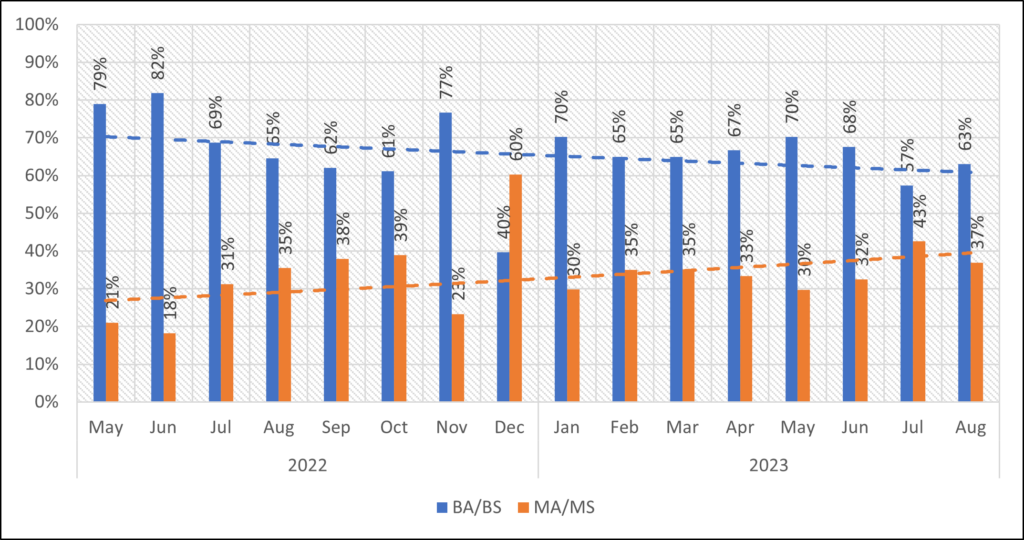

Education Requirements

This area presents data on education requirements for the CRM sector. Initially, we document education requirement for the sector as a whole, we then break down education requirement by position type.

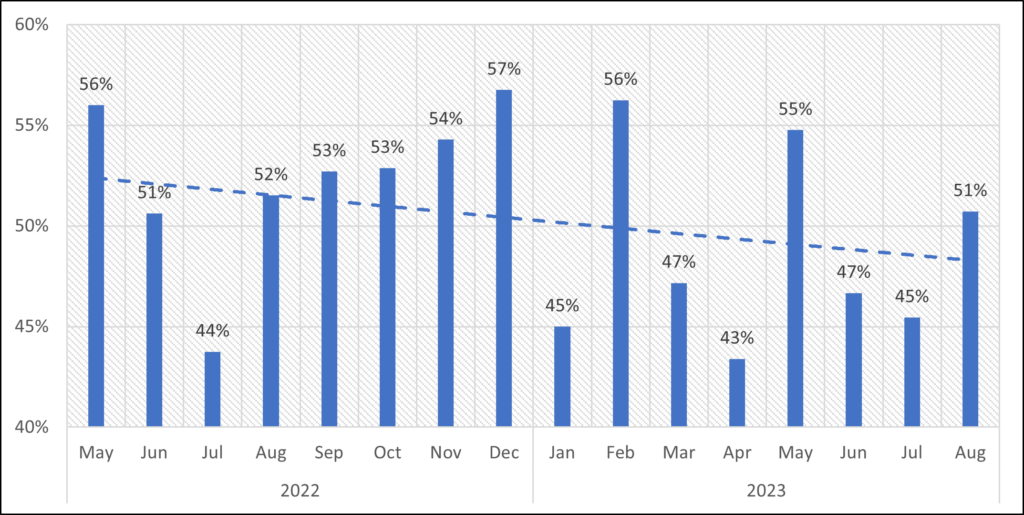

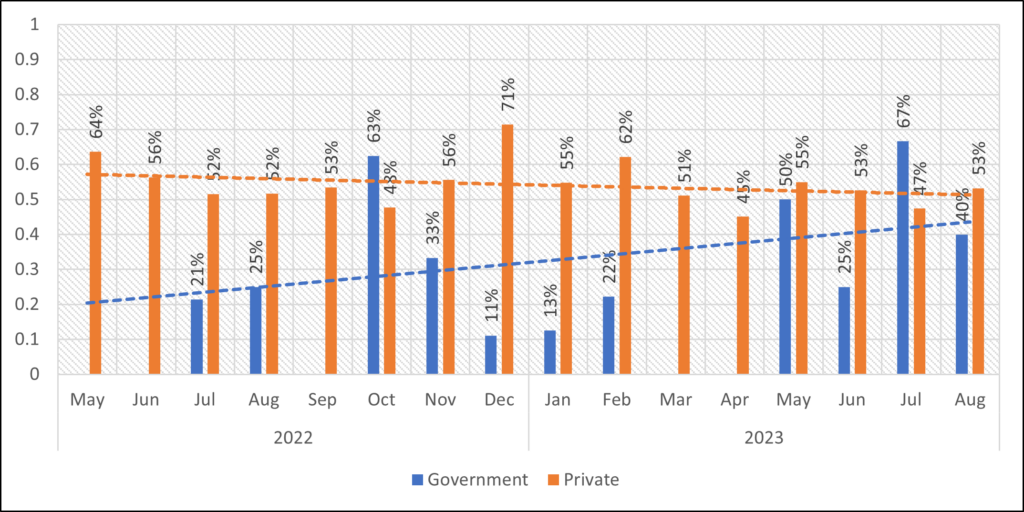

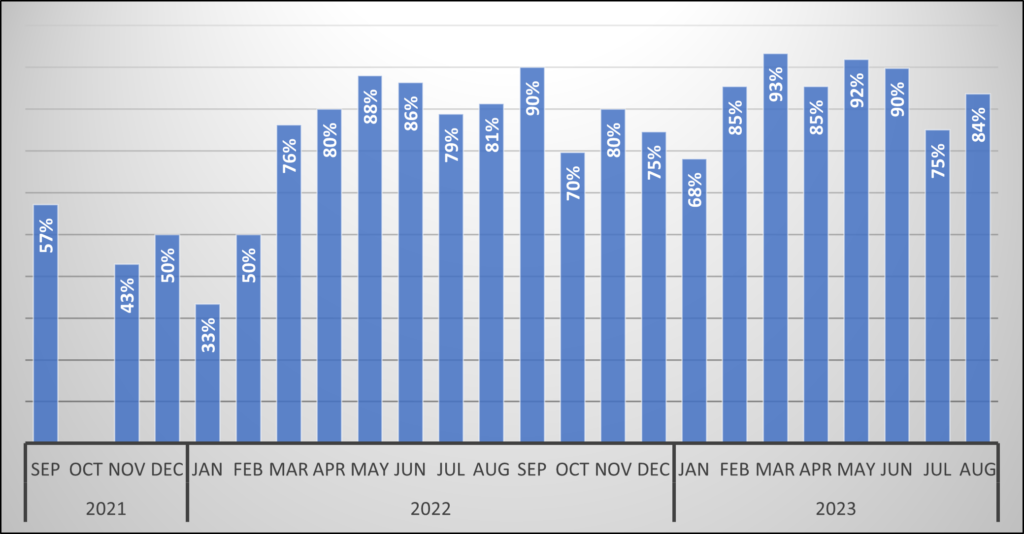

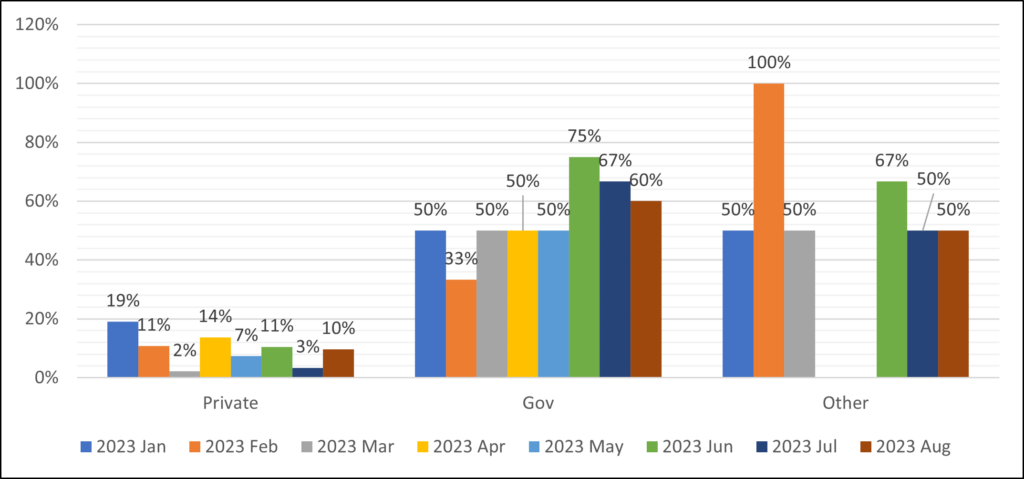

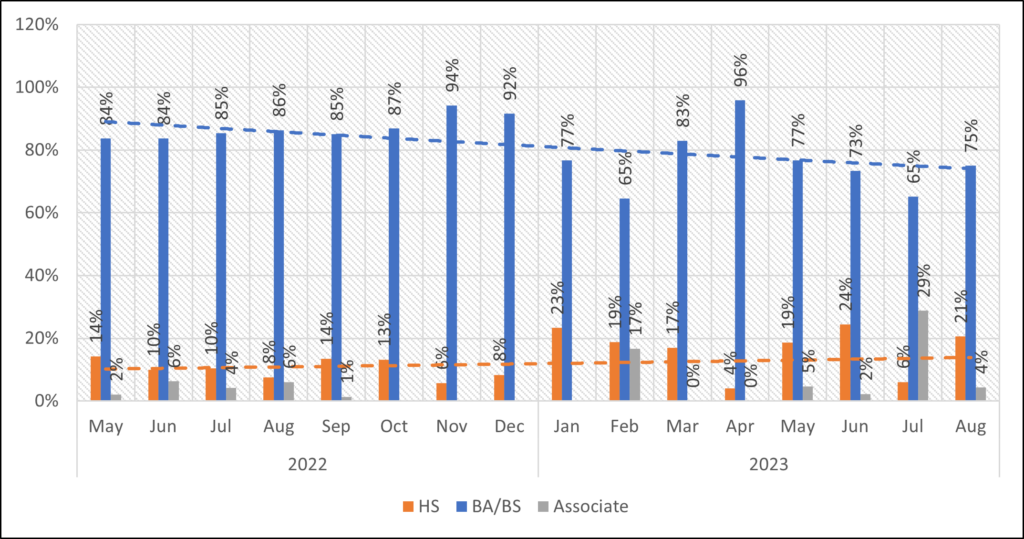

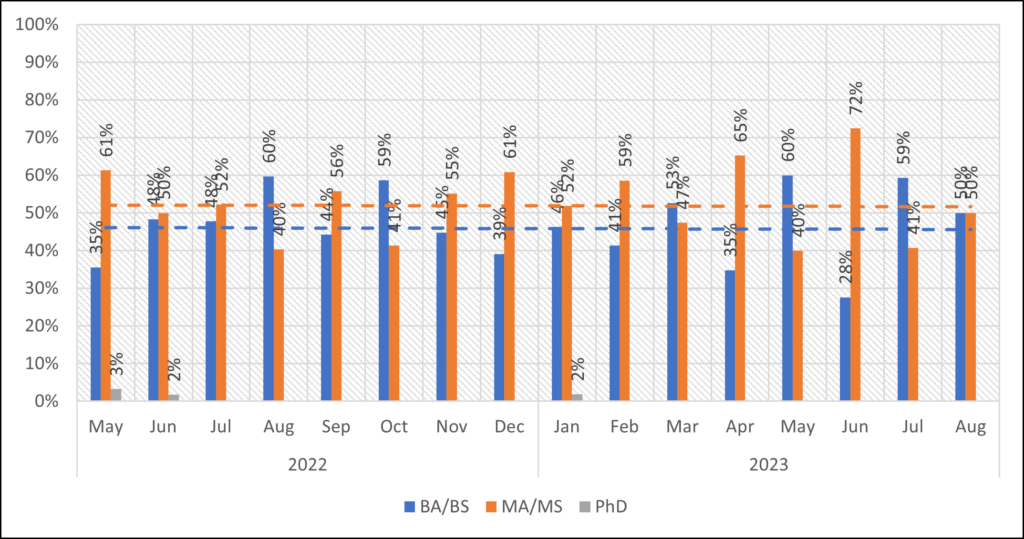

Field School Requirement for Field Techs

This area documents the requirement of a field school as a condition of employment for Field Techs. It first documents the field school requirement for the sector as a whole and then breaks it down by employer type. Regional data is tabulated in our Quarterly Reports.